Additive Technology Is Outpacing Manufacturers' Efforts to Grasp It

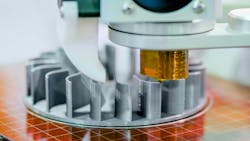

The global additive manufacturing (AM) market was valued at approximately $16.69 billion in 2022 and is projected to grow to $74.70 billion by the end of this decade. While early applications of additive technology were primarily limited to prototypes, props and models, AM has advanced significantly over the years, with adoption trends matching its rapid development.

AM offers manufacturers the opportunity to streamline processes and reduce lead times. A recent survey conducted by Formlabs across multiple industries revealed that over 60% of the most recent adopters of additive manufacturing are applying the technology in the production of end-use parts.

Adoption and acceptance of AM technology may be on the rise, but many businesses still struggle to determine the optimal applications for AM. Just like any tool, additive has strengths and weaknesses and requires a substantial learning curve to master. As the hardware continues to advance, it is essential to adapt and find new ways to leverage its capabilities.

Strengthening Supply Chains

In some use cases, AM has the potential to reduce part lead times by as much as 90%. This is particularly relevant for companies working with difficult-to-machine materials like titanium and nickel-based alloys. Through localized production, manufacturers can mitigate expensive delays by printing and delivering parts in a matter of hours or days.

Related content from other EBM publications:

Rapid-Prototyping with 3D Printing for a NASCAR Cup Mustang

Stewart-Haas Racing uses 3D printers to produce full-scale body panels for wind tunnel testing of the NASCAR Ford Mustang Dark Horse

Smart technologies considered critical to manufacturers' success

Government, experts look for ways to promote adoption, as survey finds widespread interest among business leaders.

Similarly, the U.S. Air Force and GE Additive's Pacer Edge program aims to leverage metal AM to produce "cold start" parts that typically have a procurement lead time over 300 days. By eliminating the reliance on forging and casting for these components, the program aims to minimize lead time and eliminate bottlenecks in production, enabling faster, smoother workflows.

High-Mix, Low-Volume

These examples demonstrate how industrial 3D printing excels in high-mix, low-volume (HMLV) scenarios, where customized products are manufactured in small batches. This makes the technology particularly impactful in dental and medical settings.

Dental products such as bridges and crowns require a high degree of customization. AM enables dental practitioners to perform 3D scans and produce personalized molds, models and implants tailored to a patient's anatomy. This process is typically completed on-site and in a significantly shorter time frame compared to traditional methods. As a result, the dental industry stands out as one of the most prominent adopters of AM technology. In 2022, dental 3D printing accounted for nearly one-third of the overall AM market.

While AM offers numerous benefits, it also presents some challenges. The technology is best suited to small production runs, and the post-production phase can be complex and cumbersome. The lack of shared standards within the industry complicates testing and qualification. Furthermore, the limited “build envelope” or maximum physical size of printed pieces with AM hardware can restrict the range of potential applications, making it most appropriate for small and mid-sized parts.

Extensive research and development efforts are necessary to unlock the full capabilities of AM. For manufacturers interested in integrating this technology, it is crucial to identify the scenarios where AM can offer the greatest benefits. Conducting an in-depth analysis of case studies and practical applications is an important initial phase in this process.

Finding the Right Fit

While AM has made considerable strides since its inception, the industry has a long journey ahead toward achieving widespread adoption. In recent years, major players in the space have started developing standards for AM that will streamline testing and qualification processes. Collaborations like these—combined with enhanced education and training opportunities for manufacturers—are critical steps toward accelerating the integration of AM into the broader manufacturing ecosystem.

To effectively adopt this technology, manufacturers need hands-on experience with various applications. Industry events and other collaborations of practitioners across fields provide valuable opportunities for growth, facilitating connections and education and helping designers and engineers assess how and where industrial 3D printing technology might serve their organization.

After more than a decade of evolution, the potential of AM is now more evident than ever. For those considering how to harness this powerful tool, the key lies in understanding its capabilities and honing in on the most efficient uses of the technology. By mapping the strengths of industrial 3D printing against their product and building a clear adoption strategy, manufacturers can position themselves to reap the benefits of additive. In doing so, they will stay ahead of the curve in an increasingly competitive space.

About the Author

Olga Ivanova

Director of Technology, Mechnano

Olga "Dr. O" Ivanova, Ph.D., is the director of technology at Mechnano. A researcher with more than 10 years of experience in AM, she leads the development of novel formulations and identifies process improvements to satisfy customer requirements. Ivanova is an event advisor for RAPID + TCT 2024.