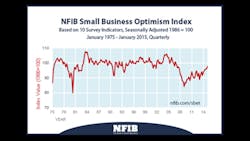

WASHINGTON - Optimism in the economy fell among small business owners in January according to the National Federation of Independent Business.

The dip comes after two straight months of gains following the November elections, but still shows the small business sector is operating normally.

“January’s decline was mostly due to owners being less optimistic about sales growth and business conditions, not spending and hiring plans,” said NFIB Chief Economist Bill Dunkelberg.

The following is an overview of the latest Small Business Optimism Index as reported by the NFIB:

The Small Business Optimism Index fell 2.5 points to 97.9, giving back the December gain that took the Index over 100. Still, the Index indicates that the small business sector is operating in a somewhat “normal” zone. Seven components fell, one was unchanged and 2 rose a bit. Most of the decline was accounted for by expected business conditions (43% of the decline), expected real sales (14%) and earnings (14%). The good news was the increase in the percent of owners reporting hard to fill openings and the drop of only 1 point in the net percent of owners planning job creation from December’s very good number. Add to that the report of jobs added per firm at 0.16 reaffirmed the December reading of 0.20, both historically very high numbers. Job creation is the core of growth and the small business sector appears to have shifted to second gear, boring but steady.

The increase in the percent of owners reporting hard to fill job openings is good news." - Bill Dunkelberg, NFIB Chief Economist

The percent of owners reporting higher worker pahy held at 25%, the best reading since late in 2007. However, there is still no evidence that this is pushing owners to raise prices significantly. Reports of price reductions are still quite high, so perhaps compensation increases are “funded” by energy cost savings.

Reports of actual capital spending held near the highest levels in the expansion at 59%. Plans for capital spending gave up 3 percentage points but also held at high levels for this expansion. The percent citing the current period as a good time to expand gave up 3 points as well, but still the second highest level since December 2007.

Related

Interest in borrowing remained at historically low levels, and complaints about credit cost and availability also at low levels. Reports of increased borrowing did not show up in the January survey, consistent with PayNet’s report that smaller firms were still not enthusiastic borrowers. Owners reported paying an average 5.3% for short-term loans, up 20 basis points.

The small business sector is pulling more of the weight it historically accounted for in recovery growth, but still short of its potential. A lot of firms were lost in the Great Recession and some researchers claim that firms are failing faster than new firms are being started. If true, the small business sector will account for less of the GDP than was historically the case.

About the Author

IW Staff

Find contact information for the IndustryWeek staff: Contact IndustryWeek