Economy Will Bounce Back in 2015 if Uncle Sam Doesn't Muck Things Up

Although many manufacturers won't even know how successful their year has been until after the Christmas shopping season ends, some economic forecasters are already moving on from 2014 and have set their sights on projecting what kind of a year 2015 will be. According to a recent study conducted by consulting firm Deloitte, the new year should also be a happy one, as 88% of the senior executives polled believe the U.S. economy will grow in 2015. Only 4% of respondents fear a recession.

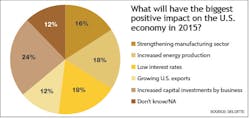

Much of that growth will be powered by an increase in corporate capital investments. Another major driver of economic growth will be the manufacturing sector, which should increase in strength in 2015 (see chart).

The biggest global challenge to U.S. prosperity, respondents say, will be turmoil in the Middle East, followed by China's economy, and fears of stagnation in Europe.

"Shocks from outside the U.S. and internal fiscal policy mistakes are likely the biggest challenges to continued U.S. economic improvements in 2015," says Ira Kalish, chief global economist with Deloitte Consulting. "Unless the situation in the Middle East worsens considerably, I don't expect it to be as big a challenge as stagnation in China or Europe would be in the new year." From Kalish's perspective, a more relevant issue for 2015 will be how the Federal Reserve balances concerns about inflation with concerns about employment. Eighteen percent of respondents believe the Fed will tighten monetary policy appropriately, 21% think the Fed will tighten too soon, and 37% say the Fed will tighten too late (and 24% don't know). In a separate survey conducted by Deloitte of 100 CFOs at large companies, respondents weren't nearly as optimistic about capital investments. In fact, capital spending growth is forecast to increase year-over-year by only 3.5%, the lowest growth rate since Deloitte began the CFO survey in 2010. By way of comparison, forecasts for capital spending growth were in the 12% range from 2010-2012, but have dropped precipitously the past two years.About the Author

Dave Blanchard

Senior Director of Content

Focus: Supply Chain

Call: (941) 208-4370

Follow on Twitter @SupplyChainDave

During his career Dave Blanchard has led the editorial management of many of Endeavor Business Media's best-known brands, including IndustryWeek, EHS Today, Material Handling & Logistics, Logistics Today, Supply Chain Technology News, and Business Finance. He also serves as senior content director of the annual Safety Leadership Conference. With over 30 years of B2B media experience, Dave literally wrote the book on supply chain management, Supply Chain Management Best Practices (John Wiley & Sons, 2010), which has been translated into several languages and is currently in its second edition. He is a frequent speaker and moderator at major trade shows and conferences, and has won numerous awards for writing and editing. He is a voting member of the jury of the Logistics Hall of Fame, and is a graduate of Northern Illinois University.