Integrated Business Planning Is Not Just a Marketing Hoax

Integrated business planning (IBP) is a process that does exactly what its name implies—it brings together fragmented strands of strategic, financial and operational planning and performance management. Establishing mature IBP processes can be difficult, especially for larger and more complex manufacturers. While many factors contribute to this difficulty, the primary one has been the absence of technologies that fully support it.

What’s changing is what I call IBP platforms—technologies that combine enterprise performance management (EPM) and sales and operations planning (S&OP) to provide incremental capabilities that neither provides individually. In so doing, IBP platforms address long-standing challenges that financial and operational professionals have struggled to overcome. The result: opportunities for step change improvements to how manufacturers plan, manage and govern their business.

Behind the IBP Marketing Hoax

Historically, IBP has been used to describe processes that extend S&OP beyond balancing supply and demand, by integrating aspects of financial planning. Proponents are typically supply chain professionals. They argue that integration enables a more advanced form of S&OP—one that is more profit-driven and that effectively engages executives in enterprise-wide decision-making.

Detractors, however, believe that IBP is nothing more than a rebranding of S&OP by consultants and software companies. They argue that what is now called IBP is what S&OP practitioners have been doing for years. Moreover, they further believe that what is being sold as IBP software supports elements of IBP, but not enterprise-wide planning. Such beliefs have led some to conclude that IBP is a hoax.

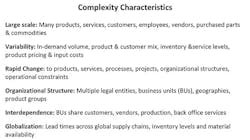

This criticism is not always warranted, particularly among smaller and less complex manufacturers. There are different ways to support IBP processes. For example, some use EPM software to support financial planning and budgeting, as well as S&OP. Others use a combination of S&OP and EPM tools. But as manufacturers start exhibiting the complexity characteristics shown below, these approaches quickly become less effective.

IBP Enables Manufacturers to Manage Complexity

What happens is that it becomes increasingly difficult to maintain the assumptions that connect strategic, financial and operational plans. There are too many moving and interconnected parts to cope with. What results are slow processes that aren’t always viewed as being accurate or effective.

This happens because the models supporting these applications are too simplistic. For example, EPM tools can’t always accurately translate demand scenarios into operationally realistic costs, inventories and cash flows. S&OP applications, on the other hand, provide a spectrum of financial planning capabilities. However, few support the ability to do scenario planning on a full set of financial statements that are explicitly reconciled to operational plans.

Given that, in complex settings, scenario planning drives the vast majority of IBP value, this capability gap is significant. What’s more, this gap is a primary contributor to views about the “IBP hoax.”

What’s Different about IBP Platforms?

IBP platforms address these gaps with embedded logic that is shared between EPM and S&OP processes and applications. This logic includes bills of materials, routings, inventory parameters, lead times, standard costing and MRP that are used by both financial and operational applications. Moreover, these models have important characteristics, in that they support:

- Time sensitive versions, where models and parameters vary from one period to another.

- Alternate model versions that can be used for monthly S&OP or strategic analysis.

- Utility tools that enable mass changes to planning models to support scenario planning.

- Distributed models ownership, where responsibility for maintaining models can be shared across the enterprise, rather than being concentrated in finance or supply chain.

This embedded logic isn’t isolated to just production. It also enables similar improvements to other aspects of business planning, such as consolidation, cash flow forecasting, and activity-based costing and planning.

IBP Platforms are Following the Same Path as ERP

What IBP platforms are doing is similar to what was accomplished with ERP 20 years ago. Back then, forward-thinking ERP vendors integrated bills of materials, routings, procurement, production management, standard costing and general ledgers to dramatically improve the ability to plan and manage production, from both operational and financial perspectives. They did so using integration to provide incremental capabilities that legacy systems couldn’t. This same evolution is now taking place in financial and operational planning systems.

This point is important to understand because some argue that mature IBP processes can be supported by separate EPM and S&OP applications. Such assertions are incorrect. What’s not being recognized is that meaningful integration is only achieved when planning applications share the same models. When they don’t, capability gaps arise.

Integrated Models Enable Incremental Capabilities

When planning models are shared by EPM and S&OP applications, incremental capabilities result that stand-alone applications can’t support individually. While many incremental capabilities result, five high level ones illustrate the transformative nature of IBP Platforms.

The first is double entry planning—embedded logic that automatically drives balance sheet and direct cash flow planning. This logic, when combined with production logic, not only drives direct cash flows, but also provides the basis for highly accurate cost, profit, inventory, balance sheet and foreign currency exposure forecasts.

The second is integrated variance analysis, a capability that automatically separates volume, mix, pricing, cost, productivity and foreign exchanges variances that comprise differences between any combination of budget, actuals, forecasts and scenarios. From an S&OP perspective, this capability also automates “integrated reconciliation” processes.

The third is concurrent planning. Integrated models enable more planning activities to be completed simultaneously, thereby collapsing cycle time and eliminating non value-added activities. This is in contrast to fragmented processes, where many more activities are being performed sequentially.

The fourth is matrix planning, a capability that provides the means to simultaneously plan from both functional and business process perspectives. This capability is essential for doing two things: first, planning and managing productivity; and second, driving cross-functional alignment around shared goals and objectives.

The last capability is end to end scenarios that can simultaneously assess the impact of potential demand and service level targets on costs, capacity constraints, cash flows, inventory levels and financial statements; in other words, the enterprise as a whole. Execution time is fast because only one model/application drives the process. Moreover, front-line people can be engaged in scenarios through distributed model ownership.

Is It Time To Replace Existing EPM and S&OP Systems?

Collectively, these capabilities enable manufacturers to fully achieve IBP objectives. Conversely, the absence of such logic is a key contributor to many of the challenges faced by finance and supply chain professionals.

What’s not being recognized is that, in complex settings, the ability to improve financial planning and forecasting processes—such as profit and cash flow forecasting and scenario planning—is inextricably linked to operations. For example, profit-based S&OP and rolling forecasts are interrelated parts of the same process. By extension, the full value of IBP can’t be achieved without fixing the (well documented) problems with budgeting.

In light of this, manufacturers should reconsider EPM and S&OP strategies. For those investing for the first time, IBP platforms offer a very compelling yet simple value proposition: two systems and processes for the price of one. For others, they will need to consider the ability to achieve IBP objectives, as well as the cost of achieving them. In such cases, the evolution of IBP platforms makes replacing existing EPM and S&OP systems a potential option.

Developing an IBP Strategy

One factor represents the primary obstacle for leveraging IBP platforms: Planning processes are typically owned by multiple stakeholders, not one process owner. As such, manufacturers often buy and implement planning and performance management solutions separately. The net impact is that they tend to “pave the cow path,” resulting in only marginal process improvements. Three steps can help organizations, and more specifically, change agents avoid this situation:

- Educate key stakeholders to help them understand the need for integration to address interconnected challenges.

- Enlist an executive to sponsor an IBP assessment—one that has the most to gain from IBP.

- Help the sponsor define key requirements up front to focus assessment teams and foster innovation.

By taking these steps, organizations can avoid missteps that undermine the value of IBP programs. More than ever, CFOs, CSCOs, CIOs and COOs need to work together to ensure that their organizations develop a coherent and coordinated plan for improving how they plan and manage their business. In so doing, they’ll be in a better position to capitalize on IBP platforms.

Dean Sorensen is founder of the IBP Collaborative and a management consultant specializing in finance and supply chain transformation. The IBP Collaborative helps organizations understand and leverage innovative business practices and technologies that enable step change improvements in how they plan and manage their business.