Cadillac’s Difficult Road Ahead

Everything starts in California. That has been a catchphrase among marketing executives for decades. From the introduction of hula hoops to skateboarding to McDonalds, the catchphrase has a basis in fact. While the electric vehicle did not start in California, sales have really taken off there. Registrations of battery-electric vehicles in California and the West Coast are the highest in the nation by a significant margin. California’s clean-air legislation, incentives and climate make it a natural high-volume market for electric vehicles.

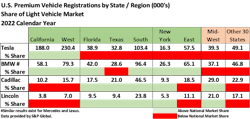

Premium vehicle registrations are significant in California as well. The state is the number one market for BMW, Mercedes-Benz and Lexus (and Tesla), the dominant players in the premium segment. Overall, if you want to be a player in the premium vehicle business, you must play hard there. If you want to get your battery-electric vehicles accepted by the monied-class, then that is where you start.

Historically, Cadillac was identified as a brand that bestowed status to the owner. Elvis loved Cadillacs, and so did Hollywood and presidents. Bruce Springsteen even sang about them. Unfortunately, over the past decade, the glimmer has worn off and the awards have been rare. U.S. Cadillac sales have been declining since 2015, and the brand currently ranks sixth overall in the premium segment.

California Dreaming

Moving forward, Cadillac’s ability to establish the brand as a leading player in the electric vehicle space will be burdened by its current market position on the West Coast. BMW and Mercedes-Benz outsell Cadillac by 5:1 in the region (Lexus by 4:1). Market leaders have an existing customer list that is huge, for both cars and SUVs. These luxury owners like brand stability and nameplates that are recognized at the country club. BMW, Mercedes, and Lexus have model naming conventions that have been consistent for over a decade.

Cadillac misses on that brand equity dimension. Their models have changed naming conventions more than market leaders, giving buyers an additional task of explaining, or defending, their purchase to neighbors. Importantly, both BMW and Mercedes have entered the battery-electric space with naming conventions rooted in existing models. Cadillac is zigging in another direction.

Yet, Cadillac’s difficulties go beyond branding. Leading premium marques in California have a high percentage of exclusive stores; their look and feel give shoppers the “Rodeo Drive” experience. Cadillac has almost 40% of their dealers “dueled” with other mainstream brands of General Motors. If exclusivity matters to premium battery-electric buyers, then Cadillac is missing the mark. Their California registrations per exclusive outlet (248) are dwarfed by BMW (1,075), and Lexus dealers (1,250).

Cadillac’s current and future portfolio is weaker than competitors’, especially in passenger cars that remain popular among BMW and Mercedes buyers. Adding injury, Cadillac’s current mid-size entries get mixed reviews from Motor Trend and Consumer Reports. Not a good foundation. (Tesla’s ratings in Consumer Reports fare worse).

Cadillac remains high on the consideration list for luxury makes. However, in marketing parlance, they have struggled turning high consideration into sales. Moving forward, the brand does not have the portfolio or brand firepower to compete effectively on the West Coast.

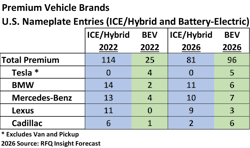

Getting shoppers into a Cadillac is difficult today. The job will not be any easier in the battery-electric space, where sixty-six competitive entries will be launched through 2026.

Getting to the Vision in North America

Cadillac’s electric vehicle launches, and the brand’s transformation, will require excess marketing resources. A bright spot: Cadillac does have the potential to generate battery-electric sales in markets where the brand is strong, like the high-volume markets of the Midwest. Texas, Florida and New York also present opportunities.

But the battle for acceptance will be fought on the West Coast with a strategy that appears different than market leaders. Cadillac is not only launching battery-electric models with new names; they are dropping their internal-combustion counterparts soon after the vehicles are launched. BMW, Mercedes, and Lexus, on the other hand, will maintain a stable of passenger cars and SUVs that are ICE and hybrid.

Cadillac’s first entry, Lyriq, got off to a slow start last year after quite a bit of hype. Sales in the first quarter of this year were less than 1,000 units, and they will need to run fast to reach RFQ Insight’s North American forecast of 14,500 units for 2023. (Assumes $7,500 in federal incentives). In comparison, Tesla Model X will sell more than twice that number at a significantly higher MSRP.

RFQ estimates that Cadillac needs to sell 85,000 battery-electric SUV units in 2026 to be a premium electric player in North America—90% of their 2019 SUV volume (excluding Escalade), with at least 40% sold on the West Coast. The brand must begin to capture the hearts and minds (and wallets) of the West Coast crowd or fall short of its vision. Cadillac will also continue to lose share given the potential elimination of XT5 and XT6 gasoline versions.

The recently released EPA proposal on CO2 levels will pile on more pain for the vehicle industry. This highly disruptive proposal could force a radical change in manufacturer’s program plans for 2029 and beyond. The implied disruption demands that Cadillac jumpstart battery-electric sales now, in the markets that matter (hint: California).

The battery-electric journey for Cadillac will be hazardous and slow-going through 2026, given the brand’s current position. Cadillac’s paradigm must change. The government cannot make consumers buy electric vehicles, and nobody knows that better than Steve Carlisle, president of GM North America.

Warren Browne is president of RFQ Insights and is adjunct professor of economics and trade at Lawrence Technological University. Browne retired from General Motors in 2009 after 39 years of service. From 1991 to 2009, he held senior executive positions at GM.