Turn Your Supply Chain into a Competitive Weapon

A well-designed supply chain is a powerful weapon, especially in fast-moving markets. It can reduce cost, increase revenue and delight customers. But taking the bold steps to overhaul a company’s mission-critical manufacturing and distribution footprint isn’t easy. As a result, leadership teams often opt for incremental changes that fail to deliver big benefits.

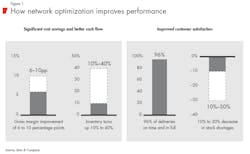

That’s a missed opportunity. Companies that take a more strategic approach improve plant output by up to 25% and inventory turns by up to 40% while reducing capital expenditure and increasing the agility, flexibility and speed of the supply chain, Bain research shows. Overall, creating an optimal manufacturing and distribution network increases gross margins by 6 to 10 percentage points (see Figure 1).

Leadership teams that achieve those gains have a broader and more strategic view of network optimization. They see it as an ongoing effort to determine the ideal number, size and location of manufacturing and distribution assets for a top-performing supply chain. They use network tools to figure out the right balance among cost, service, capital efficiency and flexibility—from purchasing raw materials to delivering finished goods—in order to best meet the company’s needs and goals.

Successful companies understand the power of designing the network to support a specific strategy. For a discount retailer such as Aldi, for example, that may mean optimizing the network for costs. For a fashion retailer such as Zara, it might be optimizing for speed. The key is understanding what provides competitive advantage. The answer to that question—be it cost, service or speed—becomes the North Star for evaluating supply chain choices, such as the most efficient flow of goods from suppliers to customers. It helps determine the right balance among cost, service level and capital efficiency.

In our experience, we see four myths that limit the ability of leadership teams to turn their supply chain into a competitive weapon.

Myth No. 1: Network optimization is only valuable following a major supply chain disruption, such as a merger or significant geographic expansion.

False. While it’s obvious that mergers and geographic expansion create an ideal opportunity to reevaluate a company’s network, businesses with stable operations also can improve their performance significantly by optimizing their manufacturing and distribution assets.

It’s all about asking the right questions. Companies often fail to examine the assumptions behind their existing network configuration. Is it really critical, for example, to deliver products within 24 hours? If only 20% of customers care about next-day delivery, that network constraint may be adding unnecessary cost.

As companies grow, leadership teams typically add production or distribution capacity where they can without considering a strategic reconfiguration of the network. The result is incremental changes that fail to deliver big benefits. At worst, they result in an overly reactive supply chain.

Successful companies look at their supply chains with an eye toward the future. As customers, suppliers and products change, they evaluate manufacturing and distribution assets to ensure that the network supports the company’s strategic ambitions. That means regularly challenging existing assumptions and constraints, such as delivery times, to understand whether they still make sense.

The leadership team at one global consumer products company, for example, assumed that its supply chain network didn’t require attention since the company’s structure was stable and the competition posed no disruptive threat. But when senior managers embarked on a comprehensive evaluation of supply chain performance, they discovered major opportunities to lower costs and improve the speed of delivery. The network redesign trimmed the number of manufacturing sites, replaced older machinery with fast, flexible assets and reshaped the company’s supplier structure to match a new delivery footprint. Those changes delivered a gross margin improvement of 7 to 8 percentage points.

Myth No. 2: If you have invested in supply chain network optimization software and tools, you have optimized your network.

False. Investing in network optimization tools is a necessary first step to create a high-performing supply chain, but the software alone is not sufficient. Why? Network tools have become increasingly advanced, allowing companies to do sophisticated simulations, analysis and scenario planning. However, a tool is ultimately only as good as the creative ideas used to model a future supply chain. If the input is not strategic, the tool’s output is not as useful as it could be.

For instance, strategic scenario planning can help leadership teams evaluate different configuration options and better adapt their supply chains for the future. But someone must decide what to test. By testing multiple variables, management teams look beyond the constraints of their existing supply chains and understand the trade-off of choosing one performance improvement metric, such as inventory levels, over another, such as delivery frequency. Using network tools to conduct this type of analysis gives leadership teams the information they need to make a bold leap to a dramatically different network design.

Take the case of one large and fast-growing regional grocery chain that needed to quickly revamp its supply chain to support its growth. Based on the company’s existing operations, the network optimization model recommended adding three new distribution centers at a capital investment of $150 million. But before embarking on that path, the leadership team decided to step back and challenge some of the assumptions underlying the existing network design. What would happen if they segmented their product flow differently or if they improved inventory practices to free up more space in their existing distribution centers?

By starting with a clean slate and incorporating best practices, the leadership team was able to devise a new supply chain structure that delivered greater capacity but required only $50 million in capital expenditure—a third of the cost of the original plan. The new structure extended the life of the company’s supply chain by more than 10 years while lowering operational costs and maintaining service levels.

Myth No. 3: The main benefit of network optimization is reducing costs.

False. Network optimization can increase a company’s competitive edge by improving the customer experience and satisfaction, increasing revenue and eliminating supply chain risks. Many leadership teams, under pressure to meet financial targets, seek short-term cost cuts from the supply chain. That approach produces incremental gains but overlooks the additional strategic benefits from network optimization.

Improved customer experience and increased revenue: A top-performing supply chain can help companies keep pace with evolving customer expectations, such as faster delivery times. It also enables them to better understand and address the needs of different customers and to segment their service offerings to customers more effectively. Better customer service, in turn, helps accelerate revenue growth by improving a company’s ability to adapt to rapid changes in demand and by expanding output capacity.

A fast-growing Latin American personal care company, for example, redesigned its supply chain to improve delivery speed and flexibility and to adjust to new tax laws. It faced rising costs and logistics complexity after entering new retail channels and creating new brands, and its business-to-consumer service was poor in comparison with its competitors’ service. In addition, new taxes on e-commerce were undercutting profitability.

After considering several scenarios, the leadership team shifted from a centralized distribution model to a hub-and-spoke distribution system, with central, regional and a select number of local fulfillment centers, strategically placing distribution nodes to reduce the company’s tax burden. Using advanced supply chain analytics, the company carried out simulations to evaluate the trade-off between different levels of service and revenue growth. That helped the team determine the right service level to achieve the desired growth. The new supply chain design enabled service on par with the competition, reduced distribution costs by 9% and improved gross margins by 23%. In addition, the new network allowed the business to grow as much as 20% a year without further investment.

Business resiliency and reduced supply chain risk: Network optimization modeling also helps reduce supply chain risk. Leadership teams can use scenario planning to evaluate shocks, such as a production line going down, and figure out whether the company would be able to sustain production and service levels until full capacity is restored. That information helps them decide whether and how to design such backup capacity.

Myth No. 4: Network optimization is about longer-term improvements and rarely yields quick wins.

False. Network optimization can produce quick wins by reallocating production volume and flow within an existing supply chain footprint, eliminating stock shortages, reducing inventory levels or avoiding capital spending—just to name a few. In fact, we typically see companies achieve 60% of run-rate savings in transportation and distribution costs within the first 12 months of a network optimization effort.

A North American food company, for instance, achieved rapid gains by remapping customers to more efficient plants and distribution centers to reduce transport distances and improve network speed. During the initial analysis, the company discovered it was shipping packaged soups from a Midwest manufacturing facility to a California distribution center before finally shipping them to customers in Utah and Colorado. The company remapped those customers to receive products from a Midwestern distribution center and saved more than 700 miles per shipment. Additionally, it identified a series of high-volume customers that could receive full truckloads directly from the plant, saving an extra transportation move and distribution handling costs. The company implemented these changes within two months of the initial network optimization analysis.

Getting Started

Many companies talk about supply chains as a cost, but successful organizations view their supply chain as a competitive weapon. A fine-tuned manufacturing and logistics network enhances operational performance, improves customer experience and increases margins. It also helps leadership teams adapt to changing markets and customer demands. Leadership teams interested in getting the most out of their supply chain can begin by asking themselves a few key questions:

• Is our network operating under stress?

• Are new entrants beating us on cost or service?

• Do we know how to adapt our network to meet evolving customer needs and product plans?

• Are we achieving year-over-year efficiency gains in our network?

• Are we taking advantage of new digital technologies, and how do they change our network needs?

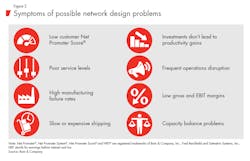

These questions may point to network design problems or signal that it’s time to rethink a company’s manufacturing and distribution network (see Figure 2).

If customers are demanding faster delivery and higher service levels, for example, network optimization can highlight how to meet those demands efficiently. With technologies and markets changing at a rapid clip, the odds are good that leadership teams can deploy network optimization to unlock significant value and improve their competitive edge.

Keith Donnelly is a partner with consulting firm Bain & Company in the Atlanta office, Meghan Shehorn is a Bain partner in the Chicago office, and Debjit Banerjee is an expert principal in Bain’s New York office.

About the Author

Keith Donnelly

partner

Keith Donnelly is a partner with consulting firm Bain & Company in the Atlanta office.

Meghan Shehorn

partner

Meghan Shehorn is a partner with consulting firm Bain & Company in the Chicago office.

Debjit Banerjee

expert principal

Debjit Banerjee is an expert principal with consulting firm Bain & Company in the New York office.