So That Happened: Dog Machining, Fracking Batteries and Greening Kohler

Editor’s note: Welcome to So That Happened, our editors’ takes on things going on in the manufacturing world that deserve some extra attention. This will appear regularly in the Member’s Only section of the site.

Fracking for EV Batteries?

The transition to the green, electrified future of mobility will have to include some techniques that environmentalists don’t particularly love.

In its announcement earlier this week that it plans to get into the EV battery business, officials with energy giant ExxonMobil (No. 1 on the IW U.S. 500 list of the country’s largest manufacturers) said they’re going to drill for lithium, extracting the light metal from saltwater deposits deep under the ground in Arkansas.

“After using conventional oil and gas drilling methods [emphasis added by IW editors] to access lithium-rich saltwater from reservoirs about 10,000 feet underground, ExxonMobil will utilize direct lithium extraction (DLE) technology to separate lithium from the saltwater,” company officials said in their announcement.

The key term there is conventional. Hydraulic fracturing, the practice of injecting fluids into underground shale formations the break up rock formations and release oil and gas, is unconventional. So, no, for now Exxon’s plans to drill for enough lithium to make 1 million EV batteries per year won’t include fracking. And, the oil company is pitching the traditional drilling methods it plans to use as a greener, less-carbon-intensive alternative to conventional rock mining for lithium.

So, will ExxonMobil become the green corporation of the year? Unlikely, but this new energy economy continues to be full of surprises.

Final note on lithium drilling – the town in the center of the Smackover formation is El Dorado, Arkansas. The El Dorado myth dates back to the discovery of the New World as explorers looked for a legendary city of gold. Well, lithium is a silvery-white, flaky metal, and it costs roughly 57 cents per ounce (compared to nearly $2,000 for gold), but El Dorado is becoming the site of a minerals rush as companies prepare for increased electrifications of everything.

—Robert Schoenberger

Kohler Looks to Get Leaner

It’s a long journey from bathtubs to hydrogen fuel cells.

The leaders of privately held holding company Kohler recently said they will sell a majority stake in their distributed energy subsidiaries to investment firm Platinum Equity, which will run Kohler Energy as a separate company. The plan needs to take a few more steps, including having talks with Kohler’s works councils, and is expected to be completed by mid-2024.

Kohler Energy will be home to a hard hatful of brands that make power systems for homes and factories as well as gas and electric powertrains. Spinning those out to Platinum makes a lot of sense: The tailwinds of electrification, reshoring and infrastructure investments are a boon to energy-related businesses—and are in need of a lot of capital to capitalize on those megatrends—while the kitchen-and-bath sectors look set to be confined in the economy’s slow lane for a while.

“We expect to drive significant continued investment that increases value to our customers, team members, and shareholders,” Kohler Energy Group President Brian Melka said, highlighting the different capex profiles of the two business groups. “I’m proud of what the team has done to build an industry-leading business, and we look forward to working with Platinum Equity to embark on our next phase of growth.”

As if to hammer home the distinct product lineups, Melka this week unveiled Kohler Energy’s first hydrogen fuel cell power system, which his team will begin testing early next year with the aim of shipping it to hospitals, water treatment plants and other critical infrastructure.

Might there be another deal in the works? Wisconsin-based Kohler, which is marking its 150th year in business this year, also runs a hospitality portfolio centered around golf resorts and spas, including the Whistling Straits golf course in Sheboygan that hosted the 2021 Ryder Cup.

—Geert De Lombaerde

Cutting Tools and Sausage Dogs

ANCA, a manufacturer of CNC grinding machines, has announced the winners of its sixth annual Tool of the Year Awards. The 2023 contest saw hundreds of attendees at the ceremony and gala dinner at EMO Hannover.

Emuge-Franken took home first prize for their multi-functional carbide cutting tool with ceramic material. Efficiency, precision and extended lifespan were cited as the primary characteristics that made the tool stand out.

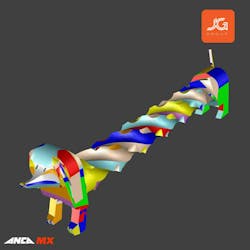

In the Virtual Tool Category, JG Group earned first place for the second consecutive year; the group created a simulation of a Dachshund using various profile operations. “JG Group's whimsical ‘sausage dog’ entry added a delightful touch to the competition, underscoring the remarkable flexibility of our software and the impressive results that can be achieved when blending creativity and expertise,” says ANCA Co-Founder Pat Boland.

The 2023 awards also introduced the inaugural Female Machinist of the Year award, secured by Lena Risse from Risse Tool Technology GmbH. “Recognizing women who are choosing to enter our industry is paramount,” says Boland.

Submissions for the 2024 contest will open in May.

—Anna Smith

Goodyear CEO Retires, and More Big Changes Coming

The longtime president and CEO of Goodyear, Richard J. Kramer, announced today that he will be retiring from the Akron-based tiremaker in 2024.

Kramer, 60, has served as Goodyear’s CEO since 2010, leading the company through the Great Recession and the pandemic, as well as its transformation into technology mobility company. His leadership streamlined Goodyear’s manufacturing, reduced costs and de-risked and fully funded Goodyear’s pension plans, according to a company press release. Kramer also led the acquisition of Cooper Tire—Goodyear’s largest-ever acquisition—in 2021.

“Reflecting on the past 14 years, it has been an incredible privilege to lead this iconic American company as chairman, CEO and president,” Kramer said in a company statement announcing his retirement. “As we embark on our next stage of growth, I am confident that our Goodyear Forward plan will build an even stronger foundation for the next generation of leadership to continue paving the way for Goodyear’s enduring success.”

Goodyear had been dogged of late by activist investor Elliott Investment Management and agreed earlier this year to add three directors who sought change in company strategy.

In its earnings call today, Goodyear also announced a new transformation plan—Goodyear Forward. According to the release, Goodyear Forward includes:

- “Pursuing strategic alternatives” for Goodyear’s chemical business, its Dunlop brand and its off-road equipment tire business—that would “optimize” $2 billion in its portfolio.

- Cost reductions in manufacturing footprint, purchasing, supply chain, R&D, and subscriber acquisition

- Optimizing product positioning and branding

"We believe the 'Goodyear Forward' transformation plan represents a significant set of steps toward a stronger and more profitable Goodyear,” said Elliott portfolio managers Marc Steinberg and Austin Camporin in a press release. “We thank Rich for his leadership and the review committee for its collaborative engagement, and we look forward to continuing our dialogue with the company as it implements these initiatives and works to deliver the substantial upside value that we see for all Goodyear shareholders."

Kramer was #31 among the 50 highest-paid CEOs in automotive, according to Automotive News’ 2022 compensation survey, with total compensation of $21.8 million in 2021 and $8.9 million in 2022.

Goodyear has 74,000 employees and 57 manufacturing facilities in 23 countries. It was #85 on the IndustryWeek 500 list of the top industrial companies in 2022, with 41.9% in revenue growth. It did not make the list in 2023. An influx of cheaper tires from China and supply-chain disruptions are hurting U.S. tire manufacturers.

—Laura Putre

About the Author

Laura Putre

Senior Editor, IndustryWeek

As senior editor, Laura Putre works with IndustryWeek's editorial contributors and reports on leadership and the automotive industry as they relate to manufacturing. She joined IndustryWeek in 2015 as a staff writer covering workforce issues.

Prior to IndustryWeek, Laura reported on the healthcare industry and covered local news. She was the editor of the Chicago Journal and a staff writer for Cleveland Scene. Her national bylines include The Guardian, Slate, Pacific-Standard and The Root.

Laura was a National Press Foundation fellow in 2022.

Got a story idea? Reach out to Laura at [email protected]

Robert Schoenberger

Editor-in-Chief

LinkedIn: linkedin.com/in/robert-schoenberger-4326b810

Bio: Robert Schoenberger has been writing about manufacturing technology in one form or another since the late 1990s. He began his career in newspapers in South Texas and has worked for The Clarion-Ledger in Jackson, Mississippi; The Courier-Journal in Louisville, Kentucky; and The Plain Dealer in Cleveland where he spent more than six years as the automotive reporter. In 2014, he launched Today's Motor Vehicles (now EV Manufacturing & Design), a magazine focusing on design and manufacturing topics within the automotive and commercial truck worlds. He joined IndustryWeek in late 2021.

Anna Smith

News Editor

News Editor

LinkedIn: https://www.linkedin.com/in/anna-m-smith/

Bio: Anna Smith joined IndustryWeek in 2021. She handles IW’s daily newsletters and breaking news of interest to the manufacturing industry. Anna was previously an editorial assistant at New Equipment Digest, Material Handling & Logistics and other publications.

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has been in business journalism since the mid-1990s and writes about public companies, markets and economic trends for Endeavor Business Media publications, focusing on IndustryWeek, FleetOwner, Oil & Gas Journal, T&D World and Healthcare Innovation. He also curates the twice-monthly Market Moves Strategy newsletter that showcases Endeavor stories on strategy, leadership and investment and contributes to other Market Moves newsletters.

With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati in 1997, initially covering retail and the courts before shifting to banking, insurance and investing. He later was managing editor and editor of the Nashville Business Journal before being named editor of the Nashville Post in early 2008. He led a team that helped grow the Post's online traffic more than fivefold before joining Endeavor in September 2021.