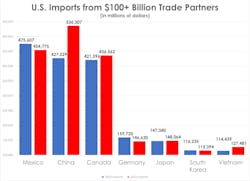

Continuing global tensions and tariffs on goods imported from China have upended trade standings, pushing Mexico to a dominant No. 1 position as the biggest supplier of imports to the United States.

Data released by the U.S. Department of Commerce show a dynamic upset of global trade, highlighted by a $130 billion flip between China and Mexico. Trade with Mexican goods grew by nearly $21 billion and Chinese merchandise fell by $119 billion. Put another way, China’s exports decline last year was roughly the total amount of U.S. imports from India and Brazil combined.

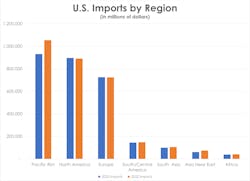

While near-shoring, the practice of moving manufacturing from Asia closer to the United States to shorten supply lies, may have played a factor, it doesn’t look like it played much of a role outside of Mexico.

Imports to the U.S. from South and Central America were down nearly 6%, a much better showing than the Middle East’s 17.4% drop in goods sent to the U.S. or the Pacific Rim’s 11.7% decline (driven almost entirely by China’s 20.3% dive in exports to the U.S.).

The overall decline in imports to the U.S. is the first major drop since pandemic-fueled declines in 2020.

About the Author

Robert Schoenberger

Editor-in-Chief

LinkedIn: linkedin.com/in/robert-schoenberger-4326b810

Bio: Robert Schoenberger has been writing about manufacturing technology in one form or another since the late 1990s. He began his career in newspapers in South Texas and has worked for The Clarion-Ledger in Jackson, Mississippi; The Courier-Journal in Louisville, Kentucky; and The Plain Dealer in Cleveland where he spent more than six years as the automotive reporter. In 2014, he launched Today's Motor Vehicles (now EV Manufacturing & Design), a magazine focusing on design and manufacturing topics within the automotive and commercial truck worlds. He joined IndustryWeek in late 2021.