2015 IW 50: Polaris Unseats Apple

Polaris Industries Inc. (IW500/229), the arguably more traditional American manufacturer (read: one that owns and operates factories in the U.S.) muscled past Apple Inc. (IW500/3), to take the top spot on the annual IndustryWeek 50 Best U.S. Manufacturers list. Apple held the summit for three years running, with Polaris just behind, finishing 3rd in 2011 and 2014 and 2nd in 2013.

The list is based on a formula applied to the IndustryWeek U.S. 500 list of the largest public manufacturers. The calculations measure three years each of six metrics, with the recent years weighted most heavily.

Polaris' rise is the result of consistently solid double-digit growth in revenue, return on assets, return on equity and sales turnover for the past two years. During that time, the powersports company outpaced the consumer computer & electronics leader on those measures.

Polaris is a familiar company to IndustryWeek 50 Best list watchers, who will find the company on the list in all but the two recession years, 2007 and 2008, in the last 10 years. The company manufactures off-road vehicles, including all-terrain vehicles, snowmobiles and side-by-sides, and owns the Victory and Indian motorcycle brands.

CEO Scott Wine through the years has credited a focus on new product development, manufacturing strategy and operational excellence for the company's success.

CEO Scott Wine through the years has credited a focus on new product development, manufacturing strategy and operational excellence for the company's success. Coming out of the U.S. 2009 recession, Wine noted that the company had launched 34 new products and planned to expand operational excellence initiatives. In 2010, he announced a manufacturing realignment, which included a new facility in Monterrey, Mexico. Two years later, Wine declared that "Operations is a competitive advantage," as he reported the savings from the manufacturing realignment, while also noting that investment in research and development remained steady.

Early this year, Polaris announced that it would build a 600,000-square-foot manufacturing facility in Huntsville, Ala., slated for completion in the second quarter of 2016.

The company's 2015 second quarter results indicate continued success, with a sales increase of 11% year over year to a record $1,124.3 million. A confident-sounding Wise acknowledged an earnings hit due to "significant cost pressures, and delayed shipments related to continued difficulties with our new motorcycle paint system in Spirit Lake, Iowa," according to the company press release. "Although production still cannot keep pace with demand, we are confident in our plans to further increase our motorcycle throughput in the second half of the year."

Where Apple Stumbled

Meanwhile, Apple, the far larger company by revenue, ranking #3 in the IndustryWeek U.S. 500, still holds commanding leads over Polaris in profit margin and inventory turnover. (The difference likely results from the companies' different business models, with Polaris operating factories and Apple contracting for production work.)

Long the leader by far in inventory turnover, Apple fell to second, behind Alon USA Partners LP (IW500/287), a petroleum & coal products company, 62.1 turns to 57.9. That's a big drop for Apple, whose inventory turnover hit 112.1 in 2013 was and 83.5 in 2014.

Apple reported in late June its latest quarterly profit jumped 38% to $10.7 billion on surging iPhone sales. CEO Tim Cook dubbed the performance "amazing," pointing out iPhone revenue in the quarter was up 59% from the same period the year before. Still the widely watched company's shares fell more than 6% in after-market trades, following the release.

Questions remain about whether its latest new product, the Apple Watch, which launched three months ago, will ultimately be a success.

Industry Diversity

Watching two very different companies battle for supremacy year after year is one of the benefits—and part of the fun—of running the numbers gathered to create the IndustryWeek 50 U.S. Best. While celebrating the best of the biggest U.S. manufacturers, the ranking features a wide array of industries, demonstrating that strong profitable businesses still can thrive in the U.S. Of the 28 primary industries represented on the IW US 500, 20 are included in the top 50.

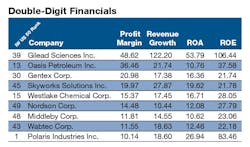

Viewed another way, eight industries are represented among the nine companies that enjoy the elite achievement of double-digit performance in each of four financial metrics (profit margin, revenue growth, return on equity, and return on assets). The one industry with two representatives, Polaris and Wabtec Corp. (IW500/303), on this cut of the data is the railcars, ships and other transportation equipment industry. The much larger Apple (the largest company on the IndustryWeek US 50 Best) missed making this list with a single-digit revenue growth of 7%.

Staying Power

Apple and Polaris are two of only 12 companies that have made the IndustryWeek 50 Best list in each of the last five years. As well, they are the only two companies consistently ranking in the high single digits in each of those years.

Monster Beverage Corp. (IW500/350) comes closest, having extended its stay in the top 5 for the third year running. The beverage maker this year ranks 5th, down one spot from last year, on the back of strong ROA (34.01%) and ROE (48.69%).

Only two companies have made the IndustryWeek US 50 Best ranking for each of the past 10 years: Coach Inc. (IW500/211) and Colgate-Palmolive Co. (IW500/80) Indeed, Colgate is the only company that's made the list every year since its inception in 2003, while Coach missed making the ranking in 2004.

About the Author

Patricia Panchak

Patricia Panchak, Former Editor-in-Chief

Focus: Competitiveness & Public Policy

Call: 216-931-9252

Follow on Twitter: @PPanchakIW

In her commentary and reporting for IndustryWeek, Editor-in-Chief Patricia Panchak covers world-class manufacturing industry strategies, best practices and public policy issues that affect manufacturers’ competitiveness. She delivers news and analysis—and reports the trends--in tax, trade and labor policy; federal, state and local government agencies and programs; and judicial, executive and legislative actions. As well, she shares case studies about how manufacturing executives can capitalize on the latest best practices to cut costs, boost productivity and increase profits.

As editor, she directs the strategic development of all IW editorial products, including the magazine, IndustryWeek.com, research and information products, and executive conferences.

An award-winning editor, Panchak received the 2004 Jesse H. Neal Business Journalism Award for Signed Commentary and helped her staff earn the 2004 Neal Award for Subject-Related Series. She also has earned the American Business Media’s Midwest Award for Editorial Courage and Integrity.

Patricia holds bachelor’s degrees in Journalism and English from Bowling Green State University and a master’s degree in Journalism from Ohio University’s E.W. Scripps School of Journalism. She lives in Cleveland Hts., Ohio, with her family.