The Power of Aligning Business and Pricing Strategy Is Overlooked, Underrated

IndustryWeek's elite panel of regular contributors.

I have been privileged to work over 25 years in the industrial sector. I am passionate about producing and selling things. Being able to walk in a production facility and watch how things are being manufactured is invigorating. The other side of the coin is that I often spend quite a bit of time explaining to leaders in these industrial companies how to connect business and pricing strategies. Many of these leaders are brilliant in production, technology and finance, but often lack strategic acumen across the board. So, we hear comments like “We need to fill the plant,” “Sell volume at all costs,” and “Pricing should be based on cost as it is the only thing we can control.”

Every business is different for sure, and in the industrial business, capacity absorption and utilization are key drivers of costs. However, chasing volume and pushing sales teams to fill plants send the wrong signals to the market and can have dire long-term consequences. I vividly remember the CEO of a multi-billion-dollar industrial company constantly repeating, “We need to double sales” or “We need to be $6 billion in sales.” Salespeople were running around the market signing deals they should not have taken and destroying value along the way. I was hired to train the marketing and sales to sell on value at that time, and it did not make real sense at all.

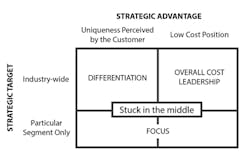

I often must go back to basics and explain to these leaders the fundamental concept of generic business strategies introduced by Michael Porter several decades ago. The three strategies are:

- A differentiated strategy based on strong differentiation and uniqueness offered to the entire market.

- A low-cost and low-price strategy when price is the unique differentiator and is offered to the entire market.

- A focus strategy where a company chooses its target segments and focuses on that only (regional or industry segment).

The first issue emerges when there is a lack of clear strategic positioning for an industrial company. Many of them chase all three strategies at once, are stuck in the middle and are good at none of them. It creates confusion for customers and their internal teams. Pricing becomes an issue as customers can exchange price levels and start complaining. It also opens the doors for gray markets.

Industrial leaders often call me or other pricing experts to tell us that they have a pricing problem. In reality, pricing is a symptom of something not working in their strategy. Fix that structural strategic issue and then align your value and pricing strategy in accordance with that. I often tell them that pricing strategy and tactics will not fix systemic and structural issues in business strategy or business model issues. They need to pick a strategy or at least a main strategic position and create alignment in the rest of the processes.

The strong connection between business strategy and pricing strategy is powerful when done well. It brings clarity to sales and marketing to focus on the right markets, the right customers and the right product priorities. It reinforces the long-term orientation of the company toward the strategic positioning but also shows the commitment of leaders to that positioning. It creates consistency between go-to-market functions and operational functions on what to deliver and what level of product and service quality. Finally, at times, it shows that leadership can walk away from unprofitable opportunities, stay true to the core and protect valuable customers.

The focus moves away from pursuing every deal and filling the plant, to pursuing the right customers and opportunities that are aligned with the positioning and support the long-term vision. Of course, there might special cases or exceptions for strategic high-volume opportunities. There might also be times when aggressive discounting can be allowed if needed. Let us not forget that we might be running large plants!

The notion of alignment between business strategy and pricing strategy is essential. A company cannot claim to have a differentiation strategy and give discounts right and left. Apple, for example, is a shining example of alignment. Go in an Apple store and ask for a discount. The staff will be shocked at the question. They might not understand what you are asking! They surely have no authority to give discounts, and the systems do not have discount options. That is true alignment.

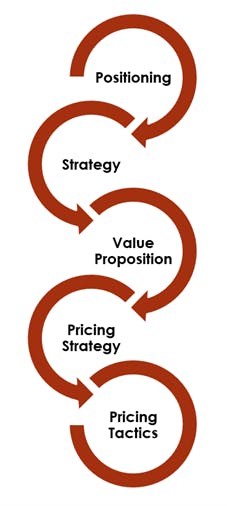

So, the strategic positioning of the firm must lead to a clear strategic plan that communicates strategic priorities and goals to all functional groups and guides internal processes. The strategy reinforces the corporate customer-value proposition, which then gets proliferated in the product or service portfolio. From there, pricing strategy and pricing tactics support the execution of the positioning and the value proposition. If you are producing and selling high-end industrial equipment and your value proposition is high-end and highly value-added to customers, you will most likely deploy a value-based pricing strategy and focus on value-based selling to support your pricing tactics. If you are a low-cost producer of widgets and are selling on price without bells and whistles, then your pricing strategy might be cost-plus and focused on not losing high volume deals. You will for sure have a cost advantage to compete.

It takes a fair amount of courage for leaders to stay true to this logic and to start saying no to opportunities that do not make sense. We all love to make deals. We all love to grow and build new plants. I prefer profitable growth and controlled growth. Be bold; join the pricing revolution!

Stephan Liozu is Founder of Value Innoruption Advisors, a consulting boutique specializing in industrial pricing, digital business and subscription-pricing models, and value-based pricing. Stephan has 30 years of experience in the industrial and manufacturing sectors with companies like Owens Corning, Saint-Gobain, Freudenberg and Thales.