IIoT Means Nothing and No One Uses Generative AI

IndustryWeek’s 2024 technology survey digs into data collection and analysis, cuts through AI hype, indicates new interest in automation and suggests one of our predictions this year was completely wrong.

Dismantling hype remains a challenge for anyone that wants to understand the relevance of new technologies. It’s a huge problem in the consumer electronics world—Apple’s new $3,500 Vision Pro hardware doesn’t meet the hype and faces sluggish sales—and a less cumbersome but still irksome challenge in the manufacturing industry.

Our annual technology survey as always cuts to the chase, and this year’s results had a few surprises.

- A lot of manufacturers use IIoT systems without realizing they’re using IIoT systems.

- AR/VR and computer vision either are losing manufacturers’ interest or have become so popular that no one thinks of the tech by these labels anymore.

- No one uses generative AI (GenAI) for manufacturing applications.

Sorry, that last one wasn’t a surprise at all.

An Old Name for Old Technology

The first mention of “internet of things” dates back to 1985, though some consider the phrase coined in 1999 at MIT. It’s a long-established concept in any case and from that point of view the industrial internet of things (IIoT) feels like an old term.

“IIoT just puts an industrial lens on IoT and what is IoT? Everything and nothing at the same time. So that's why it's kind of opaque as a topic,” says Ryan Martin, senior research director for industrial and manufacturing at ABI Research.

“IoT evolved from machine-to-machine or M-to-M [networking]. Manufacturing is kind of day zero for IoT. It just so happened that IoT iterated and evolved much faster in consumer markets like smart home than it did in factories,” Martin adds.

When we talk about IIoT systems, what we usually, really mean is wiring up plants with networked sensors to gather and analyze data. Simon Jacobson, VP analyst in Gartner's supply chain operations group, says the terms are not synonmous.

"On one hand there’s the expansion of activities done at the edge and an ever-expanding series of operational data sources that are underleveraged which fuel the IIoT platform discussion. On the other hand the number of unstructured processes (skills management, changeovers) that are not even yet digitized is substantial, making data capture and analysis are just as—if not more—important," Jacobson says.

So this year, we decided to update our old IIoT-based questions and the change in data reflects the usefulness of abandoning buzzwords.

The Popularity of Data Capture and Analysis

Last year when we asked manufacturers to tell us how they used IIoT, 25% said they had no plans, 26% were waiting for the right use case and 16% were still in the planning phase. That’s 67% who said they effectively weren’t using IIoT technologies.

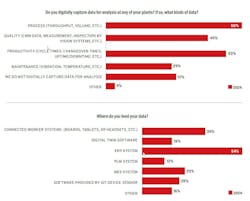

This year, we asked whether respondents digitally capture data at their plants and if so, what kinds of data.

- 60% said they capture data to analyze processes like throughput and volume.

- 53% measure productivity, information like cycle times, changeover times, uptime and downtime, etc.

- 45% use data to monitor quality with technology such as coordinate measurement machines and vision systems.

- 28% monitor things like vibration and temperature to inform maintenance schedules.

Only 31% of respondents said they do not digitally capture data for analysis. Or, to put it another way, only 31% said they don’t use IIoT technologies, compared to 67% last year. Either the manufacturing industry went through a sea change or dropping the old language matters.

“We are seeing less focus on IoT as a specific bundle of technologies and more interest in looking for solutions to specific problems like predictive maintenance, or yield improvement, or asset optimization. So, clients are less likely to come to us asking for an IoT platform than they once did, but much more likely to come asking for a solution to a business problem where IoT may very well be a good option as part of a broader solution,” says Paul Miller, vice president and principal analyst at Forrester.

This year we also asked respondents where they feed captured data.

- 54% said enterprise resource planning (ERP) systems.

- 33% said connected worker systems like boards, tablets and XR headsets.

- 23% port the data into manufacturing execution systems (MES).

- 16% use digital twins.

Nearly two-thirds (62%) of respondents said their data analytics projects meet expectations.

“There are more stakeholders across an org driving need for ERP, and MES is only now going through a renaissance in terms of accessibility, cloud and SaaS. For better or worse, the old school of thought is that an ERP is central to the org and therefore if a major update or migration were to occur, to start with the ERP as the backbone and innovate around it,” says Martin. “This stat may speak to data collected from non-shop floor endpoints; it may be considerably higher if surveying frontline operators.”

Artificial Interest in Artificial Intelligence

Speaking of trends and vague language let’s get to AI. Three quarters of respondents said they did not use AI in their business. We asked the remaining 25% to elaborate. Only two respondents cited a manufacturing-specific use case. The rest were business applications with nothing to do with manufacturing operations, such as pricing engines, document writing, corporate communications and sales and marketing applications.

Considering the popularity of machine learning we found this data a little surprising, unless we’re dealing with more problems created by unspecific language.

“Most manufacturers I speak with know that ML and AI are tightly related (and sometimes even synonymous). But they’re so bombarded with generative AI messaging right now that when they’re asked a quick question about ‘AI’ they probably hear ‘generative AI,’ don’t give it too much thought, and answer the question they thought they heard rather than the question they were actually asked,” says Miller.

“But there’s a whole body of existing practice around AI and machine learning that is in danger of being ignored here. Machine learning algorithms support quality inspection cameras, predict the need for maintenance, tweak the temperature of an industrial process, or guide autonomous robots across a warehouse, every single day. If we include all of those existing uses of AI and machine learning (and we should), an awful lot more than the reported 25% of your respondents are using it, I guarantee,” Miller adds.

The popularity of machine learning in manufacturing does make this response curious, says Jacobson.

"[Machine learning] is prevalent and potentially obfuscated by the hype of Generative AI. For machine learning the cost of entry for some tools has gown down and can disrupt how companies leverage the technology to identify anomalies or new efficiencies faster by removing the rudimentary or traditional and time consuming [methods]," Jacobson says.

When we asked specifically whether respondents used GenAI tools like ChatGPT and OpenAI, 36% said yes. We again asked them to elaborate. On reflection we were fishing with this one, trying to see if anyone has concocted manufacturing-specific GenAI use cases.

Short answer: No. Companies use these tools for chatbots, knowledge base development, marketing, background research, editing, all the use cases one would expect. Miller argues that manufactures have very good reasons to keep gen AI away from factory floors.

“Many of the public-facing generative AI tools currently on the market are accused of ‘hallucinating’ or inventing facts, because of the non-deterministic way they work: In a manufacturing use case, where mistakes could damage expensive equipment or injure employees, that’s unacceptable,” says Miller.

Sinking Interest in XR and Computer Vision?

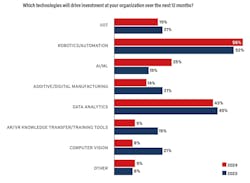

When selecting the top three technologies to drive investment over the next 12 months, respondents indicated a precipitous lack of interest in three technologies. Additive manufacturing sunk to 14% this year from 21% last year, bad news for the additive companies still struggling to show profits if our data represents a broad trend.

AR/VR, a technology we expected to highlight this year, dropped as an investment priority to 9% in 2024 from 18% in 2023. The results seem odd compared to how respondents see the benefits of using XR or smart glasses. Last year, 32% saw increased production/efficiency as the chief benefit. This year, 45% gave the same answer. One imagines with rising awareness of what this technology can do that interest would at least remain level, not drop by half.

Miller thinks these data also reflect challenges based on language. With AR/VR becoming more mature and credible every year, companies no longer think of themselves as investing in AR/VR. Instead, they talk about training packages and work order management solutions.

Computer vision suffered the most precipitous drop, down to 8% this year from 21% last year. Miller thinks this is yet another challenge based on language.

“The quality assurance team isn’t buying computer vision – they’re buying a solution that improves line-side detection of defects. Cameras, machine learning, lighting rigs, and all the elements of a capable computer vision deployment are just part of the broader solution they’re implementing. … That’s computer vision, and it’s useful, but it’s not something a survey respondent would ever call an ‘investment priority’ in its own right,” Miller says.

Martin agrees that language could present an issue with these results.

"Machine vision solutions are more popular among larger manufacturers, of which there are fewer in number and can play a factor in results. Also, some may not make the connection that MV is a subset of AI without an explicit taxonomy,” says Martin.

More Knowledge, More Robots, Changing Cybersecurity Responsibilities

According to the data our audience grew more knowledgeable about the technologies they consider most important. Last year, 26% responded they were “only slightly” knowledgeable. This year, only 18% gave the same answer.

In 2023, 42% of respondents said their business did not use robots and 31% said their operations were not automated. This year, only 31% said their business did not use robots and only 24% said they are not automated. Machine tending dropped as a reported use case for robots while assembly, pick-and-place and material handling all increased slightly.

When asked whether manufacturing professionals play an active role in and have responsibility for cybersecurity protecting connected equipment, only 59% said “agree,” down from 70% last year. This might indicate IT departments taking a more active role in OT cybersecurity or manufacturers combining their IT and OT cybersecurity from the same vendor.

Finally, organizations reported prioritizing the improvement of OT operations and performance levels when adopting digital technologies, which matches last year’s data. However, driving the business’ ability to innovate was the second highest priority for most respondents and by a wide margin, with aligning OT with business goals and enabling/ensuring competitive differentiation weighing in equally.

About the Author

Dennis Scimeca

Dennis Scimeca is a veteran technology journalist with particular experience in vision system technology, machine learning/artificial intelligence, and augmented/mixed/virtual reality (XR), with bylines in consumer, developer, and B2B outlets.

At IndustryWeek, he covers the competitive advantages gained by manufacturers that deploy proven technologies. If you would like to share your story with IndustryWeek, please contact Dennis at [email protected].