2022 IndustryWeek Salary Survey: The Talent Shortage Strikes Back

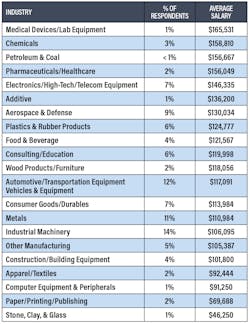

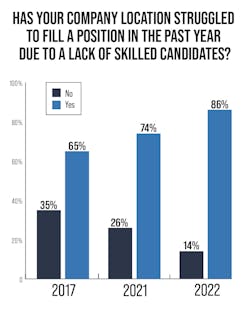

A year ago, manufacturing showed signs of life in IndustryWeek’s Salary Survey as the industry appeared to stabilize after the worst effects of the COVID-19 pandemic. This year, though, the talent shortage struck back.

Survey respondents said their companies are trying new things to attract workers, such as touting flexible schedules. Several indicated their companies were raising base and entry level wages or improving benefits. Despite that, the overall tone of the free-response section when asked what companies are doing to recruit and retain talent was exasperation: Several respondents simply said, “everything we can.”

Average Salary and Purchasing Power

Many respondents reported feeling overworked following waves of quits. That and high inflation may have shifted what employees value most. One-fifth of those surveyed said base salary is the most important part of their job to them. “Challenging work,” the top priority for 22% of respondents last year, slipped to the second-most-popular response this year at 17%. Job stability fell to a distant third, with 13% of respondents calling it the most valued part of their jobs.

As one respondent put it, “Stability, challenging work and career advancement are also important, but in today’s environment, you have to be able to pay the bills.”

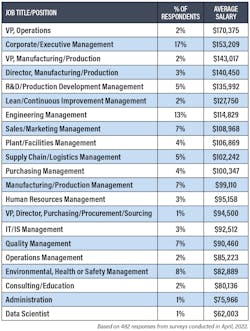

Perhaps in response to workers’ shifting priorities, wages grew more in this year’s survey than the last one. The average IW salary in 2022 was $116,998, up from last year’s average salary of $115,559, an increase of about 1.2%. This is in line with the rest of the results: A plurality of IW readers who responded to the survey, 30%, indicated that their own salaries grew between 3% and 5% in 2022. The next largest category, those who saw no salary growth or loss, made up a quarter of respondents, and 22% saw salaries grow between 1% and 3%.

While that’s a troubling figure, there have been some gains in dollar terms. Last year, the plurality of respondents—38%—indicated that their salaries didn’t grow at all. It also doesn’t take into account how many survey respondents received bonuses in addition to their normal salary. About 60% of survey respondents collected an annual bonus.

Generational Wealth

The wage increases that did come to manufacturing came somewhat unevenly.

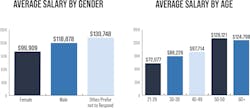

Perhaps explaining some complaints in survey responses that young people are unsuited for or uninterested in hard work, manufacturing doesn’t appear to be paying off for young people. The average wage for respondents in their 20s fell from $76,000 to $72,000.Wages for those in their 40s fell at a similar rate, from $102,000 to $98,000, although salaries for those 30-39 years old changed little from 2021. The same results show that wages for the oldest workers in manufacturing are rising faster than for any other wage group. Salaries for those 60 and older rose by about $7,000 in 2022 to $125,000, reversing a long-term trend that saw this group’s wages fall by $12,000 between 2017 and 2021.

In another reversal, wages for women workers rose despite little change to the workforce gender breakdown. The average wage for women respondents rose by almost $14,000 after falling in 2021, while the average wage for men fell by just under $2,000 after it rose about the same amount in last year’s results. The percentage of men and women in manufacturing has changed by less than 2% in each category.

Despite the higher salaries collected by older workers and women this year, a number of comments said misogyny and ageism remain issues in some manufacturing workplaces. An engineering manager in his 60s working in the automotive industry noted that “all the older workers were the first to be furloughed during the Covid crisis,” and that, despite talent shortages, those who were laid off found it difficult to find jobs elsewhere. Another respondent, a data scientist at a CNC fabricator, said her company “has a track record of not promoting females,” who are “underpaid and overworked.”

COVID-19: Supply Issues Linger

In addition to blunting wages, inflation has also blunted companies’ purchasing power, aggravating the existing issues with supply chains. Supply chain issues, material availability or costs were also top-cited issues manufacturing faces today, listed by more than one-third of respondents.

One might naïvely expect COVID-19 to have loosened its grip on industry in the two years since it was named, but it continues to squeeze industry, according to our survey. About one-fifth of respondents to IW’s latest salary survey indicated they took a pay cut or were laid off or furloughed due to the pandemic in the past 12 months, down from about one-quarter of last year’s respondents.

A few comments indicated that the chaos of COVID continues to tangle supply chains and confuse operations. One manufacturing executive at an industrial machinery business wrote that his business, like countless others, is experiencing a “backlog of orders due to supply issues” caused by the pandemic. Further down the company hierarchy, an industrial engineer in the automotive business said he’d been pressured to accept a reduced salary due to the pandemic’s impact on company revenue.

Conclusions

The results from our annual salary survey reflect the difficult situation manufacturing finds itself in. Already-dire dysfunction in manufacturing employment and supply chains got worse, exacerbated by the rising tide of inflation. We conducted our annual salary survey in April, so respondents answered fresh from experiencing significant waves of quitting and already long acquainted with the aftershocks of COVID-19 on the supply chain.

As one manufacturing veteran with more than 30 years of experience in the industry put it, “The last two years have been the most difficult in my career.”

Those challenges, coupled with the large number of people quitting jobs, are putting stress on remaining workers as they have to work harder to pick up the slack or train whatever new people their companies manage to hire.“Open positions make (the) workload extremely difficult,” one respondent noted. “Lack of recognition for doing multiple jobs makes me think of looking for a new job.”

Despite those challenges, the survey also reflects an industry on the mend. When asked how their companies were performing now vs. before the pandemic, about a quarter of respondents this year said a little bit or much worse, compared to 30% a year ago. The percentage who said their companies were doing a little bit or a lot better climbed to 39% from 35%. Those saying performance hadn’t changed stayed steady at 35%.

Click here to download the full Salary Survey report, including data not included in this story or the magazine article that ran in the summer issue of IndustryWeek.

About the Author

Ryan Secard

Associate Editor

Ryan Secard joined Endeavor B2B in 2020 as a news editor for IndustryWeek. He currently contributes to IW, American Machinist, Foundry Management & Technology, and Plant Services on breaking manufacturing news, new products, plant openings and closures, and labor issues in manufacturing.