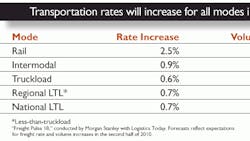

Manufacturers need to plan for a modest hit to the wallets as transportation rates for motor carriers, railroads and intermodal transportation are likely to increase over the next six months. According to equity research firm Morgan Stanley, companies using rail carriers to ship their freight will see a 2.5% hike in their rates through the end of 2010. What's more, as the economy starts to recover, manufacturers expect to increase their use of the railroads by 2.6% this year. Rail is generally the least expensive mode of domestic transportation, and volume growth is expected to be comparable to the 2003-2004 rebound.

All modes of transportation studied in the Morgan Stanley survey (conducted with IW's sister publication, Logistics Today) will see both rate and volume increases, an indication that the recession has bottomed out and companies are at the very least replenishing their inventories. Survey respondents believe that truckload and intermodal capacity is returning to pre-

recessionary 2008 levels. In fact, there's some thought that even less-than-truckload (LTL) capacity is beginning to tighten.

"Truckload shippers are most concerned about a lack of capacity, but are not yet signaling a return to the capacity crunch levels of 2004-2005," observes Morgan Stanley analyst William Greene. Restocking inventories will drive the next leg of the recovery, Greene notes, with 55% of respondents reporting lower year-over-year inventories, and 43% reporting higher ordering.

On the LTL side, regional volumes should outperform national, based on the survey. It's also possible that national LTL carrier YRC's worst days are behind it. "Some shippers appear to be shifting some volume back to YRC, but not in a major way," Greene notes. "Small shippers seem more willing to try YRC services to save on costs. Morgan Stanley suspects the recovery for YRC is likely to start slowly, with some shippers trying a few lower-priority spot moves first as costs start to rise before allocating more volume as confidence grows."

When asked to grade the state of the economy on a 1-to-10 scale, survey respondents offered a score of 5.4, the highest level since September 2007. As the economy improves, shippers are finding it more difficult to receive fuel surcharge concessions from the truckload carriers. A year ago more than half (51%) said they received concessions, but today that percentage has dropped to 35%.

About the Author

Dave Blanchard

Senior Director of Content

Focus: Supply Chain

Call: (941) 208-4370

Follow on Twitter @SupplyChainDave

During his career Dave Blanchard has led the editorial management of many of Endeavor Business Media's best-known brands, including IndustryWeek, EHS Today, Material Handling & Logistics, Logistics Today, Supply Chain Technology News, and Business Finance. He also serves as senior content director of the annual Safety Leadership Conference. With over 30 years of B2B media experience, Dave literally wrote the book on supply chain management, Supply Chain Management Best Practices (John Wiley & Sons, 2010), which has been translated into several languages and is currently in its second edition. He is a frequent speaker and moderator at major trade shows and conferences, and has won numerous awards for writing and editing. He is a voting member of the jury of the Logistics Hall of Fame, and is a graduate of Northern Illinois University.