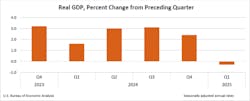

The early months of 2025 have been a rude awakening for business leaders hoping for a smooth economic environment. In Q1, U.S. gross domestic product contracted by 0.3%, which is an early decisive downturn but not as gloomy as the Federal Reserve’s GDPNow Q1 estimate of -2.7%.

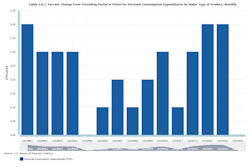

Personal consumption expenditures (PCE), the price index that measures the rate of inflation and is the Federal Reserve’s preferred inflation gauge, slowed to a 2.3% year-over-year increase in March (from 2.7% in February). This is welcome news, as the previous month’s inflation data showed an acceleration away from the Fed’s target inflation rate of 2%.

As shown in the chart below, there was no change in PCE from February 2025 to March 2025, indicating that the inflation rate is holding steady.

What do these new numbers mean? Global supply chains are feeling the strain. After a surge in shipments in Q1, imports from China have slowed dramatically. Manufacturers that use components from China in their products could face imminent shortages.

It remains to be seen how prices will react once tariffs are fully in effect. The baseline assumption is that companies will push through price increases to protect margins, which will show up in elevated Q2 and Q3 inflation figures.

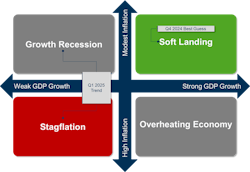

The Quadrant Shift: From Soft Landing to Stagflation

Consider a 2x2 matrix that uses GDP growth on the x-axis (weak vs. strong) and inflation on the y-axis (modest vs. high).

At the start of 2025, the U.S. was comfortably situated in the soft landing quadrant, which is characterized by strong growth and modest inflation. This is the ideal zone for steady demand, healthy margins and cautious optimism.

Since then, the economic landscape has shifted. The latest GDP and inflation data points toward either a growth recession or stagflation, which is marked by weak or negative growth paired with high inflation.

Lingering questions about how companies and consumers will react to tariff-related price increases make the near-term inflation forecast difficult to read. Regardless, the strategies that work well in a soft landing—such as new product launches, market expansion and targeted price adjustments rather than across-the-board increases—may now become liabilities in the new landscape.

What’s Causing the Shift?

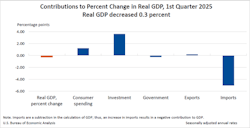

The sudden drop in GDP was largely driven by heavy forward-buys on imports, as companies faced with imminent tariff hikes accelerated their Q1 purchases to build inventory and avoid higher landed costs later in the year.

While this preserves short-term margin, it will create a demand vacuum in Q2 as those firms now work through inventory backlogs. The import surge is likely a temporary blip, but what remains to be seen is how consumer spending and investment will react to broad tariffs. To fight rising inflation throughout the pandemic, massive government spending was used to buoy weak demand. It’s very likely that strategy won’t be repeated in 2025.

At the same time, Chinese exports, a backbone of many U.S. supply chains, have temporarily slowed due to logistical bottlenecks, cancelled orders, regulatory changes and retaliatory trade actions. This supply shock is pushing input costs higher just as the Fed’s rate hikes have begun to weaken consumer and business spending.

The Federal Reserve is cornered. The standard playbook for combating inflation is rate hikes, but tightening monetary policy too aggressively in a contracting economy risk causing or deepening a recession.

There is no easy policy fix. Businesses will have to chart their own survival strategy.

How to Navigate a Weakening Economy

Agility and discipline are paramount in an uncertain environment defined by margin pressure and constrained supply. Here are five key strategies to consider:

1. Exert pricing power carefully

Pricing discipline is like a gym membership: you have to put in the work to see the results. Clear customer communication can take the sting out of price increases and using transactional data to segment customers according to each segment’s willingness to pay to avoid over-charging price sensitive segments while not leaving money on the table for those who prioritize value over price can reduce the risk of volume loss while preserving pockets of profitability.

2. Tighten operations

Rebalance inventories and shorten procurement cycles, especially where tariff-evading overordering occurred. Avoid tying up cash in slow-moving SKUs at the tail end of the portfolio. Prioritize faster-turning, higher-margin products. Consider renegotiating supplier terms to reduce capital outlay or stretch payments.

3. Cut costs strategically

Cost discipline is critical, but blunt cost-cutting can backfire. Tighten the belt by focusing on discretionary overhead that does not contribute to near-term revenue or strategic advantage, such as non-essential travel. Delay large capital projects and re-evaluate vendor contracts. Protect investments that support customer retention, pricing capability or supply resilience.

4. Prioritize core customers

In a volatile environment, not all customers are equal. Double down on closing margin leakage by evaluating pocket margin, which is the profitability of a transaction after all discounts, rebates and costs are accounted for. Support reliable, profitable customers and deprioritize risky or low-margin segments.

5. Accelerate supply-chain diversification

The import bottlenecks from China are a reminder that supply chain risk can turn sour overnight. Explore alternative suppliers in nearshore markets, even if unit costs are marginally higher. The benefit of improved lead times, supply security and reduced tariff exposure may far outweigh the added price.

Caution and Urgency

The economic environment has suffered seismic shifts, and those still operating with a 2024 playbook may find themselves caught flat-footed. Reduced growth is a difficult opponent because it demands balance—cutting costs without cutting muscle, raising prices without losing loyalty, preserving cash without stopping momentum.

The companies that survive and emerge stronger will be those that adapt early, act decisively and embrace disciplined experimentation. Waiting too long to change course is a grave mistake.

About the Author

Dan Cakora

Pricing Economist, Vendavo

Dan Cakora is a pricing economist and business consultant with vendavo, a SaaS market leader in B2B pricing, selling and rebate solutions. Dan has worked in various aspects of pricing for over 15 years. He started his career as a field economist, responsible for helping to measure inflation for the federal government. Before joining the Vendavo team, Dan was a customer at a large, international B2B distributor. He has led pricing teams, developed pricing and sales enablement products, and has a passion for data visualization. Dan has an MBA from DePaul University and a BS in economics from Purdue University.