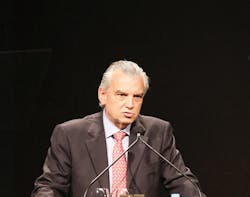

Embraer CEO Lays Out Commercial Aviation Battle Plan

In a visit to Washington, Paulo Cesar de Souza e Silva, president and CEO of Brazilian aircraft builder Embraer, sat down for a roundtable with editors from Aviation Week & Space Technology and sister publication ATW. Following are his remarks about the company’s commercial aircraft unit and ambitions to expand its aftermarket business.

AW&ST: Your segment of the commercial aviation market is becoming more crowded with new entrants such as the Mitsubishi Regional Jet.

Silva: My target is to continue to be the market leader in our segment and the third-largest commercial aircraft manufacturer. We are going into a cycle in which there will be more players in this segment. And those players will have different mindsets and financial resources. So, it is going to be very challenging in the coming years. I would like to see us better penetrate the services side. Embraer already is there, but there are many more opportunities [we can] explore to make the services and support business much more relevant in terms of revenue.

Embraer CEO’s Battle Plan

- Increase MRO to 25% of revenues

- Build on success in Asia with E195-E2

- WTO fight over Bombardier C Series aid

Boeing recently created a whole new services division. What are your goals for growing Embraer’s services business in the next 5-10 years?

We already have about 15% of our revenues coming from services. In the next 10 years we would like to grow that to roughly 25%. We have MRO businesses in Nashville, Tennessee, and in Portugal. We are supplying interiors for our business jets, and have just inaugurated a facility in Titusville, Florida, to manufacture business jet seats. We are going to manufacture the first-class seats of the E2 [airliner]. So we are enlarging our capability to supply certain equipment in the aircraft, and maintain it and then go deeper. For example, we manufacture landing gear for the E2, the KC-90 [military transport] and the Phenom 100/300 and Legacy [business jets]. But we are not in repair. So that is something we could do, not only for our aircraft but also for other aircraft.

ATR has been very successful in Asia. How do you see the commercial market in Asia and China specifically developing for Embraer?

We are already market leaders in China—we have about a 90% share of the 100-seat jet market. The E2 is selling well there. I believe Asia is where the bulk of air traffic will grow. Our presence in that market is not yet at the level we would like, so that is a core target for us. We believe that the economics of the 195-E2 are such that we can be successful in Asia. The E2 is bigger, with economics that are better than the smaller narrowbodies and very close to the regular narrowbodies in terms of unit costs, which matters a lot in Asia.

How is the E2 flight-test program going?

The campaign is going very well. We are flying three prototypes, with the fourth coming [this month]. We have flown about 35% of what we need. We are on time, so deliveries will begin in the first half of 2018. The performance of the aircraft is meeting projected requirements. The aircraft is slightly underweight, which is excellent. So we are very happy with the development so far. We believe that we will have the most efficient family of aircraft in this segment. Every model is optimized for its market. We have three wings on the E2 for the 170, 190 and 195.

You recently slid the debut of the E175-E2 a year to the right. It looks as if the whole issue of scope clauses (labor agreements that limit the size of aircraft an airline can contract out to regional carriers) are fairly intractable as far as the U.S. pilot’s unions are concerned. Does that give you concern that the E175-E2 might never happen?

That is a tough question to answer. A lot of the E175-E2 program is also linked to oil prices. If we believe those will go up and stabilize at $80-90 a barrel, the E175-E2—and the E2 in general—will be more attractive. The E175 has a narrower market than the Embraer 190/195—the bulk of it is no question here in the U.S. However, we have to look at the scope clause and the likelihood that it will change in the next round of [labor] negotiations in 2019. I think that is a possibility, but it is small at this stage. So we have to wait and see what happens. The one-year postponement gives us more time to understand what is going to happen in 2019 on the scope clause negotiations and oil prices.

Is it possible you could put the 175-E2 in a deep freeze until things change, or would you just say ‘Let’s not go with that?’

It is just a matter of one or two years of shifting, but we will do it because we are in an advanced stage already. It has a dedicated wing, but everything else—the components, the avionics, the interior—are basically the same as the 190. And let’s not forget there will be a market outside the U.S., and a new entrant [the Mitsubishi Regional Jet] will offer an aircraft of the same size. So we will do it anyway, because we will be competing with a new manufacturer.

You had decided not to develop a 170-E2. If there’s no relief in sight on the scope clauses is that something you would reconsider?

No. That is off the table. We could probably do the 175-E2 with fewer seats, make it sort of a 170, and wait until we have the scope clause relief. That would be more economical.

In the spring of 2016 you voiced displeasure over losing an order from Delta Air Lines to Bombardier’s C Series. You were unhappy with the Quebec government’s $1 billion investment in the C Series. Is there any action Embraer or the Brazilian government can take?

I continue to be very unhappy, because this is causing a huge disruption in the market. We are no longer competing with Bombardier, but with the [provincial] government that is now manufacturing aircraft. We think this is very unfair, and we are talking seriously to our government to move into a different level of conversation, or to go to a more disruptive conversation between Brazil and Canada. It is up to our government to take that fight to the World Trade Organization. [Brazil announced in late December that it would file a complaint with the WTO.]