Mexico Has a New President: What Does Sheinbaum’s Election Mean for US Manufacturing?

The term of Mexican President Andrés Manuel López Obrador (AMLO) will soon conclude, after six years of national and international political controversies and confrontations as the first avowed leftist party to rule the country’s direction.

Within this context, there are two questions that we must address. How has manufacturing fared during AMLO’s 6-year term? And what will the new course be under the leadership of now president-elect Claudia Sheinbaum, AMLO’s protégé who will have a complete legislative majority?

Let’s first look back at AMLO’s leadership, and then see what the future might hold with a new administration.

Mixed Reviews on Manufacturing Growth

Throughout AMLO’s administration, and somewhat contrary to what one might think, the manufacturing sector's performance has been critical to Mexico’s economic success. However, it is crucial to look deeper at the positives and negatives that manifested during this period, including the recovery after the economic downturn in 2020.

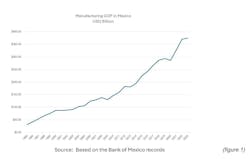

During the first five years of AMLO's government, the manufacturing gross domestic product (GDP) showed a sustained growth, but also during AMLO’s tenure, manufacturing GDP has shown the worst performance of any Mexican president since the beginning of the 21st century. (Chart data: Mexican Ministry of Economy.)

The nearshoring effect has played a major role in this growth. Supply-chain relocation has benefited investment in Mexico—in sectors such as real estate, where there has been an unexpected increase in the demand for industrial warehouses.

Information from the Mexican Association of Private Industrial Parks (AMPIP) indicated a net absorption of 21.5 million square feet in 2019 and nearly 54 million square feet of warehouse space in 2023. Despite that massive increase in use, total available space (existing and under construction) fell throughout the past six years.

This increase in demand has prompted construction challenges for new industrial parks, keeping developers working at full speed to respond to companies seeking to establish themselves in Mexico.

Energy resources require immediate attention. During AMLO's administration, experts and industry representatives have repeatedly emphasized the importance of investing in green energy and the energy distribution network to supply new industrial parks, but focused instead on fossil fuels.

Water has also become a critical resource, given that Mexico is particularly vulnerable to climate change. The Bajío—the manufacturing hub of Central Mexico and home to major production centers in Guanajuato, Querétaro and Aguascalientes—has a semi-arid climate, as do U.S.-adjacent territories in Mexico’s North, Northeast and Northwest regions, where much of manufacturing development is concentrated. Experts have pointed to the urgent need for public policies to mitigate these risks and ensure a sustainable water supply.

Robust Foreign Investment

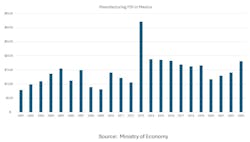

In terms of foreign direct investment (FDI) in the manufacturing sector, the results have been positive. Manufacturing FDI took a hit during the pandemic, but the trend has been upward during AMLO’s term: from $16.6 billion in 2019 to $18.11 billion in 2023.

This flow of investment has been vital to technological reconversion and has strengthened the trade relationship with the United States, Mexico's leading trading partner in manufacturing.

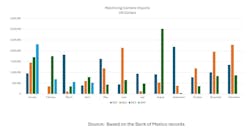

For example, the metalworking sector, a vital supplier of components for automotive, aerospace and medical devices, registered significant machinery imports, an unmistakable reflection of industrial activity. In 2023, data from the Bank of Mexico showed an increase in imports to around USD $555 million (from $390 million in 2022) in the machining sector alone, while imports in laser-cutting equipment were $361 million (from $255 million in 2022), in both cases a 29% growth.

Regarding importing machinery for transforming plastic—such as injection, blowing, extrusion, molding, etc.—the Bank of Mexico recorded a total value of imports in 2023 of more than $1.83 billion, an increase of 16% over 2022.

The United States-Mexico-Canada Agreement (USMCA), which replaced the North American Free Trade Agreement (NAFTA), has played a crucial role in this growth. The USMCA establishes more significant regional content requirements and higher labor standards, encouraging local production and allowing Mexico to overtake China as the leading auto parts exporter to the United States.

USMCA Helps Mexico Surpass China

The fact that Mexico displaced China made world news. Data from the U.S. Census Bureau shows an import value of $427 billion from China in 2023, down from $536 billion in 2022 and $504 billion in 2021. By comparison, Mexico’s import value to the U.S. in 2023 was $475 billion, up from $452 billion in 2022 and $382.5 billion in 2021. The trend continues in 2024, since during the first four months of the year, the United States imported $129 billion dollars from China compared to $162 from Mexico.

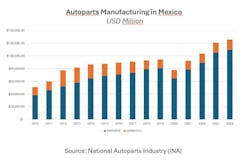

One of the sectors where the impact of the USMCA and nearshoring are most noticeable is the automotive sector, the main engine of the Mexican manufacturing economy. In 2019, Mexican plants produced $94.4 billion worth of components; by 2023, that reached $121.2 billion, and this year, the National Auto Parts Industry (INA) expects to reach $151.7 billion, an all-time high.

As mentioned before, Mexico is now the leading exporter of auto parts to the United States, with 42.5% of the U.S. market—well above Canada, with 10.5% and China, 8%.

In addition to its modernization, the USMCA now demands higher regional content (RCV), going from 62.5% under NAFTA to 75% in the USMCA. This motivates the narrowing of value chains and makes Mexico essential to the region's productive structure.

These growth expectations are also reflected in vehicle assembly, as light vehicle production in Mexico has recovered from the 2020 crisis (also responding to global trends), reaching 3.77 million units in 2023, almost the same level as 2019.

Due to the crisis and an already announced drop in car production, only 3 million cars were manufactured in Mexico in 2020. It needs to be clarified whether the production of 4 million light cars will be achieved by 2024. Still, there is confidence that growth will continue, as further adjustments to the manufacturing requirements of electric vehicles continue to be implemented.

Manufacturing Growth and Social Welfare

Beyond the political jargon and initial market reaction, everything seems to indicate that there will not be many changes in the current manufacturing development trend—mainly due to outside factors—as supply chain relocation and the automotive transition to EV, that could exert pressure on public policies in Mexico.

Claudia Sheinbaum has given clear signals that she will maintain and strengthen support for the manufacturing sector and its relationship with the United States. In her speeches on the campaign trail and in her position as the election winner, she has highlighted the importance of foreign investment and the relocation of production chains (nearshoring) as opportunities to also improve social welfare in Mexico.

Since April 2023, when she was still head of the government of Mexico City, Sheinbaum participated in a “nearshoring” forum, of the discussion “The City and Transformation”, where she stated that foreign investment must translate into decent jobs and fair wages. She stressed the need for these investments to benefit the population, particularly young people, to ensure a promising future for the country. Her commitment to social and economic well-being is reflected in her support for progressive labor policies, such as raising the minimum wage and eliminating outsourcing.

A Strong Showing as Mayor, But Many Unknowns

Sheinbaum also enriched Mexico City’s potential as a logistics hub for Latin America, attracting investment from global companies such as Nestlé and Siemens. These investment projects added to the modernization of industrial infrastructure in projects like the city’s Vallejo-I industrial zone and innovation center that highlight the city’s commitment to sustainable economic development.

The future president has assured the public that she will respect the autonomy of the Bank of Mexico and maintain a reasonable balance between debt and GDP, providing economic stability and confidence to investors. In addition, Sheinbaum has promised to continue with the energy transition, promoting renewable energy and energy efficiency, which will contribute to environmental sustainability and reduce energy costs for businesses and households.

Sheinbaum's commitment to nearshoring and company relocation, together with good working conditions, rights and housing for workers, has been also present in her speech as part of a “comprehensive approach to economic development.” Her administration seems to prioritize strengthening the industrial parks in the Southeast region on Mexico and developing new so-called “wellness poles” (industrial economic regions) throughout the country, making it easier to attract high-quality investments.

Sheinbaum also mentioned her intention to strengthen the sustainable-energy plan for the state of Sonora and establish a unique plan for the port city of Campeche that focuses on agricultural production and infrastructure development, reflecting an inclusive and regionally balanced economic development vision.

It seems that Sheinbaum could build on AMLO's positive results in the manufacturing sector, having achieved sustained growth despite the challenges and turbulences caused by the ideological clashes and political confrontations that have polarized the country.

It's heartening for businesses that she plans to build on the growth of the previous administration. But there are still many unknowns, such as maintaining the stability of the economy, ensuring investor confidence, solving the challenges of production and distribution of clean energy, facing the problem of water stress in the region, and solving the current security problem that afflicts logistics in the country. Investors' eyes will be watching those items closely. For now, manufacturing development does not warn of significant changes, at least in the short- and medium-term.

About the Author

David Luna

David Luna is a journalist based in Querétaro, Mexico. He has specialized in manufacturing, innovation and digitalization for more than 25 years. He is dedicated to translating the language of industrial operations and processes into the world of business and everyday life.