Yes, Trade Deficits Are Hurting American Manufacturing

A trade deficit occurs when a country imports more goods and services than it exports. The macroeconomic explanations are often convoluted and do not make sense to the average voter.

This typical example of a nebulous explanation comes from a leading manufacturing group: A trade deficit arises as a result of several factors, including overall domestic economic conditions and standards of living; domestic consumption and purchasing compared with savings rates; and the price of goods in the market, which is, in turn, affected by exchange rates, domestic structural issues (e.g., taxation regulation) and openness to international trade.

This long-winded sentence doesn’t really say whether the trade deficit is good or bad for manufacturing.

Because of this kind of explanation, the trade deficit is largely a misunderstood economic concept, but here are some basic facts to consider:

- Trade deficits are not a simple accounting convention; they are real debt that must be paid back

- Trade deficits must be financed, and we finance our trade deficit by borrowing from our trading partners.

- The big irony is that we borrow money from our trading partners to finance our trade deficit so that we can buy more of their exports.

- When the value for the dollar is increased, our exports become less competitive and imports cheaper.

- Contrary to popular belief, the trade deficit debt must be paid back, and this will be increasingly hard to do with growing federal deficits.

- If we get crosswise with China, they may decide to not loan us any more money and cash in their US securities.

Pro-Trade Deficit Argument

There are people who support trade deficits because they believe that the overall aggregate benefit is worth financing the deficits. They know that we might lose jobs and even industries, but they believe the aggregate benefits to the economy are worth the losses, and they prefer to ignore trade deficits.

Michael Froman, a former trade representative, is a good example of the aggregate argument. He says, "every legitimate economist says that measuring trade policy by the size of the goods deficit is probably not a passing grade in basic economics class." Mr. Froman was a chief negotiator for the Trans-Pacific trade agreement, which was killed by President Donald Trump.

Other aggregate economists argue that running trade deficits provides liquidity to the global market, and that the U.S. pays very little to borrow for its trade deficit, which finances more imports for U.S. consumption. They also argue that reducing the trade deficit would lead to lower growth and economic instability of U.S. trade partners. These are noble goals that support the rest of the world but ignore American manufacturing.

Perhaps the best argument in support of trade deficits comes from the Hoover Institute. Russ Roberts of the Institute summarizes his aggregate argument by saying, "by directing resources to where the economy is most competitive, it creates new opportunities and society-wide advances that improve life for everyone in unforeseen ways. Rather than protecting struggling industries, he says, policy should focus on giving people the skills to compete and flourish."

The fact is that one of these struggling industries that he does not want to support is manufacturing. Roberts also makes it sound easy to give the losers of trade deficits the skills to compete. But after 27 years of debate and six major studies, we still have not developed the training programs to help the millions of people who have lost their jobs because of trade deficits.

Effects on Manufacturing

A growing number of people believe that while trade deficits may be good in the aggregate, they are killing the manufacturing sector and that is troublesome.

President Donald Trump has been railing against trade deficits since even before he was elected. His logic is that since the trade deficit exists almost exclusively in manufactured goods, we must do something to lower trade deficits if we are to grow America’s manufacturing sector.

In March 2018, he said, "the jobs and wealth have been stripped from our country year after year, decade after decade, trade deficit after trade deficit." His intention is to increase factory jobs..

I agree that American manufacturing, more than any other sector in the economy, is hurt by trade deficits. It is important to point out that more than 70% of our current trade deficit of $566 billion (as of 2017) is in manufactured goods—not services.

If we are going to make any progress to reduce the trade deficit, we must increase exports. About 70% exported goods are manufactured goods. We must increase our exports, and that can’t happen unless we can save and grow American manufacturing.

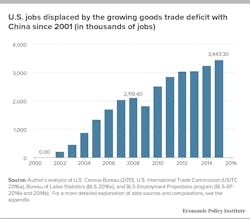

Critics of this thinking argue that even without trade deficits, manufacturing is not a job-growth industry because of productivity and automation. But this doesn't account for the majority of lost manufacturing jobs. A report by Robert Scott of the Economic Policy Institute gets closer to the truth. Scott's report is based on data from the U.S. Census, International Trade Commission, and the Bureau of Labor Statistics. Scott's conclusion is, “due to trade deficit with China, 3.4 million jobs were lost between 2001 and 2015. I think this is reliable evidence that the trade deficit has, indeed, eliminated manufacturing jobs.”

From 2001 to 2015, the U.S. trade deficit with China rose from $83 billion to $367.2 billion during the 14 years. But convincing the economists who don’t believe that trade deficits hurt manufacturing and eliminates manufacturing jobs may require looking at the job loss in individual industries.

The following chart by the Economic Policy Institute shows that the biggest changes in increasing imports over exports were in manufacturing industries, particularly durable goods. Except for oil, aerospace, and transportation (Boeing jets), all of the durable goods and industrial supply industries are being hurt by rising deficits. During this same period, America also lost 59,794 manufacturing establishments.So, yes, American manufacturing and manufacturing workers are being hurt by trade deficits.

The obvious losers in trade deficits are manufacturing workers, small and midsize manufacturing companies and the taxpayers who must pay for the debt. The winners are the multinational companies who have plants in foreign countries and have enjoyed record profits during the same 14-year period.

The Big Picture

The U.S. cannot afford to sacrifice manufacturing and its workers, to the goal of attaining some kind of aggregate benefits to the economy. Here are some reasons:

1. America's economic strategy as explained by President Barack Obama is to lead the world with a strategy of innovation. Innovation is based on R&D, and 70% of all research and development and most technologies come from manufacturing. Without manufacturing we will not be able maintain a strategy of innovation.

2. Even if the trade deficit is financeable, it will probably not be politically sustainable. Did you know that as of 2017, the US trade deficit was $11.5 trillion—which begs the question, “How much debt can we finance?” Can we go to $20 trillion? Can we allow the trade deficit to exceed the federal deficit or the gross domestic product? There will come a time when the interest on the debt and its contribution to the increase in federal deficit will become too big of a problem. From an economic and political point of view, the growing trade deficit is a time bomb, and the economists who want to ignore it are preaching voodoo economics.

To reduce the trade deficit, we must increase our exports and reduce imports. More than 70% of all exports are manufactured goods, so manufacturing is the key to changing the import export deficit—not services.

We Need a Plan

From both a manufacturing and economic point of view, I think it is time to face the facts and develop a government plan to reduce the trade deficit. Applying tariffs on imports is a good first step, but it won’t reduce the trade deficit. We don’t need a political plan with general goals. We need a plan with specific solutions to stop our trading partners’ currency manipulation and lower the value of the dollar.