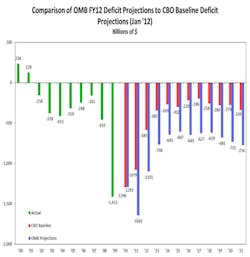

Based on the most recent data from federal sources (graphed below), we can expect a reduction in the federal budget deficit beginning this year and extending into 2016 (Office of Management and Budget estimate) or into 2017 (Congressional Budget Office estimate).

This is obviously good news since it means the nation will be incurring debt at a slower pace for the next five or six years. These projections fit well into our forecast of economic growth in the US through 2017, except for a relatively mild 2014 recession.

Of course, there is bad news. These improvements come largely on the back of an $800 billion increase in tax revenue achieved through the expiration of the so-called Bush tax cuts, new Medicare taxes coming from the Healthcare Reform Act, and mandated increased taxpayer participation in the Alternative Minimum Tax.

There is more bad news. The improvement is only temporary. The underlying demographics make it impossible to sustain the improvement through the long haul unless major systemic changes are undertaken in the entitlement systems.

I may be cynical, but it seems to me that these deficit reductions may prove too tempting for Congress, and increased government spending on new or existing programs may result.

Bottom line: Accept the good news for what it is worth -- a temporary reprieve from the larger problem of national debt.

About the Author

Alan Beaulieu Blog

President

One of the country’s most informed economists, Alan Beaulieu is a principal of the ITR Economics where he serves as President. ITR predicts future economic trends with 94.7% accuracy rate and 60 years of correct calls. In his keynotes, Alan delivers clear, comprehensive action plans and tools for capitalizing on business cycle fluctuations and outperforming your competition--whether the economy is moving up, down, or in a recession.

Since 1990, he has been consulting with companies throughout the US, Europe, and Asia on how to forecast, plan, and increase their profits based on business cycle trend analysis. Alan is also the Senior Economic Advisor to NAW, Contributing Editor for INDUSTRYWEEK, and the Chief Economist for HARDI.

Alan is co-author, along with his brother Brian, of the book MAKE YOUR MOVE, and has written numerous articles on economic analysis. He makes up to 150 appearances each year, and his keynotes and seminars have helped thousands of business owners and executives capitalize on emerging trends.

Prior to joining ITR Economics, Alan was a principal in a steel fabrication company and also in a software development company.