Declining U.S. worker productivity has become a hot issue during the presidential campaign, among economists and press as well as the candidates themselves. Labor productivity — defined as the amount of GDP produced per hour worked — just registered its third straight quarterly decline.

Many see this as cause for concern, including Kevin Drum of Mother Jones, who writes that “productivity growth is probably the single most important component of national economic activity, and it doesn’t inspire a lot of confidence to see it dog paddling along like this.”

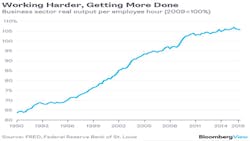

But I’m not so concerned, for several reasons. First of all, this decline is perfectly normal. Take a look at the recent history of labor productivity:

Small declines like the recent one are not an uncommon occurrence, even in good economic times. Productivity plateaued between 1993 and 1996, and again between 2003 and 2005. The economy was pretty healthy during those times (housing bubble notwithstanding). Conversely, several of the biggest productivity jumps have happened during recessions, in 2001 and 2009.

In fact, this has been the pattern in recent recessions and recoveries. In olden days, productivity tended to surge in good times, but since 1990 the correlation has reversed. The labor market in the U.S. is pretty good — unemployment is low, jobs are being created. That fits perfectly well with the new normal.

This has to do with the way companies use labor now. When bad times hit, employers lay off workers but keep production relatively steady — they do more with less, so productivity goes up. When the recovery comes, companies hire workers back, but still keep production relatively constant, so productivity falls. The new trend is due to the fact that companies don’t alter their production levels nearly as much as they used to. No one knows why this is happening (though economists have of course made various models to try to explain it).

Another reason not to worry is that labor productivity isn’t a good measure of the economy’s real underlying efficiency. Output doesn’t just require labor, it takes capital as well — buildings, machines, software, etc. There’s another measure, called total factor productivity, or TFP, which takes into account all of these inputs, not just labor. While labor productivity is expected go up and down as a result of changes in aggregate demand, total factor productivity is generally thought to be a better indication of underlying forces like technology and government policy.

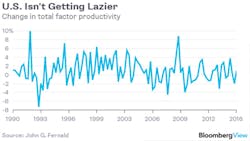

And when we look at TFP, it’s not dropping. John Fernald at the Federal Reserve Bank of San Francisco is famous for measuring TFP very carefully, adjusting for the rates at which businesses use the capital they own. Here’s his measurement of TFP growth since 1990:

As you can see, TFP has been sluggish in recent years. This has caused many economists to wonder if technological progress is slowing down. But regardless, it’s clear that TFP isn’t actually falling. The economy isn’t getting less efficient. It’s just getting a little more labor-intensive. Over the past few quarters it’s using more workers, and less machines and buildings, to produce goods and services.

Over the long term, fluctuations in demand should roughly cancel out, so TFP and labor productivity should generally move in the same direction. But even over decades, it’s questionable whether labor productivity really drives changes in the standard of living for most Americans. Median hourly compensation has gone up much more slowly than labor productivity for the last few decades — most of the gains from a more productive workforce have gone to higher-income workers. So while faster productivity growth over the long term would be a good thing, the U.S. economy hasn’t yet figured out how to put these gains into the hands of the average American.

So there are several reasons not to worry about slow productivity growth. It’s probably just an artifact of the business cycle. And reversing the decline wouldn’t solve the thorniest problem the economy faces — how to translate productivity gains into broad-based prosperity.

By Noah Smith