Decline in Number of US Manufacturing Factories Is Not Due to Offshoring

The perception that firms leave and set up shop on foreign soil simply for cost purposes is misplaced, according to a new Manufacturers Alliance for Productivity and Innovation (MAPI) report.

MAPI Chief Economist Daniel J. Meckstroth, Ph.D., argues that U.S. companies commonly open operations abroad to serve the local markets—it’s not about finding the cheapest way to make their products.

“Relatively few plants are shut down in the U.S. by an owner who opens up an identical facility abroad and supplies the U.S. market with imports from the foreign affiliate,” Meckstroth said. “A widespread, more fundamental reason for plant closings and openings is the sourcing decision, where U.S. firms purchase intermediate goods and services—from domestic or foreign suppliers. The procurement decision should be based on cold, hard calculations of the total cost of ownership.

A “runaway plant” as defined in the report is a factory that closes in the United States and reopens in a foreign country with a lower cost structure, producing the same product(s) to be shipped back.

“There is a major distinction between investment in runaway plants and investment in foreign affiliates to participate in the global marketplace,” he added. “Only 11% of foreign affiliates’ sales return to the U.S.— 9 percentage points to the U.S. parents and 2 percentage points to other U.S. customers. On the other hand, 89% of affiliates’ sales are in their own countries or to other non-U.S. customers.”

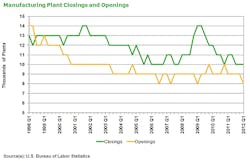

The churn rate, or the discrepancy between plant closings and openings, explains the dynamics of the decline in U.S. plants. Over the last 13 years, 3.5% of factories closed each quarter while 2.9% opened.

The most recent data are in line with the long-term trend. In the first quarter of 2012, 10,000 plants closed, or 3.3%, while 8,000 plants opened, or 2.6. This in turn affects the workforce. For example, from the first quarter of 2010 to the first quarter of 2012 there was a cumulative loss of 108,000 jobs.

Not a Manufacturing Revival

Recently, some runaway plants returned home and there are some positive economic incentives to encourage more domestic sourcing. Among them, the U.S. dollar has fallen 23% in value since 2002; unit labor costs in U.S. manufacturing have been relatively flat over the last 10 years and well below the rate of consumer inflation; and natural gas prices in the United States are at least two to three times lower than in Europe and Japan.

“Although economic forces and business requirements seem to be shifting in favor of domestic sourcing, there is little evidence that a manufacturing revival has occurred,” Meckstroth noted.

Manufacturing’s share of GDP fell from 12.1% in 2007 to 11.5% in 2011, and the import share of U.S. manufacturing consumption rose from 38% in 2006 to nearly 40% in 2011.

Meckstroth said more factors need to be in play for a real industry upswing, especially those relating to public policy areas such as corporate taxes, trade, technology, talent, and regulations.

“The necessary positive economic and strategic forces are not reinforced by supportive public policy,” he said.

About the Author

IW Staff

Find contact information for the IndustryWeek staff: Contact IndustryWeek