Make Your Move: US Aircraft Production Flying Friendly Skies

Growth in the U.S. economy as measured by industrial production continues unabated, with all major sectors -- mining, manufacturing and utilities -- showing momentum. All indications from the internal rate-of-change trends are that production activity in the U.S. is strengthening. This is also supported by the leading indicators we follow. The ITR Leading Indicator, the U.S. Leading Indicator, the Purchasing Managers Index, and the Chicago Fed National Activity Index suggest a stable rate of growth (no recession) in the economy in 2014, although growth in the first half is expected to be stronger than the second half. We suggest you check for potential bottlenecks in your operation that could slow production. This is also a good time to consider expanding sales staff and increasing marketing efforts.

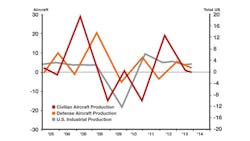

The civilian and defense aerospace industries are flying in different directions (see chart). Growth in defense and space aircraft production is solid, but the pace of growth has slowed over the past 12 months. On the civilian side, aircraft production is lower than at this point last year, but domestic production is situated to post gains by year end.

On an annual basis the Civilian Aircraft Production Index is 0.2% below the year-ago level, but the trend is beginning to reverse, driven in large part by Boeing Co. (IW 500/14) and a recent deluge of orders. At the recent Dubai Air Show, Boeing secured over $100 billion in orders. Emirates Airlines ordered 150 of the newly launched wide body 777X, with an option to purchase 50 more. In addition, Qatar Airways placed orders for 50 aircraft, and Etihad Airways ordered an additional 25, making three of the four first customers for the 777X from the Middle East. (Luftansa had previously placed an order for 34.)

Production on the 777X will start in 2017, and the first aircraft will come off the line in 2020. Business was also brisk for single-aisle jetliners, with low-cost carrier FlyDubai ordering 100 737s. Boeing's recent decision to keep production based in the Seattle area was the result of hard-fought concessions between unions, the state of Washington, and the company, and is a sign of Boeing's power in the region.

The resurgence in civilian aircraft production is not limited to Boeing. Work continues on Airbus' (IW 1000/52) new production facility in Mobile, Ala. The plant is expected to begin production in 2015 and will employ nearly 1,000 workers. This is a further sign of America's renewed manufacturing ascendancy.

Military Aircraft Spending in Holding Pattern?

Defense-related aircraft production in the U.S. is at a record level, but the pace of growth in this sector has slowed. In December the president signed a comprehensive defense spending bill, along with a budget deal that would avert a government shutdown for nearly two years and alleviates some of the sequester cuts by approximately one-third. This budget deal restores $63 billion to the defense budget over the next two years.

However, the deal caps the Defense Department 2015 base budget request at $521 billion. This is 1.1% below 2014's base budget of $526.6 billion, but higher than it would have been had the full ramifications of sequestration gone into effect. With all eyes on government spending and narrowing the budget deficit, it is unlikely we will see substantial gains in defense-related aircraft production over the next few years.

| Stay up-to-date with economic news and trends on Alan Beaulieu's Make Your Move blog at iw.com/blog/make-your-move. |

IndustryWeek readers should be encouraged by the general health in the U.S. economy and the outlook for stable growth in 2014. Consumers and businesses appear to be more settled and less anxious than a year ago. There could be pockets of instability and mild weakness as we finish the year, but no overtly negative cycle is in view. 2014 will finish better than 2013.