Consumers in the U.S. are an incredibly powerful force, with consumer activity making up an estimated 67% of the U.S. economy. What we do as consumers will quickly impact distributors and manufacturers. The good news is that we are projecting that the consumer will keep the economy on a positive footing for the year as a whole and that means 2013 will end above 2012. The bad news is that headwinds faced by the consumer are likely to cause the last quarter of 2013 to come in a thin 1.3% ahead of the year before.

See Also: Global Manufacturing Economy Trends & Analysis

The headwinds include the increased cost of gasoline (up 11.7% from the beginning of the year) and a reduction in take-home pay for millions of Americans as the FICA tax returned to its normal level. The 2% increase/return was needed but does not make it any less painful.

Retail sales for the last 12 months, excluding automobiles and adjusted for inflation, are 2% ahead of the year-ago level. The last quarter is a thinner 1.6% ahead of the same quarter one year ago. The year-over-year comparisons are trending lower, signaling we are on track with our projection of slower, but continued growth in the U.S. economy later this year. The good news that March showed an 11.4% increase from February is somewhat diminished by the fact that February posted a steeper-than-normal decline, most likely because of bad weather.

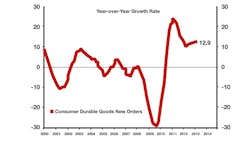

New Orders for Consumer Durable Goods on the Rise

A similar year-over-year trend is evident in automobile retail sales and in building material, garden equipment and supplies retail sales. The dollar trends are moving higher, but the rate of rise is noticeably slowing. The same is true of construction home improvement spending. Annual retail sales at appliance and electronics stores are at $99.2 billion, but this represents a 1.1% drop from the same period in 2012. Expect more softness in this key durable goods sector.

Consumers are also increasing their spending at furniture stores and outlets with annual sales growing 3.4% above last year's level. While the news of upward growth is encouraging, we must keep the $50.6 billion in annual sales in the context of its pre-recession levels of $60 billion. The good news is that growth in housing starts and existing home sales, which are 31.1% and 9.8% above their year-ago levels respectively, will help provide momentum for sales in this market. Expect sustained but moderate growth in the quarters ahead.

Several key segments of retail sales contributed to the slower rate of growth in overall sales. The largest segment, general merchandise stores retail sales, which includes department stores and wholesale clubs, saw sales in March continue to decline, slipping to a level 1.7% below last year's activity.

New orders for consumer durable goods are likewise experiencing upward dollar movement, and the rate of rise has been increasing. On an annual basis, new orders are at $431 billion, a level of sales 12.9% ahead of last year. Quarterly new orders are 12% above last year, another positive sign. Inventory levels are 3.1% ahead of this time last year, which is great news in that we are not seeing a rapid increase in inventory levels in comparison to orders.

Leading Indicators Support Positive Outlook

A look at the leading indicators support our overall positive outlook for 2013. The Chicago Fed National Activity Index six-month moving average continues to rise indicating economic activity is increasing. While the Conference Board's U.S. Leading Indicator edged lower on a rate-of-change basis in March, the indicator's positive amplitude and its typical nine-month lead time to the overall economy indicates U.S. industrial production will expand through at least the remainder of this year. The ISM Purchasing Managers Index also slipped in March but remained in expansion territory at 51.3. A positive sign for 2013 in this report is the expansion in new orders. Of the 18 industries surveyed, only two (petroleum & coal products and primary metals) reported fewer new orders.

What's the bottom line for 2013 and beyond? We expect businesses to see growth for 2013 as a whole, a mild consumer-led recession in 2014 and a recovery in 2015. 2014 will give you a great opportunity to assess potential future bottlenecks when a busier 2015 rolls around. It is also important to step up training efforts prior to increased demands on your team.

For more economic insights from ITR economics, check out the Make Your Move blog .