NAM/IW Q3 Survey: Manufacturer Outlook Still Positive, But Optimism Wanes

Overall manufacturing activity has weakened significantly as the year has progressed, mirroring challenges in the larger macroeconomic environment. Some of the headwinds were temporary, including the supply chain disruptions stemming from the Japanese disaster and dramatically higher energy costs resulting from Middle East unrest and rising global demand. While many of these transitory factors have abated, the economy remains stuck in neutral. Recent economic events have not helped matters, with businesses and individuals expressing rising anxieties in light of financial concerns in Europe, a highly-charged debate over raising the debt ceiling, continued high unemployment and wild gyrations in global equity markets. In light of these developments, economists and business leaders have downgraded their expectations for growth for the remainder of this year and next.

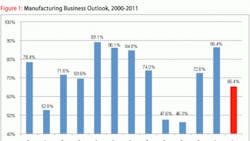

The NAM/IndustryWeek Survey of Manufacturers reflects this much-weaker sentiment. When asked about the current business outlook, manufacturers were generally positive, but they were significantly less optimistic than just three months ago. Whereas 86.4% of respondents were either very or somewhat positive in their business outlook in the June survey, only 65.4% said the same in the third quarter -- a drop of over 20 percentage points. Many responders shifted from "somewhat positive" to "somewhat negative." Nonetheless, it is important to note that nearly two-thirds of manufacturers had a positive outlook on the economy.

Even with an upbeat assessment for manufacturing activity, individuals responding to this survey clearly downgraded their expectations for growth moving forward. For example, in the June survey, nearly 80% manufacturers predicted higher sales over the course of the next year, with the average expected increase being 5.5%. Today, almost 58% forecasted higher sales, with an average expected increase of 3.2%. That is a sizable drop in sales levels in such a short period of time. Given that a company's sales help drive so many other decisions, it is not surprising that other indicators are much lower, as well.

Manufacturers plan to increase their overall hiring and capital spending over the next year by 1.4% and 1.5%, respectively. Those figures had been 2.4% and 3.4% in the previous survey, reflecting lower expectations. Manufacturing wages are anticipated to increase 1.1% over the next 12 months, with over half predicting raises of up to 3% and almost 20% suggesting increases exceeding that. Inventories are expected to remain unchanged overall, and prices are projected to rise 2.2% (down from 3.4%).

The economy dominated the top concerns of manufacturers, along with the regulatory climate and the rising cost of energy and raw materials. Almost half of the survey respondents chose the economy as their top concern, and this was echoed in subsequent questions on the primary drivers of growth and primary challenges for their business. Nearly 65% of manufacturers surveyed said that a weaker domestic economy was hurting their sales. Interestingly, about three-quarters of these firms also said that the domestic market was an essential part of their future business strategies for growth. This signifies the importance of the U.S. market to manufacturers, and why so many of them are struggling with weak domestic performance right now.

Regulations rose from third place in the list of concerns to second place. Almost 61% said that an unfavorable business climate was one of the biggest challenges right now, and nearly 80% felt that government involvement was impeding their ability to grow their operations. Many respondents added comments to their surveys on these topics, and the vast majority of them were government-related. Several individuals expressed frustration with the regulatory actions of the Environmental Protection Agency (EPA), the National Labor Relations Board (NLRB), their state governments and others. Not surprisingly, many of them expressed frustration with the overall political process, particularly citing the inability to seriously address the nation's fiscal challenges. Others were more specific, referring to the stalemate over passage of a new transportation bill and the three pending free trade agreements with Colombia, South Korea and Panama.The third top concern was the rising costs of production for many manufacturers. Rising raw material and energy costs have squeezed profits, with many businesses unable to pass these higher costs on to the consumer. As noted earlier, manufacturers expect pricing increases in the next year to be lower than the previous survey, yet, these prices remain elevated and continue to grow, albeit at slower rates than before. Over half of the manufacturers surveyed said that these higher costs were a serious challenge to their business.

Other concerns cited by the respondents included: the competitiveness of U.S. tax rates, increased international competition, currency manipulation, rising health care costs (and lower government reimbursement rates for medical providers), the ability to attract a skilled workforce and the need for tort reform. Access to capital -- which is a major challenge for other segments of the business community, namely small businesses -- was cited by only 6.1% of manufacturers as a major challenge.

International trade represents a tremendous opportunity for manufacturers, and recent statistics show that manufactured goods exports are up nearly 13% over the past year. Overseas markets are key to many of these businesses' future growth strategies. In fact, 39.5% of respondents said that increased international sales would drive their future success, and 46% of them expected their level of exports to rise over the next 12 months. With that said, it is important to remember that the U.S. still represents a huge market in itself, with a population of over 312 million. Three-quarters of manufacturers listed the U.S. market as their top driver for future growth, even as they listed its current sluggishness as a top concern.

Size was an important determinant for how each of these firms responded to the survey. Larger firms with 500 or more employees were more likely to be pessimistic than either their smaller (less than 50 employees) or medium-sized (50 to 499 employees) counterparts, with approximately 45% of individuals from larger manufacturers expressing some degree of negativity in their current business outlook. Small and medium-sized businesses had a figure closer to 30%.

In terms of sales expectations, however, medium-sized manufacturers were the most optimistic of the group, forecasting a 4.1% rise in sales over the next 12 months. Small businesses were the least optimistic in terms of sales at 1.7 % growth, with large firms expecting 2.7%. Similar responses were found for employment and investment.

The NAM/IndustryWeek Survey of Manufacturers has been conducted quarterly since 1997, with the exception of the last quarter of 2010 and the first quarter of 2011. This survey was conducted among NAM membership between August 18 and August 31, 2011, with 312 manufacturers responding. Responses were from all parts of the country, in a wide variety of manufacturing sectors and in varying size classifications. Aggregated survey responses appear on the following pages. The next survey is expected to be released in December.

Survey Responses

-

How would you characterize the business outlook for your firm right now?

- Very positive -- 17.3%

- Somewhat positive -- 48.1%

- Somewhat negative -- 30.4%

- Very negative -- 4.2%

-

Over the next year, what do you expect to happen with your company's sales?

- Increase more than 10 percent -- 18.6%

- Increase 5 to 10 percent -- 23.1%

- Increase up to 5 percent -- 16.0%

- Stay about the same -- 27.9%

- Decrease up to 5 percent -- 6.7%

- Decrease 5 to 10 percent -- 5.4%

-

Decrease more than 10 percent -- 2.2%

Average expected increase in sales consistent with these responses = 3.2%

-

Over the next year, what do you expect to happen with prices on your company's overall product line?

- Increase more than 10 percent -- 2.9%

- Increase 5 to 10 percent -- 15.5%

- Increase up to 5 percent -- 42.7%

- Stay about the same -- 32.7%

- Decrease up to 5 percent -- 3.2%

- Decrease 5 to 10 percent -- 1.9%

-

Decrease more than 10 percent -- 1.0%

Average expected increase in prices consistent with these responses = 2.2%

-

Over the next year, what are your company's capital investment plans?

- Increase more than 10 percent -- 17.5%

- Increase 5 to 10 percent -- 10.4%

- Increase up to 5 percent -- 13.6%

- Stay about the same -- 40.5%

- Decrease up to 5 percent -- 4.2%

- Decrease 5 to 10 percent -- 5.2%

-

Decrease more than 10 percent -- 8.7%

Average expected increase in investment consistent with these responses = 1.5%

-

Over the next year, what are your plans for inventories?

- Increase more than 10 percent -- 3.9%

- Increase 5 to 10 percent -- 7.7%

- Increase up to 5 percent -- 14.5%

- Stay about the same -- 47.1%

- Decrease up to 5 percent -- 15.2%

- Decrease 5 to 10 percent -- 7.1%

-

Decrease more than 10 percent -- 4.5%

Average expected increase in inventories consistent with these responses = no change

-

Over the next year, what do you expect in terms of full-time employment in your company?

- Increase more than 10 percent -- 5.9%

- Increase 5 to 10 percent -- 9.8%

- Increase up to 5 percent -- 27.4%

- Stay about the same -- 44.3%

- Decrease up to 5 percent -- 8.1%

- Decrease 5 to 10 percent -- 2.6%

-

Decrease more than 10 percent -- 2.0%

Average expected increase in full-time employment consistent with these responses = 1.4%

-

Over the next year, what do you expect to happen to employee wages (excluding non-wage compensation such as benefits) in your company?

- Increase more than 5 percent -- 0.3%

- Increase 3 to 5 percent -- 19.4%

- Increase up to 3 percent -- 51.9%

- Stay about the same -- 26.8%

- Decrease up to 3 percent -- 0.6%

- Decrease 3 to 5 percent -- 0%

-

Decrease more than 5 percent -- 1.0%

Average expected increase in wages consistent with these responses = 1.1%

-

Over the next year, what do you expect to happen with the level of exports from your company?

- Increase more than 5 percent -- 18.8%

- Increase 3 to 5 percent -- 14.9%

- Increase up to 3 percent -- 12.3%

- Stay about the same -- 48.7%

- Decrease up to 3 percent -- 1.6%

- Decrease 3 to 5 percent -- 1.0%

-

Decrease more than 5 percent -- 2.6%

Average expected increase in exports consistent with these responses = 0.4%

-

Looking at the current business environment, which of the following is your top concern?

(Respondents rated each of these concerns with "1" being the top concern and "8" being their least concern. The number reflects the average score, with lower scores indicating greater concerns.)- Taxes -- 4.03

- Regulation -- 3.22

- Economy -- 1.96

- Cost of Raw Materials -- 3.50

- Attracting and Retaining Quality Workforce -- 4.83

- Insurance Costs -- 5.06

- Energy Costs -- 5.11

- Other -- 5.63

-

Where is your business primarily located?

- Northeast -- 18.5%

- South -- 16.8%

- Midwest -- 53.5%

- West -- 11.2%

-

What is your company's primary industrial classification?

- Food manufacturing -- 3.2%

- Beverages and tobacco products -- no responses

- Textile mills or textile products -- 1.9%

- Apparel and allied products -- 0.3%

- Leather and allied products -- 0.3%

- Wood products -- 3.8%

- Paper and paper products -- 2.6%

- Printing and related activities -- 1.3%

- Petroleum and coal products -- 1.0%

- Chemicals -- 5.1%

- Plastics and rubber products -- 9.6%

- Nonmetallic mineral products -- 0.6%

- Primary metals, or fabricated metal products -- 30.8%

- Machinery -- 12.8%

- Computer and electronic products -- 2.6%

- Electrical equipment and appliances -- 3.2%

- Transportation equipment -- 3.8%

- Furniture and related products -- 1.9%

- Miscellaneous manufacturing -- 15.1%

-

What is the size of your firm (e.g., the parent company, not your establishment)?

- Less than 50 employees -- 20.6%

- 50 to 499 employees -- 56.6%

- 500 or more employees -- 22.8%

-

What are the primary drivers of your company's growth and future strategies?

(Respondents were able to check all that apply to their business. Responses exceed 100 percent.)- Stronger domestic economy, sales of our products -- 74.9%

- Increased international sales -- 39.5%

- Increased efficiencies in the production process -- 42.4%

- New product development -- 49.8%

- Recent mergers or acquisitions -- 6.4%

- Other -- 3.2%

-

What are the biggest challenges you are facing right now?

(Respondents were able to check all that apply to their business. Responses exceed 100 percent.)- Weaker domestic economy, sales of our products -- 64.9%

- Increased international competition -- 20.9%

- Challenges with access to capital or other forms of financing -- 6.1%

- Unfavorable business climate (e.g., taxes, regulation, etc.) -- 60.8%

- Rising energy and raw material costs for our products -- 51.4%

- Other -- 8.4%

-

Do you feel that government involvement is impeding your ability to grow your operations right now?

- Yes -- 79.4%

- No -- 10.0%

- Uncertain -- 10.6%

About the Author

Chad Moutray

Chief Economist, National Association of Manufacturers

Chad Moutray is chief economist for the National Association of Manufacturers, where he serves as the NAM’s economic forecaster and spokesperson on economic issues. He frequently comments on current economic conditions for manufacturers through professional presentations and media interviews and has appeared on various news outlets. In addition, he is the director of the Center for Manufacturing Research at The Manufacturing Institute, the workforce development and education partner of the NAM, where he leads efforts to produce thought leadership, data and analysis of relevance to business leaders in the sector.

Prior to joining the NAM, Mr. Moutray was the chief economist and director of economic research for the Office of Advocacy at the U.S. Small Business Administration from 2002 to 2010. In that role, he was responsible for researching the importance of entrepreneurship to the U.S. economy and highlighting various issues of importance to small business owners, policymakers and academics. In addition to discussing economic and policy trends, his personal research focused on the importance of educational attainment to both self-employment and economic growth.

Prior to working at the SBA, Mr. Moutray was the dean of the School of Business Administration at Robert Morris College in Chicago (now part of Roosevelt University). Under his leadership, the business school had rapid growth, both adding new programs and new campuses. He began the development of an M.B.A. program that began accepting students after his departure and created a business institute for students to work with local businesses on classroom projects and internships.

Mr. Moutray is the vice chair of the Conference of Business Economists, and he is a former board member of the National Association for Business Economics, where he is the co-chair of the Manufacturing Roundtable. He is also the former president and chairman of the National Economists Club, the local NABE chapter for Washington, D.C.

He holds a Ph.D. in economics from Southern Illinois University at Carbondale and bachelor’s and master’s degrees in economics from Eastern Illinois University. He is a Certified Business Economist™, where he was part of the initial graduating class in 2015.

In 2014, he received the Outstanding Graduate Alumni Award from EIU, and in 2015, he accepted the Alumnus Achievement Award from Lake Land College in Mattoon, Illinois, where he earned his associate degree in business administration. He serves on the external economics advisory board for the SIUC’s School of Analytics, Finance and Economics.