The Future of Manufacturing 2009

"We should all be concerned about the future because we will have to spend the rest of our lives there." -- Charles F. Kettering

As American industry claws its way out of the worst financial crisis since the Great Depression, concern about the future does indeed weigh on the minds of manufacturing leaders. In their responses to the "Future of Manufacturing 2009" survey, conducted by IndustryWeek and Crowe Horwath, a public accounting and consulting firm, they identified a wide range of issues that are keeping them up at night, as well as strategies they are employing to grow their businesses in the face of intense global competition and the uncertainties presented by proposed changes in health care, environmental regulation and other policy issues.

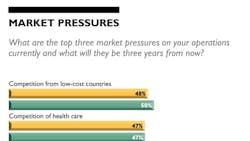

Looking at market pressures facing them currently, manufacturing leaders identified competition from low-cost countries, cost of health care and cost of raw materials as their top concerns, and they predict those same issues will continue to be their foremost concerns three years from now. While attracting/keeping skilled labor was the third-ranked concern ahead of health care in last year's study, it fell to fourth (26%) this year, a reflection of the poor job market. However, respondents don't see an abundant labor supply lasting as 37% said it would be a top concern three years from now.

Managing credit market/working capital pressures were a clear concern, rising to a tie for fourth place (26%) this year. Only 8% of respondents said it would be a significant market pressure three years from now, signaling optimism that in the long run, credit markets and profitability would return. Other major shifts identified were in taxes, regulations and environmental compliance, as manufacturers worry about who will pick up the tab in the future for the stimulus plan, the effects of new financial regulations and the cost of efforts to combat global warming.

Top market pressures vary by firm size. While 57% of respondents from firms with less than $25 million in revenue said health-care costs are their No. 1 concern, that was the case with only 29% of those at companies with $1 billion or more in annual revenue. At both large and mid-cap firms, the cost of raw materials was the chief concern of our respondents. Perhaps reflecting their sensitivity to global competition, 27% of respondents in larger firms said they were concerned about time to market for new products, compared with 9% at smaller firms.

Growth Opportunities

We asked IW readers where they see the biggest growth opportunities for manufacturers and how their company is preparing to take advantage of these opportunities.

"Absorbing business from closed competitors is the biggest growth opportunity. Need aggressive sales and marketing strategies."

"Competing with newly developed products. Three of our corporate Hoshins dating back to last October addressed development in three of our product offerings. Two have wrapped up and we're already seeing an improvement in market activity. It'll only get better as we come out of the recession."

"Environmentally friendly products and services that are specifically geared towards energy efficiency. Our company is developing products that long range will contribute to reducing the carbon footprint of major commercial buildings."

"Global demand, regardless of industry. I believe countries outside of the U.S. will bounce back a lot quicker than we will. We are ramping up internal efforts to better utilize our capacity and even expanding right now. We need only wait for foreign markets to get access once again to credit and financing for our export sales to come back. The demand remains. The domestic market has remained fairly strong."

"I believe our country's infrastructure and energy areas will see growth in the future. We have worked with some energy generation customers and our product is used in infrastructure projects. We will pursue business in these areas."

"We are not preparing. Management remains shell-shocked by the recent recession and has taken a minimum capital investment stance."

Sourcing

A significant entrant in the top 10 market pressures within the sourcing chain is supply disruption, noted by 11% of all companies, and by 20% of those companies with over $100 million in revenue.Respondents reported on average 18% of their products are manufactured or directly sourced from outside the United States. They expect their international sourcing to increase to 24% in three years. Manufacturers said they currently average 16% of their sales outside the United States, but expect that to grow to 22% three years from now. International sales were higher for very large firms -- averaging 21% for firms with revenues of $1 billion or more -- and those companies expect non-U.S. sales to increase to 29% in three years.

By a large margin, the largest sourcing destination for respondents is China (50%), followed by the European Union (34%), Mexico/Latin America (28%) and Canada (26%). While 17% of manufacturers said they are sourcing in India, they expect to nearly double that figure (30%) over the next three years. Other destinations slated for significant growth are China with a 9% increase, Southeast Asia with a 7% increase and Mexico/Latin America with a 5% increase.

Workforce

Since the recession began in December 2007, the manufacturing sector has lost nearly 2 million jobs, according to the National Association of Manufacturers' Labor Day 2009 report. Despite the dramatic erosion of manufacturing jobs, our respondents said they expect their U.S. production workforce to increase by nearly 6% over the next three years and their non-U.S. production workforce to increase an average of 4%.

Perhaps reflecting very lean operations and the need to hire to meet an increase in business, 66% of respondents predict they will increase the size of their workforce over the next three years. Another 14% expect no change, while 20% are forecasting a decrease in their workforce.

Predictions on workforce changes differed sharply based on company size. Respondents from companies with $1 billion or more in sales expect to see an average 0.5% increase in their U.S. workforce and an average 5% increase in their non-U.S. workforce. But companies with sales under $25 million expect to grow their U.S. workforces by an average of 9%, while forecasting only a 2% increase in their non-U.S. workforce.

Policy Concerns

Over the next three years, what regulatory, taxation, legislative policy or compliance issues do you expect to be of the greatest concern to your company?

"Carbon cap/tax and trade will increase the cost of energy and our processes are fairly energy demanding. This will give us a disadvantage in the global market, unless there is a shift in how we generate energy in our region."

"Excess federal and local spending resulting in higher taxes. Lack of focus on training skilled technologists. Need to shift resources from philosophy majors at universities to university engineers and community college toolmakers."

"Health care reform that would negatively impact existing employer-provided health care; card check or other pro-labor legislation that would encourage union activities/organization; taxes on income of the business that further weakens competitive position vis--vis foreign manufacturers."

"Taxation: corporate taxes and especially taxes/penalties being generated by the government that are not fiscally sound. I never thought that our own government would be so anti-American and moving toward socialism with no way to pay for these incredible entitlements."

IT Purchasing Plans

Reflecting a constant drive for efficiency, more than four out of five respondents say they plan to purchase information technology in the next three years. In fact, 70% of respondents expect their average annual IT spending to increase. Another 27% forecast flat spending, while only 4% say annual IT spending will decrease. In-house developed systems (27%) were the most frequent expenditure predicted, followed by enterprise resource planning systems (22%) and design systems such as CAD and CAE (20%).

Representing the specialized expertise required for today's complex IT systems, a significant portion of IT support spending over the next three years will continue to be for external consultants (30%).

Respondents report only 4% of their IT budget will be spent offshore, with the remainder of spending for in-house (66%). A large majority of respondents utilize some external IT support, with only 14% of respondents saying all of their spending will be for in-house resources.

Recession and Beyond

Asked how their organizations had been most affected by the recession, just over two-thirds of respondents said they had delayed capital investments. Firms with $1 billion or more in sales were particularly quick to pare back spending, with nearly 83% reporting they had delayed capital spending. Some 64% of all respondents reported insufficient revenue growth, while 44% said their firms had not achieved sufficient net income, both reflective of the working capital pressures noted earlier. A majority of companies took steps to lower their labor costs. Two-thirds reported freezing or reducing salaries and 35% reduced employee benefits.

Cutbacks in all sectors, not just automotive, put huge pressures on suppliers. Nearly one in four respondents said they had contended with failed suppliers or a supply chain disruption. While 15% of those surveyed overall said their organizations had closed a plant, 40% of companies with revenues of $1 billion said they had experienced a plant closing.

Despite myriad challenges facing their organizations, the vast majority of manufacturing leaders predict better days ahead. Respondents forecast revenue growth of 8% in 2010 and 14% in 2011. Only 10% say they expect sales to be flat in 2010 and just 5% predict flat revenues in 2011. Nearly one in five respondents (17%) expect growth fueled by mergers and acquisitions next year, while 25% expect M&A growth in 2011. The average percentage of total revenue growth expected to come from mergers and acquisitions is 3% in 2010 and 4% in 2011.

Risky Business

No recession comes with a set of instructions for avoiding the pitfalls that are bound to crop up during the recovery. We asked manufacturing leaders what risks they see for manufacturers and how their company is preparing to address those risks.

"As all organizations have been hit, where they stand from a cash/liquidity standpoint is key. Can they take advantage of the great opportunity that exists right now? We've done fine in this area. We pursued new development and are currently finalizing an acquisition of a similar business."

"Certain pending environmental regulations and cap and trade for CO2 could dramatically increase production costs, putting U.S. at serious disadvantage relative to offshore suppliers."

"Everyone throughout the supply chain is leaning out their inventories. As business returns, there is the risk of shortages throughout the supply chain, which could put some manufacturers at greater risk of failing, depending on their industry/market. We are trying to balance strategic inventories of certain materials with cash flow, while maintaining very close relationships with both suppliers and customers, in an effort to maximize our lead time with any upswings in business."

"Foreign competition will not go away. With little or no expectations from these countries regarding fair trade, human rights, etc., we will abandon some of our products and focus on less labor-intensive areas."

"Losing valuable employees to other companies that can offer more. We are keeping the communication lines open with our employees, letting them know they are valued."

"Raw material cost and transportation cost will face upward pressure. Steel industry continues to reduce capacity to increase pricing. Once demand is back, steel prices will increase dramatically. Seeking out alternative materials."

Methodology

The Crowe Horwath/IW Custom Research "Future of Manufacturing" study was conducted online in August and September 2009 to IW subscribers who indicated their job title as corporate and executive management, or operations, production and plant management. A total of 360 completed surveys were collected. All responses were anonymous. This research report is based upon data from this research, including the responses to open-ended questions provided by respondents.

About Crowe Horwath

Crowe Horwath LLP (www.crowehorwath.com) is one of the largest public accounting and consulting firms in the United States. Under its core purpose of "Building Value with Values®," Crowe assists public and private company clients in reaching their goals through audit, tax, risk and consulting services. With 25 offices and 2,500 personnel, Crowe is recognized by many organizations as one of the country's best places to work. Crowe serves clients worldwide as an independent member of Crowe Horwath International, one of the largest networks in the world, consisting of more than 140 independent accounting and management consulting firms with offices in more than 400 cities around the world.

Crowe's manufacturing and distribution practice works with clients to develop high-impact solutions in the areas of M&A integration, process optimization, supplier viability, IT advisory, working capital management, risk management, assurance, and tax.

About IW Custom Research

IW Custom Research is an operating unit of IndustryWeek (www.industryweek.com) and provides insights into executives' opinions and manufacturing trends. IndustryWeek connects decision-makers within manufacturing enterprises to share ideas and tools that inspire action. In print, online and in person, the IndustryWeek community is the leading resource for manufacturing operations

knowledge.