By most any account, 2018 was an extraordinary—and extraordinarily weird—year.

It began with a bang. The much-anticipated tax overhaul of 2017 landed with a sweet financial boost that reverberated across corporate America. This was quickly followed by a massive $300 billion bump in government spending—a portion of which was directed into manufacturers' pockets.

This double punch of good fortune acted like a shot of adrenalin into the system. Armed with unbudgeted gains, manufacturers enjoyed an early-year investment frenzy that many believed would yield nothing short of historic, record-breaking results.

But at the same time, the U.S. was also embarking on a dangerous, polemical path toward a trade war with China. In January 2018, we imposed 30% to 50% tariffs on solar panel and washing machine imports; in March, we added a 25% tariff on certain metal imports; and in July, 818 more products were hit with the 25% tax, too. All throughout, there remained constant threats of retaliations and responses, of raised or lowered tariffs, or new exceptions and new rules.

The objective in this tariff strategy seemed to echo that of the tax overhaul and government spending increases: to put the focus back on American business. The results of these plans, however, was impossible to guess. Some companies predicted billions in losses, others predicted billions in gains; some companies promised to reshore operations, others threatened to pack up and leave.

The economists and market prognosticators were at a loss. There seemed no way to accurately predict how any of this was going to end.

But now it has ended. Or at least 2018—and all its weird economic tricks—has ended. As we gear up for a new round of this year's economic maneuvers, we can finally dive into last year's results to examine the full toll all of this has played on the U.S. manufacturing market.

Cold Currency

The IW U.S. 500 provides the unique perspective we need for this. There are a million forces affecting the manufacturing industry besides government policies—from talent challenges to consumer trends, from digitization to automation, from weather to resources, and beyond. But the IW U.S. 500 cuts to the chase, ranking all public companies in simple, harsh economic terms: revenue.

Basically, it's an opportunity to examine the top line success registered by each company, irrespective of the various crises and opportunities they faced. In an extraordinary year like 2018, these data are particularly precious—they provide the real results the world has been waiting for.

So let's sit the prediction models aside and look at the raw facts.

2018, By the Numbers

On the whole, the manufacturing market was up in 2018. Way, way up.

Total revenue recorded by the companies making the IW U.S. 500 list this year hit $5 trillion—up an impressive 10.85% from the previous year. Even better, net income hit $532 billion for these companies, representing a solid 25% bump over 2017's $425 billion.

These increases represent the second year of strong growth after dips in both income and revenue from 2015-2016. Which means what we are experiencing may be far more than a simple blip.

According to Chris Kuehl, economic analyst for the Fabricators & Manufacturers Association (FMA), the overall growth can be largely attributed to that double government whammy gifted to the country in early 2018.

"In the first six months of the year, we saw a pretty big boon," he says. "A lot of people were describing this whole thing as a sugar rush."

At least this much of the story was predictable, he says.

After a year of solid gains, "companies weren't really starving for the extra money, but they certainly spent it," he explains. "A lot of them were accelerating their machine purchasing in particular—adding capacity that they really didn't even have a use for right now."

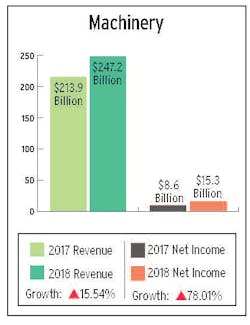

We see this reflected in the breakdown of the machinery sector—an industry most people assumed would be hard hit by the steel tariffs. But that's far from the case.

In this instance, the government spending plan seems to have overcome the potential tariff costs with ridiculous ease. But what about the greater steel industry?

Cold Facts on Cold Steel

When the Section 232 tariffs on aluminum and steel were announced in March 2018, many economists predicted an immediate increase in steel prices and a subsequent drop in steel demand. They were half right.

Initially prices for domestic steel jumped up far beyond the 25% tariff, tapping out at around 40% before slowly correcting (and then overcorrecting) through the rest of the year, Kuehl says. But, rather than curbing demand, this seems to have prompted something of a preemptive buying frenzy across the industry.

"We've been watching companies stockpile steel because they anticipated price going up—which it did," Kuehl says. "But then the prices fell again."

The result of all this spelled a very good year for the primary metal industry, which saw a 16.1% increase in total revenue and an unfathomable 80.6% jump in net income. But, again, this was the predictable and intended result of the tariffs.

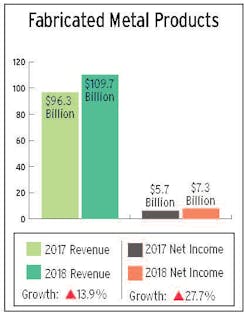

Where the prediction models fall apart is in the fabricated metal sector. These are the companies that are on the, let's say, receiving end of all these new import taxes and domestic price hikes. For them, the tariff scheme severely tied their hands—they had a strong incentive to buy domestically to avoid the tariffs, but the rising domestic prices surpassed the tariffs. No matter what they did, it seemed, they were going to lose big. Or so said the models.

And yet:

Honestly, this result utterly baffled us here. And, it turns out, we weren't alone.

"I looked at these same numbers and I was just as baffled," Kuehl says. "There's a lot of odd stuff going on here."

There are no economic models that cover this kind of oddness, he says, which makes analysis difficult. But he has pieced together enough anecdotal evidence from working with both steel producers and their fabricator companies to form a theory. And it comes down to something pretty simple: customer relations.

"There was kind of recognition that these are unusual times," he explains. "The steel guys realized that prices were going to rationalize at some point, and that if they irritated their regular customers by passing on all of those price increases, they would end up losing market share."

The compromise, he says, was to structure a new deal that skipped the costs and added a lot of volume.

"[The steel producers] said, 'I'm not going to pass this price increase on to you, but I need to make sure you give me enough in yield to justify it,'" Kuehl says.

The result, he explains, is what we see in this year's list: Everyone is up, everything is healthy. Despite all the odds.

And this, I think, is the big story of the 2019 IW U.S. 500. It's not the continued strength of oil and gas, it's not the resiliency of auto. It's that, in these extraordinary times, manufacturers are doing extraordinary things.

As Kuehl puts it, "Chaos is basically both opportunity and threat. If you're playing your cards right, you can make a lot of money. If you're not playing your cards right, you end up crying in your beer."

Facing impossibly challenging times—tax cuts minus import taxes, government stimulus minus rising costs—manufacturers found a stability that defied the markets, defied the models and defied every prediction offered.

It was an extraordinary year, sure. But it yielded extraordinary results.

Check out IW's full catalog of IW U.S. 500 articles, galleries and content.

About the Author

Travis Hessman

Content Director

Travis Hessman is the editor-in-chief and senior content director for IndustryWeek and New Equipment Digest. He began his career as an intern at IndustryWeek in 2001 and later served as IW's technology and innovation editor. Today, he combines his experience as an educator, a writer, and a journalist to help address some of the most significant challenges in the manufacturing industry, with a particular focus on leadership, training, and the technologies of smart manufacturing.