The new “demand economy” is changing everything. Several notable demographic and socioeconomic shifts are making direct and profound impacts on U.S. consumerism and, in turn, the production and movement of goods. Success in this new environment will depend on agility and flexibility, and on the ability to understand and quantify the cost and value of change.

The new paradigm unfolding today can be traced largely to four distinct, yet interrelated factors that are impacting where people live, how they shop and what their lifestyle choices mean for the industrial labor pool:

• Major cities are growing, resulting in a stronger consumer concentration in those areas. In fact, 2012 was the first year since 1900 that the country’s top 25 cities grew faster than the suburbs around them. Young people raised in the suburbs are electing to live closer to their jobs and to lifestyle choices, while empty-nesters are migrating from their four-bedroom homes into the urban core. While this trend may be more prevalent in major metropolitan areas like New York City, Chicago, Los Angeles and San Francisco, it is happening to some extent in every city, across the country.

• Our country’s middle class is shrinking. Significant, relative growth in households with incomes in excess of $250,000 as well as those making $50,000 or less is creating a more pronounced wealth disparity. This is having a major impact on retail. Value, discount stores like Target and Wal-Mart are doing well, as are higher-end brands like Nordstrom and Neiman Marcus. However, a large number of retailers are finding themselves stuck in the middle.

• One-earner households are becoming a thing of the past, especially in urban areas where the cost of living is that much more expensive. The dual-income “new” American household is yielding increased consumption density, meaning that purchasing power is being concentrated in fewer residential units.

• Education levels are rising. The percentage of young people between the ages of 25 and 29 with four-year degrees has more than tripled in the last 30 years. Additionally, the wage premium and percent benefit of holding a four-year degree has gone up 40% during that time. These educated, urban young professionals are more sophisticated, more demanding, harder-to-serve shoppers overall. Also, generally speaking, educational attainment is the enemy of industrial labor availability. Today’s young, educated professionals are much less inclined to do industrial work.

The Future of Consumerism

In an aggregated fashion, these shifts all contribute to rising consumer expectations, rising at what some would perhaps call an unreasonable rate. These expectations manifest themselves in areas like personalization, customization and demand for higher levels of service (e.g., one-day delivery and omni-channel inventory availability). Simply put, today’s consumers expect to be able to buy anything, at any time, and have their purchases delivered as soon as they want them.

Within this context, what is the future of the retail store? How will we buy goods? How and when will we receive them? It seems as though the answers to these questions are changing every day. Perhaps the only certainty is that how consumables are purchased and delivered is, indeed, evolving.

Consider e-commerce, which as a platform has grown at a quarterly and annual rate of about 15% for the past several years. Retail overall has expanded anywhere from 2% to 5% quarterly, however. Additionally, some larger consumer goods companies that do not traditionally sell direct to consumers are starting to experiment with direct-to-consumer models. We also know that the role of the pharmacy is changing. Eventually, most of our prescriptions will be ordered online, and some may come directly from the manufacturers themselves. In the future, it is safe to say that the number of goods and services that we cannot have delivered online will be distinct (mostly personal services).

As advances in data mining technology continue, we can expect a near future in which every consumer transaction generates data around preferences and location. We already are witnessing the emergence of individualized retail marketing and advertising. Looking ahead, we can expect consumer activity to have a direct impact on manufacturing and distribution, with heightened consumer specialization and product customization.

Impact on Logistics and Real Estate

So far, this discussion has focused on fairly broad changes that all are happening at a pace that is both interesting and surprising. However, the potential impact of these shifts on the logistics and industrial real estate landscapes has yet to be seen.

New requirements around inventory levels, service levels, manufacturing capacity and delivery location represent significant drivers of what could become huge increases in the overall cost of logistics in our country and around the world. One feature of this new demand economy that differs significantly from the past is that consumers are pulling us toward these new models, and pulling us so quickly that the supporting infrastructure frankly cannot keep up. Consider the following trends:

• Material costs are rising;

• Parcel freight costs are rising, up over 200% in 14 years (see chart on parcel freight ppi);

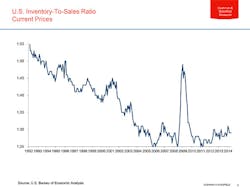

• Inventory carrying costs are rising (see chart on inventory to sales ratio) after having declined steadily for decades;

• Labor costs are rising at the same time as capital costs for material handling equipment and robotics technology are rising, with automation capex rising 20-40% a year for the last three years.

Real estate is not getting any cheaper, either. With vacancy rates and speculative construction back near pre-recession levels, the U.S. industrial sector at mid-year 2014 continues to lead the country’s commercial real estate recovery. The U.S. industrial vacancy rate continued to trend down during the second quarter to a current 7.2%, 80 basis points lower than one year ago and the lowest level since first-quarter 2008. Two California markets currently boast the lowest industrial vacancies in the nation, including the San Francisco peninsula (3.7%) and Orange County (3.9%).

Net demand for industrial space remains strong and is on track to surpass last year’s total, with 62.5 million square feet of net industrial occupancy gains at mid-year. With the tightening industrial market, average asking rents continue to trend upward in most markets. The national average direct asking rent, at $6.09 per square foot, is up 5.2% from one year ago and 11.7% higher than the recent low of $5.45 per square foot posted during the first quarter of 2011.

Right-shoring, the Barbell Effect and Incentives

The emerging consumption-driven and consumption-based economy, with its demand for short response times and heightened service levels, also will likely drive manufacturers toward production platforms that are closer to home. A decade ago, the industry talked a lot about the benefits of offshoring manufacturing to China and other overseas locations. More recently, over the past five years or so we have seen a significant migration, or near-shoring, of manufacturing into Mexico. Now, companies are looking for ways to bring manufacturing even closer to consumption, giving rise to a new trend toward “right-shoring” domestically near large population centers.

At the same time, manufacturers are being faced with decisions related to the aforementioned shrinking middle class in this country. As retailers increasingly find the most success in either the discount or high-end niches, product manufacturers will have to decide which market they want to be in. Whether they choose the flight toward cost differentiation or the flight toward brand and quality, many manufacturers will have to adjust their location and product strategies accordingly. The resulting “barbell” effect will be defined by concentrations of low-price, low-margin goods and high-end, high-margin goods at either end of the spectrum.

As they make these challenging location and sourcing decisions, manufacturers also face the declining availability of incentives dollars. Most states today are running a budget deficit. This, along with declining public support for government spending, is hindering the ability of many states to offer large-scale incentives packages to help facilitate new manufacturing projects and relocations. We anticipate that this trend will escalate in the coming years.

Looking ahead, after they solve the challenge of operating a leaner supply chain within the incredible pressures of the Demand Economy, what will manufacturing and supply chain managers need to think about in the next decade? What is the future of mobile technology? Will we be able to shop by speaking into our wrists, and see customized products arrive via drone to our apartment building roof two days later? Will 3-D printing make some manufacturing obsolete? Will raw materials be carried so far forward that the notion of finished goods inventory is a thing of the past? Will cars and trucks drive themselves, making delivery eventually easier to manage than it is today?

And you thought today was a challenge.

John Morris is leader, industrial services for the Americas, with Cushman & Wakefield, a commercial real estate services firm.