Are Wind and Sun Elements of the Manufacturing Comeback?

When it comes to renewable energy, President Barack Obama has served as the nation's proponent in chief. In his State of the Union speech on January 28, the president praised the booming oil and natural gas sector, but he also claimed the U.S. was "becoming a global leader in solar, too."

The president's endorsement of clean energy is shared by the U.S. public. A consumer survey by Navigant Research found that 79% of Americans have a favorable view of solar power and 72% approve of wind energy.

Solar and wind energy help move the U.S. toward a future with less greenhouse gas emissions, but Obama also has made an economic case for supporting clean technologies. That case focuses on jobs and rebuilding the U.S. manufacturing sector. In the state of the union, he noted, "Every four minutes, another American home or business goes solar; every panel pounded into place by a worker whose job can't be outsourced."

The president often has pointed to the need to ensure that the U.S. capitalizes on its technology research rather than see it commercialized elsewhere. In June 2011, he told an audience that "my administration has invested heavily in clean energy manufacturing, because I want to see the LEDs and solar panels and wind turbines and electric cars of tomorrow made right here in the US of A."

However, Obama could have pointed to the photovoltaic cell as a chief example of U.S. woes in holding on to high-tech manufacturing. The modern photovoltaic cell was developed at Bell Labs in 1954. But as a report from the European Commission last September indicated, China and Taiwan now produce 70% of the world's photovoltaic cells.

While both wind and solar power sources are growing, the manufacturing chains that supply them still comprise a very small part of the U.S. manufacturing community and its workforce of more than 12 million.

For example, the solar industry employs 142,000 in the U.S., according to the Solar Foundation, but the majority of those jobs are in the service sector. Just under 30,000 people are employed in solar manufacturing, according to the foundation. Manufacturing jobs peaked in 2011 at more than 37,000 but dropped in 2012 and were stagnant last year. In 2014, however, the foundation projects that manufacturing employment will grow by 8.6% to over 32,000.

There are currently 650 solar-related manufacturing sites in the U.S, the Solar Energy Industries Association reports. These companies manufacture a range of products for solar installations that include not only the components of solar photovoltaic panels, SEIA notes, but also "items used in PV, solar heating and cooling (SHC) and concentrating solar power (CSP) installations including, inverters, optimizers, and other power electronics, racking equipment, raw materials, batteries, solar hot water tanks, mirrors, etc."

The wind industry employed 17,400 in manufacturing in 2013, according to the American Wind Energy Association, a significant decrease from the estimated 25,000 manufacturing jobs at 550 facilities in 2012. That was due in large measure to uncertainty over the federal production tax credit, a familiar problem in an industry where investment decisions are based on decades and government support can disappear virtually overnight.

So what is the promise of these two green industries? Will they provide, as AWEA stated about the wind industry, a "catalyst of American manufacturing rejuvenation" or will the U.S. find itself again importing important new technologies?

Brighter Future for Solar

The solar market had a banner year in 2013 as installations of photovoltaic systems increased 41% from 2012 to 4,751 megawatts, according to GTM Research and SEIA. In addition, 410 MW of concentrating solar power (CSP) came online.

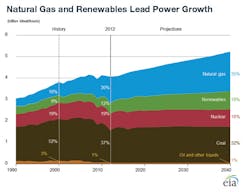

Solar was the second-largest source of new electricity generating capacity in the U.S. in 2013, exceeded only by natural gas. Since the beginning of 2010, the average cost of solar panels has dropped more than 60%. Just last year, the cost to install a solar system fell 15%.

Solar is "poised to assume a bigger role in global energy markets; as it evolves, its impact on businesses and consumers will be significant and widespread," according to a recent McKinsey analysis, "The Disruptive Potential of Solar Power." The analysis finds that sharp drops in both solar module prices and in the cost of installation and service "will put solar within striking distance, in economic terms, of new construction for traditional power-generation technologies, such as coal, natural gas, and nuclear energy."

In the utility market, the authors note, solar will have an outsized effect, capturing up to half of new consumption and thus undermining utilities' ability to deploy new generating capacity. The report said that has already happened in Europe, where "the demand for power has fallen while the supply of renewables (including solar) has risen, driven down power prices, and depressed the penetration of conventional power sources."

But while solar installations are growing daily, U.S. solar manufacturing has faced a tumultuous path. Last August, for example, GE abandoned plans to build a $300 million solar panel factory in Aurora, Colo., a victim of plummeting solar panel prices.

Trade disputes have rocked the industry. In 2011, German-owned SolarWorld, the largest manufacturer of solar cells in the U.S., accused China of subsidizing solar module manufacturers there so that they could dump below-market-price products in the U.S.

The Obama Administration took the issue to the World Trade Organization, which ruled in favor of the U.S. But now domestic manufacturers charge that China has circumvented the WTO ruling, which allowed the U.S. to impose import duties ranging up to 250% on Chinese solar products.

"[B]ecause Commerce's final orders excluded panels assembled in China from cells produced elsewhere," the Coalition for American Solar Manufacturers explained, "Chinese producers can grow silicon crystal, slice that crystal into solar wafers, outsource conversion of those wafers into cells to Taiwan or elsewhere, then bring them back for assembly into panels for export to the U.S. market" and elude U.S. duties.

John Smirnow, SEIA's vice president of trade and competitiveness, said the industry is looking for an alternative to costly, time-consuming trade litigation.

"We're working with industry stakeholders on a negotiated solution that would effectively incentivize solar panel manufacturing in the U.S.," Smirnow said, adding it would help existing solar manufacturers and encourage new manufacturing in the U.S.

Smirnow also pointed to significant new investments in the U.S. For example, Silevo, a solar panel manufacturer based in Fremont, Calif., is planning to build a new factory in Buffalo, N.Y., for production of its high-efficiency solar cells. The company is expected to invest $750 million in the 200-megawatt production facility.

As SEIA's Smirnow points out, solar manufacturing involves a broad array of products and suppliers. More than a decade ago, FLEXcon, a manufacturer of polymeric films based in Spencer, Mass., started to look at markets where it could grow its business and determined that photovoltaics held promise. Over the next few years, the company worked on product development and in 2012, introduced its KPE backsheet for solar modules. The backsheet protects the solar panel's cells from the weather and serves as an electrical insulator.

Over time, says Ken Koldan, director of OEM for FLEXcon, the company has devoted more focus to the photovoltaics market. One change in the market, he noted, has been a shift toward more photovoltaics used in commercial and utility applications. That favors the more durable kinar-based backsheets that FLEXcon produces, says Koldan.

FLEXcon prides itself as a private U.S. business that is competing successfully in a global market. Koldan notes that the OEM business is a net exporter of product. One reason is that the demand for solar power is expanding beyond traditional markets such as the U.S., Canada and Germany to Chile, India, Saudi Arabia and many other countries.

The photovoltaics market is not a primary business area for FLEXcon, says Koldan, but this is a company with an eye on the future.

"We think it is going to be successful and we want to be on the ground floor," he says. "The solar marketplace has started growing."

Eaton, a diversified power management company, produces equipment for both the wind and solar markets, as well as energy storage products. John Vernacchia, the segment manager for alternative energy, said Eaton's 2012 acquisition of Cooper Industries broadened the firm's offerings, particularly with regard to large utility-scale projects.

Eaton produces solar inverters and transformers that convert DC to AC power, connect the PV system to a building or grid electrical system and help ensure safe operation. Vernacchia said the company also produces a range of electrical and hydraulic equipment for wind turbine OEMs, with most of that business located in Europe and China.

Eaton produces most of its products for alternative energy regionally, said Vernacchia, in part because electrical standards vary from country to country.

Noting that "carbon-free electricity generation" will grow faster than other conventional sources, Vernacchia said Eaton views solar PV and wind as good areas for business growth.

That growth is taking place in a more globally diversified manner than in the recent past, Vernacchia noted, where incentives had centered much of the market in Europe.

"The U.S., China and Japan are major markets in addition to Europe," he said. "We're starting to see growth in places like Latin America."

Attributing the growth in U.S. businesses due to solar and wind can be difficult at times. For example, Eaton announced on February 10 that it was expanding and updating three facilities in the Milwaukee area. The $54 million project was expected to create as many as 200 new jobs.

"Not all the transformers in that facility are for solar PV but many of them are," Vernacchia said. "Part of the reason we needed to add capacity is that our Cooper Power System business is a major supplier of transformers for many solar PV projects."

Wind at its Back

Wind power had a terrible year in 2013 as uncertainty over the production tax credit caused investment to crumble. After 13 GW of wind-powered electrical capacity was installed in 2012, just over 1 GW came on board in 2013. However, with a change in the PTC, those numbers look much better in 2014 as more than 12,000 MW of generating capacity was under construction.

Uncertainty in the industry took a toll on manufacturers, noted Emily Williams, a senior policy analyst with AWEA. In 2012, there were 26 companies manufacturing turbines. Last year, she said, that number fell to seven or eight.

Still, she says, the remaining companies are strong competitors with thousands of units installed globally. GE, Siemens and Vestas, said Williams, control 70% of the U.S. market. Those companies attract suppliers to their operations in the U.S., both from Europe and the local community.

For example, Siemens announced in December that it had won a contract from MidAmerican Energy for 448 wind turbines for five project sites. Together, those 2.3 megawatt turbines will deliver 1,050 megawatts of additional wind generation in Iowa by the end of 2015.

Siemens Energy's Fort Madison, Iowa, facility will manufacture all the blades, while the nacelles and hubs will be assembled at the Siemens plant in Hutchinson, Kansas.

The Fort Madison plant employs approximately 500 people. Approximately 1,000 construction jobs will be created during the two-year construction period for the wind turbines, and some 40 permanent jobs will be added when the expansion is complete.

If Siemens represents the kind of global powerhouse able to weather the ups and downs of a young industry, Aeronautica Windpower, based in Plymouth, Mass., is more the domestic upstart hoping to profit from a gradual societal shift to greener power.

Aeronautica began business in 2008 refurbishing wind turbines. President Walter Wunder licensed turbine technology from Norwin A/S, a Danish company, and Aeronautica sold its first turbine in 2010. The company began production in 2011 and, with the help of ARRA funding, sold three turbines to Ohio school systems in 2012.

Aeronautica is a niche player in turbine manufacturing, producing a mid-scale 750kW unit suitable for applications such as schools or light industry. It produces nacelles in New Hampshire while it contracts for turbine blades in Holland, Mich., and towers in Michigan and Texas.

Aeronautica has a contract to build a unit for Crisfield, Md. Wunder said it took the mayor five years to get the project approved. Though the contract was signed last October, Aeronautica has to wait for components from its suppliers and likely won't complete the turbine until September.

"You're at the mercy of your suppliers," said Wunder, who said it can take eight months or more to get all the made-to-order turbine parts. After that, assembly goes quickly, he said, in as little as two weeks. He said erecting it on-site "can happen in a week once the foundation is poured."

Patience may be a virtue, but Aeronautica is moving ahead with plans to expand its business. The company has sold its first turbine in Canada, has set up distribution in the United Kingdom and has also begun providing maintenance services for other turbines.

Still, Wunder hopes that the U.S. will set a more aggressive course in promoting wind power and supporting its wind industry. Other countries, he says, are outpacing the U.S., perhaps recognizing, as he puts it, that there is "only a finite amount of energy that is coming from Mother Earth."

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.