The National Association of Manufacturers released quarterly results for its 2016 Manufacturers’ Outlook Survey on Wednesday and the results are … rather glum.

Just 56.6% of the 348 manufacturers of varying sizes who responded from all around the country are positive in the outlook of their own company, down from 59.6% in the fourth quarter of 2015. Large manufacturers the least optimistic at 51.1% (down from 56.5%), with medium and small manufacturers slightly cheerier (at 57.9% and 60.3%, up from 54.7% and down from 60.3%, respectively).

The over manufacturing outlook index? That’s down, too, to 38.6 from 40.7.

“In spite of improved overall economic data of late, the manufacturing sector remains challenged,” NAM chief economist Chad Moutray said. “With discouraging data — from declining manufacturing production to a downshift in demand and shipments — it’s no wonder manufacturers remain anxious.

“Our challenges are far from over, and this survey’s data make it clear that global headwinds and inaction in Washington on pro-manufacturing policies continue to hamper manufacturers’ outlook.”

Other numbers and facts worth knowing from the quarterly survey:

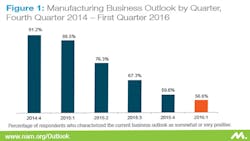

The 56.6% of all manufacturers who said they were positive or very positive about their own business’ current outlook are part of a shrinking number. That figure has dropped now in six straight quarters, starting in the fourth quarter of 2014, from 91.2%, to 88.5%, then plummeting the rest of 2015 to 76.3%, 67.3% and 59.6%.

Sales expectations have dropped significantly, too. Fifteen months ago, manufacturers said they expected sales to grow 4.5% over the next year. This time around, they expect them to grow just 0.4%, and 30.4% said they expect sales to drop during the same stretch. (Just three months ago, only 20.3% thought they would drop.)

Health insurance costs were cited as the top business challenge by almost three-quarters of all respondents (73.9%), with costs climbing 7.6% over the next year. A similar 73.0% said tax and regulatory concerns remain top of mind, and they’re “frustrated with the lack of comprehensive tax reform and with a perceived regulatory assault on their businesses.”

Manufacturers are strongly against any rate increases from the Federal Reserve, with 70.2% responding that the economy is still generally weak enough to hold off on hikes and 20.1% saying the Fed should continue its normalization process.

Oh, and along the same lines, a whopping 85.6% said the country is headed “on the wrong track”, up from 81.5% three months ago. Just 3.7% said they feel like the U.S. is headed in the right direction.

A few other challenges listed by manufacturers: Depressed energy prices and low oil prices … excess steel in the marketplace … growing governmental intrusion into business … the stronger U.S. dollar, which is making offshore sourcing more attractive to customers … and a general lack of confidence and anxiety stemming from current presidential campaigns and threat of terrorism.

Check back Wednesday, June 8, to see whether the outlook improves at all or, with those presidential campaigns only dragging on, it continues to depress.

About the Author

Matt LaWell

Staff Writer

Staff writer Matt LaWell explores news in manufacturing technology, covering the trends and developments in automation, robotics, digital tools and emerging technologies. He also reports on the best practices of the most successful high tech companies, including computer, electronics, and industrial machinery and equipment manufacturers.

Matt joined IndustryWeek in 2015 after six years at newspapers and magazines in West Virginia, North Carolina and Ohio, a season on the road with his wife writing about America and minor league baseball, and three years running a small business. He received his bachelor's degree in magazine journalism from Ohio University.