Outlook Sees Weak Recovery for Worldwide Steel Demand

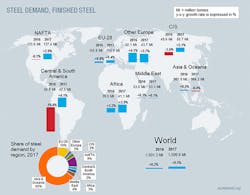

The World Steel Association issued the latest of its semi-annual Short Range Outlook reports, projecting global steel demand for 2016 and 2017. With a slightly more positive position than its April release, World Steel is forecasting that global steel demand will increase by 0.2% to 1.501 billion metric tons in 2016, having declined 3.0% in 2015.

The association represents steel producers in 66 nations, and conducts technical and economic research to promote the

For 2017, World Steel forecasts that global steel demand will grow by 0.5% and will reach 1.51 billion metric tons.

“The steel industry environment remains challenging, with escalated uncertainties driven by geopolitical situations in various parts of the world,” commented T.V. Narendran, chairman of the World Steel Economics Committee. “Recently, the U.K. referendum outcome has further raised uncertainty on the long-awaited recovery of investment in the EU.

"Weakness in investment globally continues to hold back a stronger steel demand recovery,” Narendran continued. “However, a better than expected forecast for China, along with continued growth in emerging economies, will help the global steel industry to move back to a positive growth path for 2016 and onwards. We expect this slight growth momentum to remain weak for the time being due to the continued rebalancing in China and weak recovery in the developed economies.

"Downside risks to this outlook come from the high corporate debt and real-estate market situation in China, Brexit uncertainties and possible further escalation of instability in some regions. On a positive note, steel demand in the emerging and developing economies excluding China is expected to accelerate to show 4.0% growth in 2017 thanks to the resilient emerging Asian countries and stabilization of commodity prices.”

While China has become the most important market for steel demand, investment is less than optimal in many regions of the world, the report noted. In the developed world (mainly, North America and the European Union), private investment remains weak due to “a pessimistic outlook on future demand and other continuing uncertainties,” notwithstanding consistently low interest rates.

Read MoreAmerican Machinist is an IndustryWeek companion site within Penton's Manufacturing & Supply Chain Group.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries. His work has covered a wide range of topics, including process technology, resource development, material selection, product design, workforce development, and industrial market strategies, among others. Currently, he specializes in subjects related to metal component and product design, development, and manufacturing — including castings, forgings, machined parts, and fabrications.

Brooks is a graduate of Kenyon College (B.A. English, Political Science) and Emory University (M.A. English.)