Are Manufacturers' KPI Reporting Practices Keeping Up? Part II

Part II of two. Read Part I here.

Effective KPI management requires an emphasis on accountability, transparency and comprehensive communication. When implemented well, it allows organizations to reduce costs, eliminate bottlenecks and identify new opportunities. Organizations that do not successfully manage their KPIs, by contrast, may lack actionable information about what’s truly moving the needle for their organization.

APQC conducted a survey to garner insights into these challenges. The survey explored the KPIs organizations use to manage operations, their alignment to organizational goals, and the role that measures and reporting make on the decision-making process.

In our previous article, we discussed at alignment between organizational priorities and the measures organizations use and KPI selection practices.

In this second article we will discuss:

- What practices do manufacturers use to execute their KPI reports?

- What are manufacturers’ collection and reporting gaps?

KPIs Reporting and Decision Support

Manufacturing organizations have embraced data-driven decision-making, and their decision makers use facts derived from the KPI reports in their efforts. Organizations use KPIs for a wide variety of applications including tracking overall performance of the company, identifying improvement opportunities and managing short-term objectives within the organization.

But how do manufacturing organizations execute their KPI reporting practices to ensure decision makers have the right information in a timely fashion?

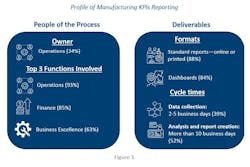

People of the Process

Regardless of industry, operations typically owns the operational KPI analysis and reporting process. However, there are substantive differences between manufacturing and service sectors when it comes to the functions that participate in the analysis and reporting process. Finance is more likely to be actively involved in manufacturing organizations (85%), followed closely by business excellence (63%). This relationship by sector makes sense in the context of the top KPIs by sector: Manufacturers rely on margins and financial results for KPIs, which call for a higher involvement from the finance function in reporting and analyzing the data. Broadly speaking, while many organizations do not confine KPI analysis and reporting strictly to operational teams, there is still plenty of room for KPI analysis to benefit from functions like process management, data and analytics, and benchmarking. These organizations also have resources that help the organizations move its analysis beyond descriptive reporting and help include context on the data from benchmarking efforts.

The Deliverables

Technology has made reporting easier: There are plenty of solutions on the market today that allow for easy creation and customization of visually appealing reports. Yet most organizations continue to use standard reports (88%) to convey KPI information, followed by dashboards and ad hoc reporting. Though manufacturing organizations tend to rely on standard report formats (online or print optimized version) for KPI reporting, they are approximately 20% more likely to use dashboards for KPI reporting than their peers in the services industry.

However, information cannot be helpful, actionable or relevant if it is outdated. Yet all too often, getting key data and insights into the hands of decision-makers takes far too long. Data collection is not the culprit here: Most manufacturing organizations (39%) complete the data collection process in less than five business days. An even smaller group (12%) are optimized and collect data in real-time. The problem is not the data collection process, but instead it is the analysis and reporting process. The majority of manufacturing organizations (52%) take more than 10 business days to complete this process, while only 6% of manufacturing organizations perform complete analysis and reporting in real time.

Automation

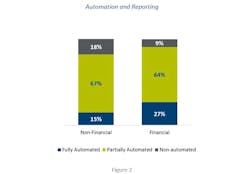

While automated KPI processes yield many benefits—faster data, fewer human errors, easier collection and reporting processes, and more sophisticated analyses—reporting automation is far from the norm at most organizations.

While many organizations leverage automation to streamline data collection, analysis, and reporting processes, few organizations have fully automated their processes. More than half of the organizations in the study are in the middle of their adoption efforts: Many do have partially automated processes for financial KPIs (69%) and non-financial KPIs (59%). Only 27% of manufacturing organizations have fully automated data collection processes for financial KPIs, and only 15% have fully automated processes non-financial KPIs.

Though it can help improve the speed and reduce human error, is automation the silver bullet solution for organizations’ reporting challenges?

Closing the Reporting Practice Gaps

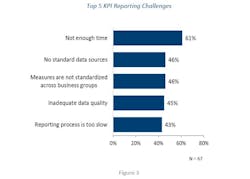

With the reliance on traditional reporting formats and cycle times of up to 10 days, it’s no wonder that two of the top challenges for managing operational KPIs are time-related: The reporting process is too slow and not enough time for the process.

Though organizations can look to automation as one solution for streamlining their efforts, the core problems of reporting are much more fundamental and require addressing before diving into full automation. If organizations do not get consensus for standardized measures and tackle their data management challenges, they will still wind up with too many reports that rely on bad data.

The first step is to get consensus on standard measures. As mentioned in the first article, best practice organizations use workshops with their key stakeholders, using selection criteria to identify the best fit measures. From there they can identify their data gaps and work toward a data management strategy to collect and provide access to data the organization needs.

APQC helps organizations work smarter, faster, and with greater confidence. It is an authority in benchmarking, best practices, process and performance improvement, and knowledge management. APQC’s unique structure as a member-based nonprofit makes it a differentiator in the marketplace. APQC partners with more than 500 member organizations worldwide in all industries.

About the Author

Holly Lyke-Ho-Gland

Holly Lyke-Ho-Gland is a principal research lead who conducts and publishes APQC research on process management and improvement, quality, project management, measurement, and benchmarking for APQC’s Process and Performance Management research team. Her research supports APQC members and clients across disciplines and centers on helping professionals and project managers solve business problems with strategy, process and measurement.