Manufacturers Brace for the Impact of Healthcare Reform

Ever since its passage in March 2010, the Patient Protection and Affordable Care Act has been a hot topic of debate, creating a lot of uncertainty among medical suppliers, payers and consumers. With key provisions going into effect this year, a wave of structural changes are expected in the U.S. health system in the near future. Regardless of the size and the nature of operations, virtually every healthcare provider and health-oriented company will have to learn how to navigate in the increasingly complex healthcare sector. Staying abreast of the changes brought on by healthcare reform will equip companies with the knowledge necessary to strategically produce and supply medical products and services.

To that end, following is our analysis of how different healthcare reform provisions, cost-containment pressure and a shift toward performance-based pricing will impact both healthcare suppliers and buyers, as well as how companies can successfully adapt to these changes.

Related Article: Medical Device Tax Could Cost Thousands of Jobs

Healthcare Reform’s Headwinds and Tailwinds

The fundamental goals of healthcare reform are to expand access to healthcare services and to improve the quality of care while controlling ever-rising healthcare costs. As a result, about 27 million previously uninsured Americans are expected to gain healthcare coverage by 2017, according to Congressional Budget Office estimates. An influx of newly insured individuals, along with steadily aging baby boomers, will likely cause an uptick in demand for healthcare services and medical supplies in the coming years. In particular, expanded prescription drug coverage will be a boon to the pharmaceutical industry’s growth by lifting up demand for novel drugs.

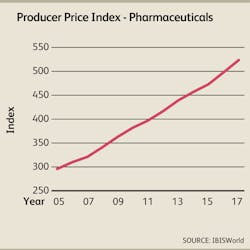

Healthcare reform is also expected to help close the Medicare doughnut hole, which will likely benefit pharmaceutical companies that often lose sales when drug beneficiaries fall in that gap and have to pay out-of-pocket for their medications. In light of spiraling demand for pharmaceuticals, such as anticoagulants, anticonvulsants and antihypertensive drugs, and the introduction of new treatments, particularly biologic drugs, IBISWorld estimates that pharmaceutical prices will trend upward at an annualized rate of 4.6% over the three years to 2017.

While healthcare reform’s individual mandate will likely bolster demand for healthcare services and supplies, other key provisions are expected to pressure suppliers’ bottom lines. In order to balance the overall expense of healthcare reform associated with the expansion of health insurance coverage, new revenue streams were necessary. As such, a 2.3% excise tax was levied on the domestic sale of medical devices starting January 1, 2013, according to the Advanced Medical Technology Association, and is expected to cost the medical device industry $30.0 billion over the next 10 years. Because the excise tax applies to all medical supply manufacturers, regardless of size and revenue, it is anticipated to take the greatest toll on small and medium-size companies, particularly those developing new technologies and incurring relatively high research and development (R&D) expenditures.

The Physician Payment Sunshine Act, which requires medical device and pharmaceutical manufacturers to report any transfers of payments or gifts to physicians each year, is also anticipated to further push up operating costs for manufacturers. In response to the tax and rising costs, some medical device companies have begun or plan to reduce their workforces, slash R&D budgets or delay expansion plans. Medical device firm Cook Medical, for example, decided to shelve its plans to expand into the Midwest region, while major vendor Medtronic plans to lay off about 2,000 employees by the end of fiscal 2014.

Despite growing demand for medical supplies and rising operating costs due to the implementation of healthcare reform provisions, manufacturers may have to concede in price negotiation with their buyers because of the growing power of group purchasing organizations (GPOs) and consolidation among hospitals. As a result, prices of medical and surgical supplies, such as medical gloves, floor-grade instruments and medical tissue closures, are forecast to grow at an anemic annualized rate of 0.8% during the three years to 2017, according to IBISWorld projections.

Originally set to take effect in 2014, the employer mandate has been delayed until 2015, providing some relief to businesses, albeit temporary. The mandate requires all businesses, including manufacturers, with 50 or more employees to provide healthcare coverage to their full-time employees or pay an annual penalty for each person. Furthermore, amidst uncertainty and changing insurance plans, some consumers have seen their premiums going up this year in spite of healthcare reform’s goal to curb rising healthcare costs. Because a highly skilled and experienced workforce is key to success for new product development, medical device and pharmaceutical companies have to revise their benefit packages to attract and retain their valuable employees.

Navigating the Increasingly Complex Healthcare System

Amidst rising cost-containment pressure and tighter capital funds, hospitals have been delaying the purchase of big-ticket items, such as MRI equipment and CT diagnostic imaging systems. Instead, some providers have been opting for medical equipment rental or repair services. A rising shift away from a fee-for-service model to a value- or performance-based model forces hospitals to reevaluate their return on investment and justify the purchase of medical supplies.

Moreover, with a threat of financial penalties for hospital readmissions, healthcare reform is placing greater emphasis on quality, causing healthcare providers to be more cautious in purchasing decisions. With that in mind, manufacturers that can successfully develop and demonstrate the efficacy and quality of their products have the strong potential to win business. In particular, medical devices and pharmaceuticals that treat rare diseases and target unmet medical needs will be extremely popular as hospitals seek to differentiate themselves from competitors by offering specialized services. As such, start-up companies that specialize in certain medical devices or pharmaceutical niches will become attractive targets for acquisitions.

Growing power of GPOs and large hospitals is bolstering merger and acquisition (M&A) activity among medical device and pharmaceutical manufacturers seeking to strengthen their positions in price negotiation. Hospitals across the country explore vertical integration by acquiring private physician practices. As hospitals become larger in size, they can exercise their economies of scale to secure the best prices from manufacturers, whereas other hospitals consider limiting their vendor choice. While larger manufacturers can benefit from this practice, smaller manufacturers with less negotiating clout will likely face significant downward pricing pressure and struggle to maintain healthy margins.

IBISWorld projects that consolidation will not only enable manufacturers to expand their product lines and geographic footprint but also help lift up prices and lock in contracts with large-scale buyers, including large GPOs and hospitals. According to S&P Capital IQ data, there were 342 M&A transactions in the medical device industry during 2013. Although M&A growth might not be as aggressive in the next few years, it may be only a matter of time before another wave of M&As passes through the medical device market.

In addition to consolidation, medical device and pharmaceutical manufacturers alike should consider divesting their underperforming businesses and expand their core operations both organically and through acquisitions. For example, major medical device operator Boston Scientific sold its Neurovascular segment to competitor Stryker for $1.5 billion in 2011, and many large-cap pharmaceutical companies are considering divesting their animal health units. Moreover, medical device and pharmaceutical companies can look to outsource their clinical research and testing activities to contract research organizations (CROs). For manufacturers without the capacity and qualified personnel to perform clinical testing in-house, outsourcing R&D activities to CROs can mean potential cost savings, accelerated development and reduced risk through their service offerings.

Seizing opportunities in burgeoning markets can be another viable option for medical device and pharmaceutical manufacturers to counteract regulatory scrutiny and higher tax rates domestically. Countries such as China, India, Brazil and Russia are alluring manufacturers with a rising middle class with disposable income, less expensive R&D environment and less stringent government oversight.

While some companies are outsourcing manufacturing to emerging markets to trim their production costs, others are pursuing acquisitions of or collaborations with foreign firms to enlarge their geographic footprint. For example, Johnson & Johnson and Merck recently announced plans to pour millions of dollars into expanding manufacturing plants in China, a country that exhibits exponential growth opportunities in the future. In the coming years, other deep-pocketed medical device and pharmaceutical companies are anticipated to join the movement.

Competitive Advantage

Healthcare reform has been drastically changing the playing field where both suppliers and buyers have to adapt to new rules and seize new opportunities. IBISWorld expects that those manufacturers who can stay one step ahead of their competitors and customers by carefully examining market trends and regulatory changes will continue to grow and expand their market share.

The influx of newly insured individuals and steadily aging population of affluent baby boomers, along with an abundance of unmet medical needs, pose tremendous opportunities for technological breakthroughs in medicine. With more decision-making power shifting to payers and patients, manufacturers that develop consumer-oriented and cost-saving products can gain a competitive advantage.

Anna Son is a lead healthcare analyst at IBISWorld. She holds a bachelor's degree in business administration and a minor in marketing from Pepperdine University. The research featured in this article can be found at www.ibisworld.com.