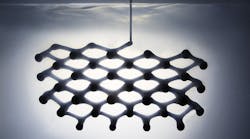

The machine inserts a needle into a block of gel and begins to “draw,” injecting soft polymers into the gel to manufacture a three-dimensional plastic part that might be difficult, or even impossible, to create otherwise. It looks like something out of the build-a-person sequence in the opening credits for the TV series Westworld.

It’s not the kind of thing you’d expect to see in a car factory. It might never be used in automobile manufacturing at all. BMW invested in the technology, anyway, in part just to see what happens if rapid liquid 3D printing takes off.

That’s not to say BMW i Ventures, based in Silicon Valley, capriciously makes risky investments with little chance of return. Its portfolio boasts 62 tech companies including 3D printer makers Carbon and Desktop Metal. The list of recent investments includes startups working to develop gel-based nanocoating to keep electronics dry and sustainable carbon-neutral steel. Self-driving cars and electric vehicles can’t afford to lose components to moisture or corrosion, and the automotive industry that uses 12% of global steel production avidly chases green materials.

Both technologies are clearly of high value to the automotive industry. It also doesn’t take much imagination to realize how manufacturing writ large would benefit from some of these projects if and when they mature. That’s the sweet spot that guides BMW i Ventures’ investment decisions.

The group formed in 2011 as the venture investment arm of BMW, making small investments in mobility startups. Uber’s growing relevance inspired BMW to understand new business models in that vertical and how to participate in them. In 2016, the fund expanded its reach into a wider breadth of technologies.

“It really has been around the core areas of technology that are relevant for the automotive ecosystem, meaning transportation and still mobility services,” says managing partner Kasper Sage, “but also, on top of that, supply chain, manufacturing, sustainability—topics that are more fundamentally closer to the ecosystem of the automotive industry.

“We invested in Kodiak Robotics, which is an autonomous trucking company,” he adds. “BMW doesn’t build trucks, doesn’t have trucks, will never build trucks. But obviously, there is an angle of autonomous driving technology that gets implemented in a certain market segment, which might offer some learnings.”

Planning for the (Realistic) Future

BMW i Ventures doesn’t seek exclusivity or right of first refusal from the companies in which it invests. The advantage of the fund, Sage says, is the technical knowledge BMW provides to assess the value of proposed technologies and the ability to help get startups ready to deal with automotive scale by understanding supply chain challenges and production needs.

“Sometimes the intention is to put some more pressure on our traditional Tier 1 suppliers who always offer the same thing, to just tell them, ‘Look, there's technology out there, if you don't offer this, we’re going to buy it somewhere else, right?’” says Marcus Behrendt, CEO of BMW i Ventures.

Asked to name some technologies that the fund helped mainstream, Behrendt notes that the fund only offers a helping hand, supporting the work of a startup’s founders, versus taking credit for anything. That said, “Out of the old fund, before 2016, there was an investment in two [electric vehicle] charging companies, Chargemaster and ChargePoint. And both have been very successful in the market.”

Focus on sustainability, at all levels of the supply chain, partly guides BMW i Venture’s investment decisions. “We invest in Lilac, basically a direct lithium extraction technology that can help decarbonize the way lithium gets generated,” Sage says. “That's obviously a big building block for electric battery technology.”

The fund also takes interest in the circularity recycling concept, such as investment in Natural Fiber Welding, a company developing plant matter-based alternatives to leather, textile and foams.

While a flip through the fund’s investment portfolio suggests a futurist’s bent, Sage wants to make sure no one misunderstands BMW i Ventures as any sort of philanthropic endeavor trying to make for a greener world.

“We fundamentally believe that only implemented technology can really make a change,” Sage says. “It’s great if you have some new mechanism or some new process but it doesn’t matter until you have implemented it in either millions of vehicles or at the right points where it can have a significant impact.”

Automotive High Technology for Everyone

For BMW i Ventures, the automobile industry serves as a testbed. Once a new technology proves out in automotive manufacturing, Sage and Behrendt hope other manufacturers will notice and think about adopting the technologies for other industries, as well.

“Rapid Liquid Print’s first application will probably not be automotive, it will be healthcare,” Behrendt says. “We want to be on the forefront to understand if [the technology] is successful there. It’s hopefully also successful in our environment and will work for automotive, and we have already done prototype parts with them and it looks promising.”

“Boston Metal [produces] green steel. The automotive industry buys a lot of steel, but it’s nothing compared to the construction industry,” Behrendt continues. “If we can, by fostering Boston Metal, help BMW buy green steel, that’s great. But if we can make a real impact on the world by providing technology that will supply green steel in the long run, that’s just the mission where we’re looking for and that's how we’re driven.”

About the Author

Dennis Scimeca

Dennis Scimeca is a veteran technology journalist with particular experience in vision system technology, machine learning/artificial intelligence, and augmented/mixed/virtual reality (XR), with bylines in consumer, developer, and B2B outlets.

At IndustryWeek, he covers the competitive advantages gained by manufacturers that deploy proven technologies. If you would like to share your story with IndustryWeek, please contact Dennis at [email protected].