Is there a Relationship Between Our Trade Deficit and Our National Debt?

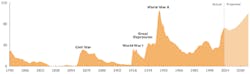

In his State of the Union address, President Obama asked Congress for fast track trade authority to move forward on the two trade agreements that have been in negotiations behind closed doors for the past four years: The Trans-Pacific Partnership Agreement and the Trans-Atlantic Trade Agreement. I have already written several articles about why fast track authority should not be granted and the dangers of the TPP. The purpose of this article is to show that there is a relationship between our trade deficits and our national debt. As shown by the chart below, we now have a more than $18 trillion national debt.

Source: http://en.wikipedia.org/wiki/National_debt_of_the_United_States#mediaviewer/File:Federal_Debt_Held_by_the_Public_1790-2013.png

Notice how it sharply ramps up starting in 2001. The recessions of 2001-2002 and 2008-2009 obviously played a significant factor in the increase in the national debt from $5.8 trillion in 2001 to its present level, because during recessions, there is a decrease in tax revenues and an increase in spending for unemployment benefits, food stamps and other assistance, as well as spending on programs to attempt to stimulate the economy.

However, 2001 also coincides with the first full year of trade with China under the rules of the World Trade Organization after "Congress agreed to permanent normal trade relations (PNTR) status," which "President Clinton signed into law on October 10, 2000," paving "the way for China’s accession to the WTO in December 2000."

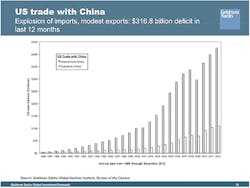

According to Alan Uke’s book, Buying Back America, the United States now has a trade deficit with 88 countries. Of course, some deficits are small, but some are enormous, such as with China. According to the Census Bureau, our top seven trading partners are: Canada, China, Mexico, Japan, Germany, South Korea, and the United Kingdom. These seven countries represent 50.9% of our total trade deficit: -$461.3 billion for January – November 2014. At an average deficit of $40 billion per month, the 2014 trade deficit will exceed $500 billion. Our 2014 trade deficit with China alone was -$314.3 billion for January – November, representing 68% of the total.

Some may claim that we are still the leader in advanced technology products, but this is no longer true. The U. S. has been running a trade deficit in these products since 2002, which has grown to an astonishing average of nearly $90 billion per year since 2010.

Even our most recent trade agreement, the Korea U. S. Free Trade Agreement (KORUS FTA), which went into effect in March 2012, has had a negative impact. Last March, the U. S. Trade Representative for the Obama Administration touted, “Since the Korea agreement went into effect, U.S. exports to Korea are up for our manufactured goods, including autos, exports are up for a wide range of our agricultural products, and exports are up for our services.” However, the reality is that our imports continued to exceed our exports, and the U. S. trade deficit with Korea jumped from -$13.62 billion in 2011 to -$22.8 billion through November 2014, which is a 60% increase in two and a half years.

Source: http://www.businessinsider.com/chart-us-trade-deficit-with-china-2013-4

Notice that there is a similar upward slope on the above graph to the upward slope of our national debt chart. Anyone can see that our trade deficits have a significant impact on our national debt.

The only thing that kept our trade deficits from being higher than they have been is the fact that we have increased the exports of services to balance our imports of goods as shown by the following chart:

|

Year |

Total |

Goods |

Services |

|

1999 |

-$258,617 billion |

-$337,068 billion |

$78,450 billion |

|

2000 |

-$372,517 billion |

-$446,783 billion |

$74,266 billion |

|

2002 |

-$418,955 billion |

-$475,245 billion |

$56,290 billion |

|

2004 |

-$609,883 billion |

-$782,804 billion |

$68,558 billion |

|

2006 |

-$761,716 billion |

-$837,289 billion |

$75,573 billion |

|

2008 |

-$708,726 billion |

-$832,492 billion |

$123,765 billion |

|

2010 |

-$494,658 billion |

-$648,678 billion |

$154,020 billion |

|

2012 |

-$537,605 billion |

-$742,095 billion |

$204,490 billion |

|

2013 |

-$476,392 billion |

-$701,669 billion |

$225,276 billion |

|

2014 |

-$461,336 billion |

-$673,612 billion |

$212,277 billion |

Source: https://www.census.gov/foreign-trade/statistics/historical/exhibit_history.pdf

As you can see, our trade deficit in goods more than doubled from 1999 to 2004 and reached astronomical heights just before the worldwide recession.

The Cost of Made in China

So how do our trade deficits add to the national debt? One way is that many products, especially consumer products, which were previously made in the U. S., are now made in China or other Asian countries, so we are importing these products instead of exporting them to other countries. The offshoring of manufacturing of so many products has resulted in the loss of 5.8 million American manufacturing jobs and the closure of over 57,000 manufacturing firms. These American workers and companies paid taxes that provided revenue to our government, so now we have less tax revenue to pay for the benefits and public assistance for the unemployed and underemployed.

Our balance of payments indebtedness for trade and the additional cost to the government paid by taxpayers for these benefits has resulted in our escalating national debt. The cheaper China price of goods that we import instead of producing here in the U. S. results in a cost to society as a whole. We need to ask ourselves: Is the China price worth the cost to society?

I say a resounding NO! We need to stop shooting ourselves in the feet. We need to stop benefitting the 1% of large multinational corporations to the detriment of the 99% percent of smaller American companies.

Beyond stopping fast track authority and the Trans-Pacific Partnership from being approved, we need to focus on achieving “balanced trade” in any future trade agreement. Until we change the goal of trade agreements, we should refrain from negotiating any trade agreement. The last thing we need is to increase our trade deficit more than it already is.

In addition, we need to facilitate returning more manufacturing to America by changing our tax policies and making regulations less onerous to manufacturers, without compromising our commitment to protect our environment. This is the only way that we will simultaneously reduce our trade deficit and the national debt.

About the Author

Michele Nash-Hoff Blog

President

Michele Nash-Hoff has been in and out of San Diego’s high-tech manufacturing industry since starting as an engineering secretary at age 18. Her career includes being part of the founding team of two startup companies. She took a hiatus from working full-time to attend college and graduated from San Diego State University in 1982 with a bachelor’s degree in French and Spanish.

After graduating, she became vice president of a sales agency covering 11 of the western states. In 1985, Michele left the company to form her own sales agency, ElectroFab Sales, to work with companies to help them select the right manufacturing processes for their new and existing products.

Michele is the author of four books, For Profit Business Incubators, published in 1998 by the National Business Incubation Association, two editions of Can American Manufacturing be Saved? Why we should and how we can (2009 and 2012), and Rebuild Manufacturing – the key to American Prosperity (2017).

Michele has been president of the San Diego Electronics Network, the San Diego Chapter of the Electronics Representatives Association, and The High Technology Foundation, as well as several professional and non-profit organizations. She is an active member of the Soroptimist International of San Diego club.

Michele is currently a director on the board of the San Diego Inventors Forum. She is also Chair of the California chapter of the Coalition for a Prosperous America and a mentor for CONNECT’s Springboard program for startup companies.

She has a certificate in Total Quality Management and is a 1994 graduate of San Diego’s leadership program (LEAD San Diego.) She earned a Certificate in Lean Six Sigma in 2014.

Michele is married to Michael Hoff and has raised two sons and two daughters. She enjoys spending time with her two grandsons and eight granddaughters. Her favorite leisure activities are hiking in the mountains, swimming, gardening, reading and taking tap dance lessons.