Riding the Recovery Wave or Preparing for a Long Slog

For manufacturers looking to maximize returns, asset productivity deserves a focus. Most manufacturers saw severe volume declines during the economic contraction of 2009, and most responded with short-term cost reductions, such as in their headcount and discretionary spending. These stop-gap measures help in the short-term, but in general, the costs will return when volume rises.

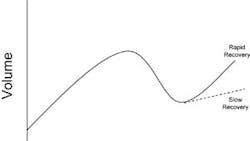

Instead, manufacturers should take a longer-term (3-5 year) view of their asset base and requirements in order to maximize returns. For most manufacturers, expectations for the pace and extent of volume recovery will fall into one of two scenarios as shown by this chart:

The high-level guidance is simple. In industries where volume should recover quickly (e.g., regain historical peak by 2011), manufacturers should focus on maximizing throughput to ride the recovery wave. However in industries where volume will likely take years to recover (e.g., regain historical peaks in 2014 or later), manufacturers should reduce their fixed asset footprint and re-align cost structure. Managing asset productivity is essential in either situation and below are key tools to consider for each scenario.

Scenario 1: Ride the Wave -- Rapid Volume Recovery

The goal here is to increase the productivity of the existing asset base so that anticipated volume growth can be absorbed into the current footprint. That is, grow output with the same set of assets. Examples of industries where this may apply could include consumer staples, medical equipment, and logistics / transportation. These are the key approaches to consider:

Improve OEE -- Operating Equipment Effectiveness is a powerful metric for improving asset productivity. OEE combines three concepts:

- Availability -- The amount of time the asset is available to produce product expressed as the percentage of actual available time divided by total time (24hrs x 7 days)

- Rate -- The rate at which the asset produces parts, expressed as a percentage of the process design rate

- Acceptance -- The first pass yield of parts produced, expressed as a percentage

The OEE metric is powerful for several reasons. It allows us to think about the productivity of assets on a common basis, it helps weigh tradeoffs among options, and it is difficult to game.

Improve Velocity (Lean Manufacturing) -- Lean manufacturing not only eliminates waste and improves production flow, but it also increases the productivity of a group of assets. The key concept is to use accurate value-stream maps to understand where wasted effort reduces flow, and from there, identify specific changes to enhance productive capacity.

Scenario 2: A Long Slog -- Volume Takes Years to Return

In this scenario, volumes are recovering slowly and will not return to peak levels for at least four to five years. The basic premise here is producing the same output with fewer assets. Examples of industries where this may apply could include housing, automotive, and aerospace. These are the key approaches to consider:

Asset Performance / Strategic Importance -- This framework analyzes assets based on dimensions of performance (cost, quality, productivity, maintenance requirements, etc.) and strategic importance (proprietary processes, proximity to suppliers and customers, insufficient similar capacity in the supply chain, etc.) It leads to a clear ranking of assets, ranging from "keepers" to targets for rationalization and change. Products produced on assets scoring low on both performance and importance are good candidates to refresh the make vs. buy decision -- particularly in a period of excess capacity across the supply chain.

Volume Consolidation -- This involves combining production from multiple lines or facilities in order to close one or several of them. As simple as it sounds, this is often difficult to achieve without careful analysis. Key factors to evaluate include converting unit volumes into the equivalent hours of capacity, segregating assets by capability, and understanding assets' full cost structures. For manufacturers with homogeneous processes, the analysis is fairly straightforward. In more heterogeneous environments, sophisticated models such as linear or integer programs may be required to compare multiple alternatives.

Working Capital Productivity -- Always Important

Regardless of the recovery scenario, another component of asset productivity that is always important to evaluate involves working capital, particularly inventory levels. Improvements in inventory will boost returns regardless of the future volume scenario. Some key approaches to consider:

Enhanced Sales and Operations Planning (S&OP) -- S&OP is the central link between manufacturing decisions and market demand. In many companies, S&OP has evolved over time, and yesterday's manual approaches to S&OP have been replaced by processes and tools that are fully integrated with business systems. A period of relatively low volume may be an ideal opportunity to enhance S&OP activity with new tools and technologies. When done properly, S&OP optimizes the delicate balance between fulfilling customer demand, minimizing inventory, and level-loading the supply chain.

Collaborative Planning, Forecasting and Replenishment (CPFR) -- CPFR increases information and process integration between supply chain partners by creating a system of shared information available to partners across the supply chain (e.g., information about current inventory levels, current and future product availability, current and future demand requirements, etc.). This helps reduce inventory levels through joint inventory management; it also typically reduces transaction costs through joint replenishment processes.

Manufacturers should take advantage of a period of reduced volume to improve the foundations of their businesses. If volume is likely to return quickly, the best path forward is optimizing assets and riding the recovery wave. If volume may be down indefinitely, the best path forward is rationalizing assets and preparing for a long slog. Regardless of the expected volume scenario, manufacturers would be well served to improve the productivity of their working capital and assets.

Mark Coming and Jeremy Wallach are management consultants with Charles River Associates. They specialize in business strategy development and improving operational and managerial performance in the industrial and manufacturing sectors. http://www.crai.com

Interested in information related to this topic? Subscribe to our weekly Value-chain eNewsletter.