7 Key Factors Driving the Offshoring of Services

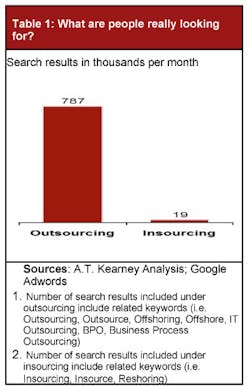

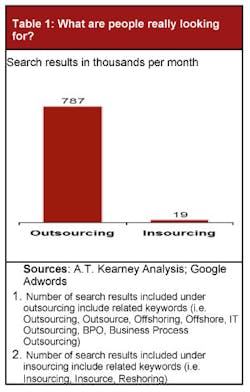

Reshoring, or the return of offshore jobs to high-cost U.S. and Western European countries, has captured the interest of the general public. This interest has largely been driven by economic recession, high unemployment levels and recent political rhetoric, supported by extensive media coverage. The press has often presented reshoring as poetic justice for profit-hungry corporations that offshored operations to lower-cost destinations at the expense of local workers and are now being forced to recant their decisions.

Mainstream media outlets have often presented reshoring as a growing trend, providing select examples from large corporations. Although the majority of reshoring examples cited are manufacturing-related (e.g. Ford, GE, Whirlpool, etc.), a few examples are cited within the services sector as well (e.g. General Motors scaling back on IT outsourcing and bringing jobs to the U.S., airlines closing offshore call centers and moving them to the U.S.). Different reasons have been cited for bringing jobs back, including increasing offshore labor costs, poor quality, longer lead times, and complexity of logistics in moving goods to the United States. Service jobs, in particular, appear to be repatriated largely to improve the customer experience.

Seven key factors will drive the continued shift to offshoring:

1. Select Talent Shortage: For large multinationals, especially technology firms, the war for talent is global. Companies such as Google, Microsoft and IBM have repeatedly lobbied the U.S. government for easing of visa sanctions to allow more foreign workers to expatriate to the U.S. According to the Bureau of Labor Statistics, the unemployment rate for computer and mathematical occupations in 2012 was 3.6% - below the 4% that observers consider "full employment." In the absence of legislative reform, companies will continue to look offshore to source talent (see table 2). According to a recent 2013 Talent Shortage Survey (conducted by Manpower) ~50% of U.S. employers are facing difficulty in filling jobs, with the most challenging areas being skilled trades, engineers and IT staff. A major revamp of America’s education and immigration policies is needed to address the talent gap and, in the absence of any near- to medium-term solutions, reshoring of service jobs on a large scale will be extraordinarily challenging.

As the wage gap between high-cost countries and popular offshoring locations has remained significant over time, and is unlikely to close anytime soon, we expect to see a preponderance of outbound, versus inbound, traffic in the services sector. And this trend is likely to be supported by the strengthening of some foreign exchange rates.

While it is important to note that the emergence of Integrated Voice Response (IVR) has reduced the human3. Learning Curve: Over 1 million jobs in IT, call centers, and other outsourced business processes have been offshored from the U.S. over the last few years. In addition to the service jobs themselves, the supervisory roles that are required to manage them, including schedulers and delivery center managers, have also left U.S. shores, and the people who filled those roles in the U.S. have been retrained into other functions. Conversely, firms in India and the Philippines, for example, have gained (and continued to develop) expertise for managing service functions, including oversight of global delivery, large, complex teams and projects, workforce scheduling, and call queuing and handling routines. Reshoring these jobs would lead to the loss of efficiencies, potential customer disruptions, and higher costs than just labor arbitrage.

4. Globalization: Over the years, outsourcing firms have become more global. Large IT-focused firms such as IBM, Accenture, ACS and CapGemini have expanded their capabilities significantly in low-cost locations such as India, many to the extent that non-U.S. employees form the majority of their employee bases. For example, IBM is now India’s second largest private-sector employer, immediately behind Tata Consulting Services (TCS). On the flip side, large India-based outsourcing companies (e.g. TCS, Infosys and Wipro) are pushing to increase their presence in the U.S. through local hiring.

To summarize, large companies today, both in the U.S. and elsewhere, are much more global than a few decades back. With greater emphasis on emerging economies and BRIC countries, companies now want to be located in, or close to, their biggest markets. As companies and outsourcing firms become increasingly global, the issue of bringing jobs home becomes increasingly irrelevant.

5. Political Tides: Over the years, federal and state governments have taken protectionist steps and enacted policies to discourage outsourcing and offshoring (e.g. prohibiting companies with state and federal contracts from sending work overseas, levying state-level tax laws). The Bring Jobs Home Act, a recent development, aims to encourage reshoring (by allowing a tax credit associated with reshoring jobs) and discourage outsourcing (by denying a tax deduction). Even if this legislation is enacted, it does not provide an adequate incentive for corporations to disrupt service delivery and reshore jobs. Further, denying tax deductions for outsourcing would be tantamount to levying a punitive tax, which does not work well in a free market economy. As the U.S. economy stabilizes post-recession, and the fiscal deficit widens, the government’s ability to fund and enact any laws that will have companies rethink reshoring will be reduced further.

6. Data mobilization and regulations: Initial issues curtailing the offshoring of many jobs were concerns about the security of customer-specific data and regulations around what data could (and could not) be shared with third parties in a different geography. Over time, however, these more provincial perspectives have been reshaped to embrace the global nature of today’s economy. Customer data is a target for hackers irrespective of geographic location. Recent high profile break-ins in U.S.-based companies (and the Department of Defense) have raised awareness of these issues to the larger public. And this favorably positions the largest global outsourcing companies. While most large outsourcing firms (e.g. IBM, TCS, etc.) have large organizations and technical solutions dedicated to securing data and systems, smaller companies cannot afford risk mitigation on such a grand scale.

Technical solutions have also helped overcome many of the security-related issues resulting from rogue agent behavior (although it still occurs). For example, virtual desktops enabled by high bandwidth connections allow agents to see—but not store—data on their systems. In many parts of the world, strict employee regulations, many of which would be unenforceable in North America, also help to maintain data security and prevent fraudulent transactions. These regulations include banning mobile phones on agent floors, paperless offices, and airport-level frisking of employees on arrival and departure from the office, including checking office bags. Reshoring previously offshored positions would require many of these regulations and processes to be set up locally, which, aside from being a challenge to enforce, would offer no incremental advantage to the companies or their customers.

Offshoring: The New Normal

7. Offshoring is becoming the new normal: Offshoring was relatively new to the customers of virtually all types of corporations in the late 1990s and early years of the 21st century. It received a lot of poor press, some of it well deserved, as firms rushed to reap the benefits of offshoring without considering the impact on customers. However, the practice has since gained gradual acceptance from customers, who now expect—or are resigned to the fact— that their calls may be answered by an offshore agent. Today, companies approach offshoring more holistically, evaluating carefully the core objectives and benefits of doing so.

Within the evolving outsourcing and offshoring environment, ‘rightshoring’ is a critical consideration (i.e., defining what services should be retained onshore and specifically what geographic locations across the globe make most sense for services being outsourced). For example, “soft” calls with significant customer interaction may go to the Philippines, bilinguals may go to Latin America, but technical calls—or those with more challenging solutions (think mid-stage collections)—may still be better routed to India. In cases where the level of daily interaction between headquarters and outsourced service centers is high, ‘nearshoring’ within a similar time zone may be an important consideration, as well.

Organizations that ignore the matching of service types to location often face difficult and unrewarding offshoring experiences. Given the trend toward rightshoring, third-party suppliers no longer offer a single location solution to clients, but instead, offer a menu or services across different locations to facilitate a holistic customer experience.

Reshoring is recalibration, not a broad trend: In manufacturing, reshoring is found, at most, to a limited degree. For services, most of the traffic today is outbound and, in absence of any significant legislative changes, we expect this trend to continue. Nevertheless, select examples of high value work being brought back onshore will continue to exist, garnering media attention and fascinating the broader public.

As outsourcing evolves, India will no longer be the right answer for all offshoring efforts. In the last two decades, companies went to India primarily for cost savings and talent. We believe that, with the increasing maturity of the outsourcing market, other key offshoring locations (mainly the Philippines, Poland, Romania, and Mexico) will continue to challenge the established destination leaders. Smaller centers will continue to exist (e.g. the Caribbean, Guatemala) but will likely not grow. And the U.S. will continue to retain high value work onshore (e.g. customer-facing voice, mobile app development).

So what does this mean for an executive looking at offshoring?

- The value from offshoring as an important element of a multinational delivery strategy is here to stay, and successful companies and business executives will continue to offshore increasingly complex work, moving it to lower cost locations.

- Offshoring dynamics are changing, and outsourcing strategies should focus primarily on addressing rightshoring.

- Businesses that have already outsourced specific functions need to continue to refine their scope, as their suppliers become increasingly mature and their customers become increasingly demanding.

Jeff Postma is a principal, Sandeep Agarwal is a manager in the Organization and Transformation Practice of A.T. Kearney, a global management consulting firm. Mohit Mohal is a manager in the firm’s Strategic IT Practice. They can be reached respectively at [email protected], [email protected] and [email protected]