Can 'Marginal' Technology Improvements Justify the Decision to Bring Manufacturing Back Onshore?

According to a recent report by Information Technology and Innovation Foundation (ITIF), as robots and other autonomous systems continue to improve in functionality and decline in costs, their likely impact on productivity will be significant. However, when speaking with IndustryWeek, report author and ITIF President Rob Atkinson mentions the current mix of robotic advances, deployment costs and investment incentives have not been enough to prompt widespread action.

“Right now, robotic technology is only marginally getting better and cheaper. As a result, it is not leading to the transformation we would hope for,” he says. “Eventually the technology itself will turn into a compelling proposition where we see faster breakthroughs and more comfort from manufacturers wanting to go down this path. The continued integration of AI into these deployments will definitely help.”

A possible a tipping point?

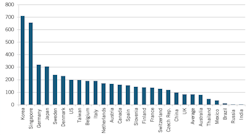

There is understandably a big difference between ideal conditions and actual adoption. As ITIF notes, some industries (i.e. automotive) and global geographies (see figure 1) are already fully committed to next generation, automated technologies. Whereas others are still waiting on an impetus to act.

According to Atkinson, the real tipping point for widespread adoption of robotic technologies is more likely to come from continued uncertainty around the global supply chain – including escalating trade challenges with China and increasingly unpredictable tariffs. “The uncertainty could give US manufacturers more incentive to act,” he says.

There is precedence for Atkinson’s train of thought. Specifically, from the late 1990s through the first decade of the 2000s, the spotlight on the benefits of offshoring put significant pressure on business leaders. Pressure that ultimately encouraged manufacturers to abandon stateside production in favor of offshore opportunities.

Figure 1: Robots deployed per 10,000 manufacturing jobs in 2017. Source ITIF“Fortunately, automation is creating new opportunities for manufacturers to produce in the US again – tilting the trend in the opposite direction. It is incumbent upon manufacturing leadership to think this through as best they can and where possible to make the choice to produce here. Automation technology can provide manufacturers with more flexibility to make products that have cost and marketing advantages.”

Understanding the Key Findings

Improvements in automation technology are poised to bring more automated manufacturing production work to developed countries, rather than offshore it to lower-wage countries. While both developed and developing economies stand to benefit from the next production system, the report explains that higher-wage nations will get more of a productivity boost from these technologies than lower-wage ones.

After all, lower labor costs in developing economies provide less incentive to adopt automation equipment like robotics, and the new production systems enable shorter production runs, smaller factories, and higher productivity—all of which will work in the direction of reshoring to higher-wage nations.

The report also evaluates the research on the impact of improvements in robotics technology on labor-market churn, explaining that higher labor-market-churn rates are not associated with higher unemployment rates. The bottom line, according to ITIF, is that most forecasts exaggerate the impact automation will have on employment. The evidence suggests structural unemployment will not increase due to automation, and labor will receive a significant share of the benefits.

The potential also exists for a collective action challenge should widespread adoption occur. “If a large number of manufacturers were to tilt in this direction there would be a noticeable uptick in the demand for skilled manufacturing labor, wages would increase, and tech colleges would introduce exciting new programs to keep pace,” says Atkinson. “Manufacturing would become more attractive and build on itself.”

About the Author

Peter Fretty

Technology Editor

As a highly experienced journalist, Peter Fretty regularly covers advances in manufacturing, information technology, and software. He has written thousands of feature articles, cover stories, and white papers for an assortment of trade journals, business publications, and consumer magazines.