The sheer amount of data on the manufacturing sector produced by research firms, not-for-profit groups, and trade associations can be mind-boggling. This data roundup collects, contextualizes, and analyzes data from the previous month of manufacturing in order to deliver a more comprehensive view of the industry as it is today.

The U.S. economy as a whole is on a long mend from an unprecedented downturn caused by the COVID-19 pandemic and efforts to contain it. In manufacturing, the sharpest drop of the downturn—for both economic activity and employment—took place roughly 12 months ago now, in March and April 2020. So, where is manufacturing one year later?

Enterprise

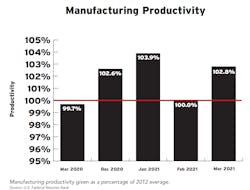

In terms of manufacturing productivity, factory output is fairly stable, aside from at least one more unpredictable catastrophe: Severe winter weather in February caused factory productivity, measured by the U.S. Federal Reserve relative to its 2012 levels, dropped a startling 3.7 points. This dip in productivity appears to have been a temporary blip, though, since March output jumped back up to just under January levels right after. On a year-over-year basis, March 2021 beat March 2020 productivity by 3.1 points.

Despite the blip, though, the Federal Reserve noted several sources of downward pressure in manufacturing productivity in its latest report. Notably, vehicle production losses in February did not recover fully in March, thanks to an ongoing shortage of semiconductors: vehicle production fell a full 10% in February but only rose 2.8% the month after.

The Federal Reserve also takes capacity utilization measurements of factory productivity. By that measure, manufacturing seems to have recovered well despite its own February hiccup, when it fell to 71.9%, a little higher than March 2020, when it was 71.4%: March 2021's capacity utilization figure, 73.8%, beats last year’s March measurement by 2.4 points.

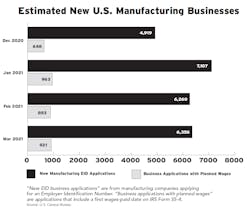

Both of the Federal Reserve’s measurements of manufacturing productivity are useful indicators for how existing factories are performing across the nation, but a growing recovery should also suggest more activity among new manufacturers and entrepreneurs.

Tax information on newly-forming businesses collected by the U.S. Census Bureau appears to indicate a strong increase in entrepreneurs filing to create a new manufacturing business between December 2020 and January 2021, which has dipped slightly since but remains well above where it was in December. The total number of new business applications increased, as did the number of new business applications that specify when first paychecks would be issued to employees.

Talent

The new year started uncertainly for manufacturing employment: in January, The Department of Labor’s adjusted statistics showed steep losses of 14,000 jobs in durable manufacturing, while durable-goods manufacturing made only 1,000 new hires.

But growth in February and March show the manufacturing sector is actually picking up new employees at an increasingly rapid pace: March’s pace of new hires more than doubled February’s growth. The latest figures from the Department of Labor’s Bureau of Labor Statistics show that manufacturers hired about 53,000 people in March, with new jobs roughly split between durable-goods production and nondurable-goods production.

Despite that promising near-term trend, the manufacturing sector still employs substantially fewer people than it did before COVID-19.

Compared to February 2020, just before the pandemic began to wreak havoc on the economy and payrolls everywhere, manufacturing as a whole employed 12.8 thousand people in the U.S.: in February 2021, that figure was 12.2 thousand. The gap between then and now is about 515,000 jobs that have yet to return during the pandemic recovery, most of them in durable manufacturing.

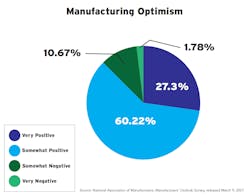

Data Spotlight: NAM’s Optimism Survey

A recent survey from the National Association of Manufacturers shows most manufacturers are looking at the rest of the year with a sense of hope. Of 450 respondents polled, 87.6% said they were at least somewhat optimistic about their company’s outlook for 2021.

About the Author

Ryan Secard

Associate Editor

Ryan Secard joined Endeavor B2B in 2020 as a news editor for IndustryWeek. He currently contributes to IW, American Machinist, Foundry Management & Technology, and Plant Services on breaking manufacturing news, new products, plant openings and closures, and labor issues in manufacturing.