NAM/IndustryWeek 3Q 2014 Survey: Confidence, Investment on the Rise

Frustration with Washington continues to hang like a cloud over manufacturers; however, optimism has begun to break through in some areas. It is hard not to be disappointed with the sluggish growth in the first half of 2014, with real GDP up an annualized 1% largely due to weaknesses in the first quarter.

Manufacturing activity has rebounded, and manufacturers remain mostly upbeat about the coming months. Indeed, the Institute for Supply Management’s purchasing managers’ index stands at a three-year high, and manufacturing production climbed 4.9 % year-over-year in August. In addition, capacity utilization nears pre-recessionary levels—a positive sign that the sector has finally emerged from the sharp downturn that began in December 2007.

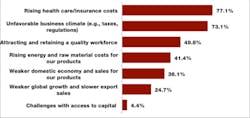

Based on the survey results, we can attribute the more-optimistic outlook from manufacturers to confidence in their business rather than in Washington. The survey results also show that manufacturers continue to face significant challenges due to policies emanating from Washington and remain extremely frustrated by the political gridlock (Figure 1).

A majority of survey respondents, 77.1%, again cite rising health insurance costs as their top challenge. In the manufacturing sector, businesses see benefit costs rising an average of 6.3% over the next 12 months (a new question starting with this report), with health insurance premiums anticipated to increase 9.6% on average in 2015. While most firms probably do not yet have actual premium figures for next year, the fact that more than half of them predict increases of at least 10% spurs considerable concern. In addition, more than 85% of those taking the survey said they believe their health care costs will increase by 5% or more—a harmful reality, particularly for small businesses.

Figure 1: Primary Current Business Challenges, Third Quarter, 2014

Note: Respondents were able to check more than one response. Therefore, responses exceed 100%.

We asked manufacturers about changes they might make to their health insurance coverage next year, particularly in light of expected premium increases (Table 1). More than half of those responding said they would have to increase copays and deductibles (55.8%) and/or increase the share of premiums paid by employees (54.4%); however, 36.7% would be able to offer the same plan. In keeping with manufacturers’ long-standing tradition among sectors with the highest offer rates, only 6.6% anticipated narrowing their provider networks, with only 1.8% intending to stop covering their workers.

Table 1: Special Question Regarding 2015 Health Insurance Plans

|

Assuming you offer health insurance to your employees, do you expect to make any changes for the next plan year? Please check all that apply. |

Percentage Saying Yes |

|

Increase copays and deductibles |

55.8% |

|

Increase employee share of premiums |

54.4% |

|

Keep offering the same plan |

36.7% |

|

Narrow provider networks |

6.6% |

|

Stop providing coverage |

1.8% |

Note: Respondents were able to check more than one response. Therefore, responses exceed 100%.

The second most-pressing issue for manufacturers remains the business climate, noted by 73.1% of those taking the survey this quarter (Figure 1). This reflects back to the idea that manufacturers believe they are experiencing success in spite of Washington policies. These policies include the need for comprehensive tax reform and a desire to reduce regulatory burdens, among other issues. A number of respondents provided additional context to their answers in the sample comments that appear in the appendix to this report. Many of them mentioned “skyrocketing” regulatory compliance costs, or challenges in complying with “complex” tax rules. Beyond those issues, roughly half of these survey respondents cited difficulty in attracting and retaining new workers. In fact, workforce development worries have been noted for some time, and as job creation opportunities continue to increase, skilled worker shortage issues will follow suit.

This quarter’s survey also delved deeper into frustrations with new labor regulations being proposed by the Administration. Among the more high-profile actions, President Barack Obama has issued an executive order that would potentially blacklist contractors with labor and safety infractions from the previous three years, the National Labor Relations Board (NLRB) is set to finalize a regulation to speed up the union election process, and the Department of Labor (DOL) is revising overtime regulations in the Fair Labor Standards Act.

Manufacturers expressed at least a moderate degree of concern regarding many of these changes. For instance, we asked them to rank on a scale of 1 to 10 their level of concern regarding DOL’s plan to change overtime regulations (with 1 being no concern and 10 being extremely concerned), and the average was 6.7. Roughly 45% of those completing this ranking scored their concern levels at 8, 9, or 10, placing a sizable percentage as highly concerned. Respondents had similar concerns about the President’s new executive order regarding federal contracts and labor law violations (with an average score of 6.2) and the new OSHA rules on injury and illness disclosure reporting (with an average score of 6.6).

Most importantly, many of these changes could have a chilling effect on the market. Roughly one-quarter of those responding said they would be less likely to hire in the coming 12 months because of the proposed overtime regulations, with essentially the same percentage noting that they would be less likely to bid on federal contracts. When asked about their biggest obstacles to bidding on federal contracts in general (Table 2), manufacturers overwhelmingly cited the rules and regulations required in the procurement process as their top reason (75.6%). Other concerns include the process length (41.3%) and the difficulty in learning about new contracts (29.4%).

Table 2: Special Question Regarding Obstacles for Manufacturers in Federal Contracting

|

What do you consider to be the biggest obstacles to bidding on a federal contract? (Check all that apply.) |

Percentage |

|

Rules and regulations |

75.6% |

|

Process takes too long |

41.3% |

|

Finding out about available contracts |

29.4% |

|

There are no obstacles |

9.0% |

Note: Respondents were able to check more than one response. Therefore, responses exceed 100%.

Outlook Most Optimistic Since 2012

Returning to the manufacturing outlook, manufacturers have become more positive of late, but the results clearly show increasing trepidation that Washington policies and regulations could significantly undermine manufacturers’ chances at growth and success. In the most recent NAM/IndustryWeek survey, 87.3% of respondents were either somewhat or very positive about their own company’s outlook (Figure 2). This continues the upward trend that began in the first quarter of 2013. The outlook measure has averaged 86.4% through the first three quarters of this year, a nice improvement from the 74.2% average observed for all of 2013. Moreover, it marks the highest reading since the first quarter of 2012 (88.7%), suggesting that manufacturers have started to recover from the more-sluggish activity seen over the past couple years.

Figure 2: Manufacturing Business Outlook, by Quarter, 2013–2014

Note: Percentage of respondents who characterized the current business outlook as somewhat or very positive.

This is illustrated in the underlying data, as well, with many at paces not seen since early 2012. For example, sales are expected to grow 4.4% on average over the next 12 months, up from 4.1% in the June survey (Figure 3). Not only is this the fastest pace since the first quarter of 2012, it also represents a strong increase from the end of 2013, when the average anticipated sales pace was 3.0%. In this most recent survey, nearly 48% of respondents predict sales growth of 5% or more, with just more than 4% forecasting declines in new orders. This latter area has shown improvement this quarter, with 9.4% predicting decreased sales over the next year in the last survey.

Capital investment and employment also moved in the right direction. Manufacturers plan to increase capital spending by 2.5% over the next 12 months, up from 1.4% in December and 2.3% in June. Meanwhile, 46% of survey respondents plan to hire more workers over the next year, with 7% anticipating employee declines. On average, firms plan to increase their employee levels by 1.9% in the next year, a significant improvement from the lackluster pace of job growth in 2013, which averaged just 0.8%.

Figure 3: Expected Growth of Manufacturing Sales, Investment and Employment, 2012–2014

Note: Expected growth rates are annual averages.

As usual, firm size impacted the data. Larger manufacturers with 500 or more employees were more upbeat in their outlook than their smaller counterparts with fewer than 50 employees, with 90.2% positive for large firms versus 82.7% for smaller ones. Greater sales expectations influenced much of that. In fact, 88.5% of large manufacturers predict sales increases over the next 12 months relative to 65.4% for small firms. With that said, medium-sized manufacturers (or those with 50 to 499 employees) have the greatest capital spending plan intentions, with an average increase of 2.8%. This was higher than the 2.1% and 2.2% paces predicted by small and large manufacturers, respectively.

Medium-sized manufacturers (or those with 50 to 499 employees) have the greatest capital spending plan intentions, with an average increase of 2.8%.

—Chad Moutray

In terms of hiring, small and medium-sized businesses forecast employment growth of 2.2% over the next year, with larger firms predicted to eke out a gain of just 0.5%. At the same time, roughly half of all respondents plan to keep their workforce levels unchanged.

In contrast to these growth areas, exports showed weakness. Thirty percent of manufacturers in the NAM/IndustryWeek survey predict export sales to increase over the next 12 months, down from 40% in the June survey. As a result, the pace of increase for the year fell to 1.3%, from the 1.6% pace noted last time. These findings align with the softness seen in manufactured goods exports so far this year.

Meanwhile, manufacturers expect their inventories to increase 0.8% over the next 12 months. This marks the third consecutive quarterly increase in stockpiles, following six straight quarters of inventory depletion. While half of those taking the survey predict inventory levels to remain unchanged, almost one-third predict increased inventories in the next 12 months.

Manufacturing Production Should Accelerate

Figure 4: Predicted Manufacturing Production (North American Industry Classification System)

Note: Industrial production is predicted two quarters in advance by regressing NAM/IndustryWeek Survey of Manufacturers data as one of the independent variables, with data stretching back to Q4:1997. Other explanatory variables include current values for housing permits, the interest rate spread, personal consumption and the S&P 500.

For several quarters now, we have used the NAM/IndustryWeek outlook data in a regression model to predict manufacturing production two quarters ahead (Figure 4). Other variables include current values for housing permits, the interest rate spread, personal consumption and the S&P 500. This model explains 90% of the variation since the data began in the fourth quarter of 1997.

The current model is very encouraging and suggests that manufacturing production should continue to accelerate, growing 3.1% over the next two quarters. In addition to an increased manufacturing outlook, the rising stock market, better housing permits data and decent growth in consumer spending help push this figure higher. Of course, this projection also has sizable downside risks, including geopolitical risks, a still-cautious consumer base, uncertainties surrounding government regulations and monetary policy changes. Yet, these data tend to mirror the optimistic assessment seen in other indicators, and they give us some encouragement about the second half of 2014 and beyond.

The NAM/IndustryWeek Survey of Manufacturers has been conducted quarterly since 1997. This quarter’s survey was conducted among NAM membership between August 15 and 29, with 230 manufacturers responding. Responses came from all parts of the country, in a wide variety of manufacturing sectors and in varying size classifications. Aggregated survey responses appear below. The next survey is expected to be released on Monday, December 8.

Sample Comments on Primary Challenges Facing Manufacturers

- “Being able to complete R&D projects with available resources.” (Computer and electronic products)

- “General lack of confidence and malaise between government and pro-growth policies (tax reform).” (Machinery)

- “Increasing challenges in trying to innovate.” (Chemicals)

- “Lack of a capable labor pool.” (Paper and paper products)

- “Lack of skilled trades, especially for welders, truck drivers, maintenance people and electricians.” (Primary metals or fabricated metal products)

- “Low-cost competitive imports entering the country.” (Primary metals or fabricated metal products)

- “Low household formation/low job growth.” (Nonmetallic mineral products)

- “Our largest customer does not have an engine that meets the new 2015 emission regulations, and therefore, our sales will be down about 25 percent.” (Transportation equipment)

- “Regulatory compliance costs are skyrocketing with little return.” (Electrical equipment and appliances)

- “State tax regulations are becoming increasingly complex and business prohibitive.” (Chemicals)

About the Author

Chad Moutray

Chief Economist

Chad Moutray is chief economist for the National Association of Manufacturers (NAM), where he serves as the NAM’s economic forecaster and spokesperson on economic issues. He frequently comments on current economic conditions for manufacturers through professional presentations and media interviews. He has appeared on Bloomberg, CNN, C-SPAN, Fox Business, Fox News, and Reuters television.

Prior to joining the NAM, Dr. Moutray was the chief economist and director of economic research for the Office of Advocacy at the U.S. Small Business Administration (SBA) from 2002 to 2010. In that role, he was responsible for researching the importance of entrepreneurship to the U.S. economy and highlighting various issues of importance to small business owners, policymakers and academics. In addition to discussing economic and policy trends, his personal research focused on the importance of educational attainment to both self-employment and economic growth.

Prior to working at the SBA, Dr. Moutray was the dean of the School of Business Administration at Robert Morris College in Chicago, Ill. (now Robert Morris University of Illinois). Under his leadership, the business school had rapid growth, both adding new programs and new campuses. He began the development of an MBA program that began accepting students after his departure and created a Business Institute for students to work with local businesses on classroom projects and internships.

Dr. Moutray is a former board member of the National Association for Business Economics (NABE). He is also the former president and chairman of the National Economists Club, the local NABE chapter for Washington, D.C. He holds a Ph.D. in economics from Southern Illinois University at Carbondale and bachelor’s and master’s degrees in economics from Eastern Illinois University. In 2007, he was named a distinguished alumnus by Lake Land College in Mattoon, Ill., where he earned his associate’s degree in business administration, and in 2014, he received an Outstanding Graduate Alumni Award from Eastern Illinois University.