AR/VR Matures, IIoT Unhappiness Rises: IndustryWeek 2023 Tech Survey

Still, organizational growing pains are nothing new for manufacturers. The challenges highlighted by some of our key takeaways from this year’s IndustyWeek Technology Survey are far from insurmountable. This is all good news.

- Augmented reality and virtual reality (AR/VR) technology has matured in manufacturing. Scaling, not experiments and pilots, becomes the chief concern for manufacturers.

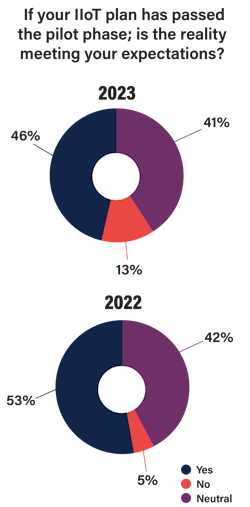

- Dissatisfaction with IIoT systems crept up last year, raising questions about how manufacturers ought to set expectations and whether we ought to reconsider this one-acronym-fits-all definition of the technology.

- Following the trend indicated by last year’s survey, manufacturers continue to find it easier to justify CapEx for technology initiatives.

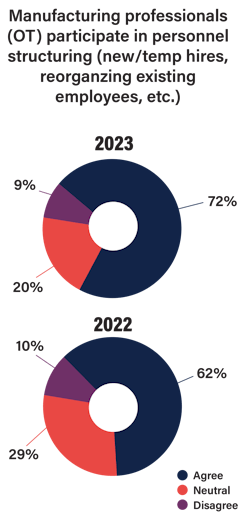

- Getting OT and IT departments aligned takes on greater importance, as OT professionals increasingly participate as technology leaders.

Engage the Virtual, Enhance the Real

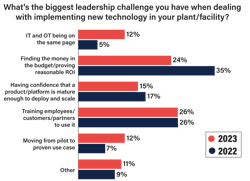

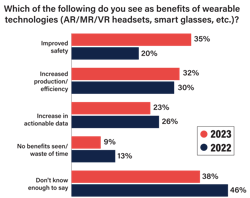

When asked what they saw as the benefits of wearable technologies like AR/VR headsets and smart glasses, 35% of survey respondents answered, “improved safety,” up from 20% in 2022. The percentage of respondents who use AR/VR for increases in production/efficiency or actionable data remained about the same as last year.

Editor’s Note: Success Leads to Unhappiness

No, that subject line isn’t a dissertation on Russian literature, it’s a recognition that the better tech gets, counterintuitively, the more flaws people see.

Apple’s first computer didn’t even have a case around it. It was just a series of circuit boards, and early adopters built wooden cabinets to hold them. And they liked it that way! It was primitive, but it was a personal computer in an era of room-sized mainframes.

The company didn’t take off until the launch of the Apple II, a machine with a plastic case, accessories, better software and massive improvements to usability.

That’s where a lot of manufacturing technology sits right now. Eager early adopters (the kinds of people who enjoyed getting splinters when assembling home computers) have shown that IIoT and AR/VR systems can bring a lot of value. Now, it’s time to move past the enthusiasts who have been very forgiving of shortcomings and flaws.

We saw another appreciable change, but this time a decrease, for “Don’t know enough to say,” down to 38% this year from 46% in 2022.

More respondents are increasingly familiar with AR/VR: Does this reflect trends?

When the pandemic hit in 2020, many manufacturers adopted AR/VR for remote assistance. Unable to send employees across countries or continents, companies instead could have an operator wear AR glasses equipped with a camera at the plant with an engineer viewing the camera feed. That method became a powerful tool for remote diagnostics and maintenance.

Once manufacturers grew comfortable with the technology, they realized the benefits of AR/ VR went well beyond remote assistance. Offsite training allows new hires to learn skills outside dangerous factory environments. Veteran employees can slip on a pair of AR glasses and record operations, effectively holding in-person demonstrations for trainees.

Eric Abbruzzese, AR/VR analyst from ABI Research, says that conversations about AR/VR no longer revolve around pilot use cases and experimentation. During a panel he moderated at the Augmented Enterprise Summit in October 2022, companies like Airbus, Dow and Bristol Meyers Squibb spoke about scaling up the technology.

“BMW, Audi, Porsche, Ford, Volkswagen Group, Stellantis, they’re all playing around with AR/VR and are scaling,” Abbruzzese says.

Stellantis views remote assistance as a way to serve sustainability goals, by limiting travel. Ford and Toyota are trying VR for remote collaboration, the latter even establishing offices in Japan and California for cross-Pacific design collaboration in VR.

“You don’t build out dedicated VR offices for collaboration if you’re not at least a little bit confident in it scaling up. And we’re starting to see that in a number of different markets,” says Abbruzzese.

How to Know What You’re Getting Into

“It’s like talking about ‘digital twin.’ Digital twin is not a single-point solution. Digital twin is a composition of capabilities, rather than a singular solution. ‘IIoT system,’ to me, is analogous to that,” says Ryan Martin, research director at ABI Research.

IIoT in manufacturing began with remote monitoring of assets and descriptive analytics and is evolving into remote control of assets and predictive and prescriptive analytics. If companies set their IIoT expectations on the coolest demo they saw at a trade show yet end up adopting a bare-bones IIoT tool without a lot of bells and whistles, dissatisfied reactions would make sense.

Maturing is also an issue. Scaling IIoT beyond successful pilot cases brings a series of pitfalls to dodge. Failure to do so would also affect satisfaction with IIoT.

“Many of the early pilots and proofs of concept were managed from innovation or R&D teams, where relatively small IoT deployments were conducted by people who were invested in exploring the technology: They liked and were interested in IoT and what it let them do, and they would forgive a lot,” says Forrester’s Miller.

“Most early adopters of industrial IoT are now in the scaling phase, moving it out of their innovation and R&D teams and expecting the mainstream workforce to engage and use these technologies,” he continues. “Quite reasonably, these mainstream workers don’t care about IoT… or any of these other emerging technologies: They care about doing their job and will be quick to complain if a poorly or incompletely implemented technology gets in the way of that.”

Mark Cotteleer, managing director, supply chain and network operations at Deloitte, understands decreased satisfaction with IIoT in the context of increased adoption. IIoT needs to align across entire organizations to meet its potential. The technology needs time to mature after scaling. Predictive and autonomous use cases may take years to prove out.

“Lots of work has been done on the ‘productivity paradox,’ in which firms that adopt new information and advanced technologies initially see a dip in performance as the organization works to digest both technology and process. Generally, when organizations stick with it, it will get better,” says Cotteleer.

Still Opening the CapEx Purse Strings

“We’ve seen the definite continuation of a recent trend… [a] focus on pragmatic and tactical solutions to specific short-term problems like supply chain disruption, energy use/cost, etc.,” says Miller. “If there’s a clear technical solution to one of these current pain points, there’s definitely a willingness to unlock budget to get it implemented.”

Martin adds, “When the spend is justified— meaning that this is going to drive immediate results, we’ll be able to measure its benefit, success or failure, with a defined and visible time horizon— those are the projects that are getting funded.”

Bridging the IT/OT Divide

The number of respondents reporting difficulties moving from pilot projects to proven use cases increased from 7% in 2022 to 12% in 2023. “IT and OT being on the same page” saw a similar but slightly larger jump, from 5% last year to 12% this year.

The divide between IT and OT comes up often in cybersecurity discussions. IT-driven security revolves much more around software than hardware. Problems with programmable logic controllers (PLCs), industrial control systems (ICS) and supervisory control and data acquisition (SCADA) devices aren’t always solvable with a patch, and temporarily shutting down plants to upgrade software probably isn’t going to fly for most manufacturers.

Therefore, some cybersecurity experts suggest that manufacturers need separate IT and OT cybersecurity teams. OT professionals find themselves getting new seats at the table, and according to the results of the 2023 Technology Survey, this goes well beyond cybersecurity.

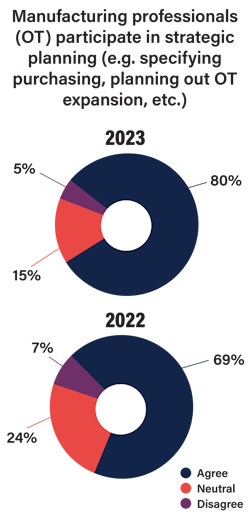

We asked participants whether manufacturing professionals who deal with OT participate in strategic planning like specifying purchasing and planning out OT expansions. In 2022, 69% of respondents answered “yes.” In 2023, that percentage increased to 80%.

It’s reasonable to connect these two leadership challenges. If IT and OT can’t get on the same page, scaling up from successful pilot programs certainly would pose a real problem.

Transforming without New Technology

When asked about their leading technology priorities for the upcoming year, “adding new technologies” went down by 7.6 percentage points and “leading digital transformation” went up by 6.1 points. This may indicate reaping the results of prior technology implementations, scaling those processes and seeing benefits without adding anything else to the equation, for now.

“From the trends we’ve seen this year, this ‘contradiction’ could be a strategic shift away from shiny object technology investments to organizational focus on people, process or programs to drive transformation,” Brian Zakrajsek, senior manager for smart manufacturing at Deloitte, says.

“[Digital transformation] means fundamentally changing the way that you do business. So, what I’m seeing now, especially given the current macroeconomic environment, there’s more adversity to operational risk,” Martin concludes. “What that means is perhaps doing things differently, but really prioritizing the end result. Technology is maybe an enabler of that, but it’s not the focus.’"

About the Author

Dennis Scimeca

Dennis Scimeca is a veteran technology journalist with particular experience in vision system technology, machine learning/artificial intelligence, and augmented/mixed/virtual reality (XR), with bylines in consumer, developer, and B2B outlets.

At IndustryWeek, he covers the competitive advantages gained by manufacturers that deploy proven technologies. If you would like to share your story with IndustryWeek, please contact Dennis at [email protected].