Five Questions to Shape a Winning 3-D Printing Strategy

Additive manufacturing has reached a tipping point, with big opportunities in innovative product design and functionality, not just cost reduction. Although additive manufacturing, often called 3-D printing, accounts for just more than 0.3% of the $10 trillion global manufacturing market, companies ranging from dental implant makers and automotive manufacturers to aerospace and defense firms now use this method to make prototypes and fully functional components.

What sets additive manufacturing apart is the ability to create almost any shape or structure with no geometric constraints and at little marginal cost. In fact, building certain structures — such as those resembling bamboo, lattice or trabeculae (thin columns of bone) — simply is not feasible with traditional manufacturing. And AM’s flexibility comes without the penalty of inefficiency, as additive manufacturing machines have a short setup time and lend themselves to just-in-time production and low inventories.

This characteristic of “complexity for free” leads to a potential cost advantage in manufacturing complex parts, particularly for small parts produced in low volumes. Designers can focus on improving a product’s functionality and not worry as much about the manufacturability of the part.

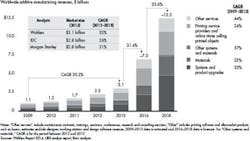

The global additive manufacturing market has experienced double-digit growth over the past five years, and an expert consensus expects a similar growth rate over the next five years, to pass $12 billion in 2018.

For CEOs and COOs, then, it’s time to map out the appropriate role for 3-D printing in their firms. This will involve determining where in the business 3-D printing will add the most value and how the organization would have to adapt to realize that value. To identify and understand the most promising opportunities, and to build a lead over competitors, senior executives should address a set of key strategic questions:

What Are Our Ambitions?

Some companies approach additive manufacturing as a niche technology suitable for only a few situations, such as prototyping or building a few unusual components. The sports car manufacturer Ferrari uses additive manufacturing for select applications like making full-scale model parts, testing components in a wind tunnel and assembling components on Formula 1 race cars.

At the other end of the spectrum, the technology could get embedded into the entire product value chain: defining the product portfolio, designing, prototyping and testing, manufacturing and after-sales service.

Defining the breadth of ambition at the start helps to determine the next steps. Companies with broader ambition tend to have low production volumes, critical time-to-market needs, high product complexity with small physical dimensions and a high level of customization.

What Adoption Route Should We Pursue?

Some companies start by adopting additive manufacturing in their design engineering group, resulting in longer development times but enabling more structured, reliable learning processes. Avio Aero, now a part of GE Aviation, has taken this route: The company launched its first dedicated 3-D printing plant in late 2013, after years of conducting engineering studies.

Other companies — such as MBDA, a manufacturer of missile systems — chose direct application on the shop floor, focusing on manufacturing and qualification issues. This route speeds up the use of additive manufacturing for producing parts and actively involves many departments. The drawback, however, is suboptimal use of additive manufacturing technology, because it remains limited by the constraints of traditional manufacturing processes.

Many companies, including BMW, Ducati and Logitech, take a third route by introducing additive manufacturing for prototypes, and the technology has often proved superior in cost and lead time.

How Fast Should We Go?

Companies can learn about additive manufacturing on their own. This approach may take longer, but can be modulated to the company’s normal operating rhythm to minimize disruption. A faster, more disruptive stance using temporary partnerships with system manufacturers or service providers, as well as selective new hires, can more quickly bring a company up to speed. This approach works best with companies that have clearly identified specific opportunities for AM and want to accelerate the process of installing manufacturing capacity and filing patents and licenses.

How Integrated Should We Be?

Larger industrial companies with years of experience in additive manufacturing have moved to greater vertical integration of their additive manufacturing activities in order to gain a competitive advantage in areas such as materials and software development. While nothing prevents companies from extending their value chain coverage over time, certain decisions early on could influence how easily or quickly they can extend coverage later. Acquiring new steps of the value chain usually requires significant investments and major changes to internal processes: At each stage, companies would have to replace protocols established for traditional methods with new protocols.

Moreover, at each phase of the value chain — from design software to final parts testing and repair — companies can choose different levels of control. Having full in-house control makes it easier to optimize and customize for a company’s particular needs. For instance, a tailored setting for machine parameters would likely result in a more suitable manufactured part, or using an internally developed powder as the source material for printing might meet specific mechanical or thermal properties better. On the other hand, more control demands a larger initial effort with higher costs, greater risks and longer implementation time.

How Should We Realign Our Organizational Structure?

Introducing additive manufacturing to an existing operation will likely have implications for a department’s size, responsibilities and relationships with other departments. The extent of these implications will depend on the level of control selected, the stages of the value chain covered and the business model chosen.

Adopting additive manufacturing typically shifts the effort from the production plant and supply chain management functions to the engineering and production planning and control functions. Additive manufacturing is a capital-intensive technology, but requires only limited labor for machine management, raw materials management and post-processing. Therefore, it also requires more intensive production planning and engineering (for optimizing parts positions and clusters, construction support, machine parameters and so on) to maximize machine utilization and performance.

These are still early days for this breakthrough technology, and there are major opportunities for the entire product life cycle, from design and manufacturing to maintenance and repair. Companies that set a strategy based on rigorous answers to the questions posed — and that also build their organizational capabilities to execute effectively — stand to reap remarkable benefits in the years ahead.

Pierluigi Serlenga is a Rome-based partner and François Montaville is a Paris-based partner of Bain & Company.