Last winter’s “polar vortex” was an event for the record books and the accounting books. Chicago, for example, experienced wind chills of -35⁰ F. Planes were grounded, roads and highways were too dangerous for travel, and schools were closed for days. The polar vortex was also a nightmare for the finance department, though for a very different reason: electricity prices were around $50 per mWh in January 2013 compared to $170 per mWh in January 2014. As a result, many were left with high energy invoices and budget mayhem.

The energy price volatility was not due to weather alone. Weather-driven demands on energy exposed pockets of risk in the market which are still prevalent today. As the nation increases its reliance on natural gas-fired electric generation, wholesale gas prices will play an even larger role in the direction of energy prices. It is therefore crucial that you begin preparing now for winter and potential energy price spikes.

Be Ready for Energy Price Volatility

Even if you’re still recovering from the budget after-effects of last winter, there are steps you can take today to prepare for future energy price volatility. When high utility bills begin to disrupt budget estimates, you’ll need to be ready with answers about what’s happening and why, and provide strategies for a solution.

The first step is to regularly track accruals and variances in usage and prices of energy consumption on a site-by-site basis. Local weather conditions of individual facilities can have a major impact on utility costs across your entire organization. Tracking this data will provide essential insight into high or low consumption at specific sites as well as provide insight into potential future risk.

Next, it is important to engage with stakeholders in the energy budget. Discuss procurement, finance, energy, real estate and facilities engineering, and provide stakeholders with a clear statement on what is happening with energy consumption across the organization and why. This will provide stakeholders with invaluable insight in the event that energy prices do skyrocket and budgets need to be readjusted. Additionally, have a discussion with stakeholders about potential scenarios that may arise and how you plan to mitigate risk. For example, what will you do if natural gas prices rise by 10% this winter?

Manage Risk through Strategy

How your organization manages volatility will be dependent on your risk appetite, which will vary by business. When considering your organization’s risk appetite, be sure to account for operational, market, budgetary and regulatory risk. The best way to manage these risks is to have a strategy in place before markets become extremely volatile—and a strategy that executives and shareholders agree upon.

Your strategy should couple your organization’s risk tolerance with current fundamentals, technical indicators and historical market patterns. The objective is to create and refine an energy strategy that prepares you for volatile energy prices and outlines your response. The strategy should also provide room to reforecast energy budgets as necessary. If natural gas prices increase by 10%, the effects will likely extend beyond the initial impact of the market spike, and your organization may need to reforecast to account for this unexpected scenario.

Plan Beyond Energy Prices

Energy prices are the key component of any energy supply strategy. But to perform well in volatile markets, your energy strategy should take other factors into account, including:

Bandwidth: Do your energy supply contracts allow for a specified quantity each month? If so, anticipate scenarios in which your usage is outside of the contracted volumes. Consider whether paying a little more for extra bandwidth is appropriate for your organization. Bandwidth issues become more pronounced in extremely volatile markets.

Quantify Market Exposure: What percentage of your entire utility budget is exposed if another market-moving event comes to fruition? Be able to quantify what is deregulated vs. regulated and where you have variable price contracts that would be most exposed to volatile market conditions.

Speed of Execution: In the event that a price target (or price ceiling) is met, how quickly can your organization react and execute on that opportunity? In a volatile market, prices can have large movements in short periods of time, and a delay of a week may mean that you have missed your target.

Term Length: Market backwardation—when a 12-month energy price is more expensive than a 24- or 36-month price—often occurs during periods of volatility. Will your organization be able to commit to these longer energy contract term lengths?

Regional Market Risks: Have you identified the regions that have pipeline and capacity restraints? Energy price volatility can be more pronounced in some regions than others and have an effect on your overall budget and strategy.

Line Up the Tools to Communicate Volatility

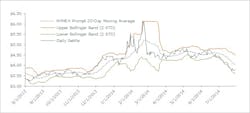

To manage risk, you must identify and communicate volatility as it happens. Although direct volatility measurements may aid in purchasing decisions, the data is speculative and does not forecast the direction of the long-term market. As an example, Bollinger Bands is a technical indicator used to monitor volatility and assist in calculating probability. These volatility bands are placed above and below a moving average, based on historical price changes. When the bands narrow (converge on the moving average), it is an indication of decreased volatility. When they widen (diverge from the moving average), it is an indication of increased volatility.

The chart below shows Bollinger Bands on the near month NYMEX Natural Gas contract. Notice the extreme widening during the winter months and how much the contract price fluctuated (very volatile). After the winter season, the bands narrowed and the market maintained a less volatile trading pattern, albeit more volatile than at the end of 2013.As winter approaches, now is a great time to take steps to mitigate energy price risk. Remember that pre-planning is the best weapon to survive volatile energy prices—you don’t need to be fearful of the winter with a strong strategy in place and early support from stakeholders. Begin preparing for winter now and your organization will be equipped for whatever surprises this winter has in store.

Ian Bowman is product manager, energy supply at Ecova, a total energy and sustainability management company.