Industrial Marketing Is Not Consumer Marketing

My first job out of college was with the Hyster Lift Truck Company. I started out in the plant working in production control to learn the manufacturing business. I was promoted to a job in the new product development department, where I was able to see how the marketing and sales strategies worked.

It was a big shock to find out that the marketing and sales I learned in college was totally different from the marketing of lift trucks.

I always liked machinery, and over the years I was involved in manufacturing and marketing lift truck attachments, marine cranes, palletizer systems, material handling robots, conveyors, and other industrial products. It didn’t take me long to figure out that marketing these industrial products required a very different kind of marketing—industrial marketing.

Since local colleges did not teach industrial marketing, I had to learn it on my own by trial and error. Then I had to train every new person that was hired in sales or marketing, both in the technical side of the products and marketing of the product.

Understanding the difference between industrial and consumer marketing is very important for manufacturing companies, particularly those companies that manufacturer custom or highly engineered products. But there are very few places to go to learn the techniques.

Several years ago I tried to find out how many colleges taught industrial marketing. I found that out of 2,500 business schools, fewer than 30 schools taught industrial marketing or industrial sales classes.

Let me explain some of the differences between consumer marketing and industrial marketing, along with why this is a problem that needs a solution:

- Product complexity. First and foremost, most industrial products are usually more complicated than consumer products and, as a result, require significant technical knowledge to sell. Industrial and technical products range from off-the-shelf bearings to custom-engineered machines of incredible complexity. The more custom the product, the more custom the marketing strategy.

- Industrial buyers. Consumer marketing presupposes powerful sellers and passive, inexpert buyers who can be influenced to purchase by a variety of advertising techniques. In contrast, industrial markets consist of very knowledgeable buyers (and often buyer teams) who analyze products and purchases in terms of user benefits often measured in dollars or as return on investment. In the case of capital equipment, the sales people do not get to talk to the final decision makers—the board of directors.

- Bids and quotations. Consumers either buy or don’t buy from listed prices. On the other hand, industrial products are often sold by request for quotes (RFQs) that may require a quotation with elaborate specifications to define the product. Specifications can be hundreds of pages long and can specify a machine right down to the type of fasteners and wire colors.

- Advertising and promotion. It is relatively straightforward to develop a newspaper ad for impulsive shoe buyers, but it is very difficult to even identify the buying influences of dragline machines or material-handling robots. Inquiries produced by industrial advertising are only the beginning of a long, expensive selling process, sometimes lasting years before the sale occurs.

- Market information. There is a lot of database information available on consumer products and an enormous amount of consumer demographic information that can identify the customer profile and market segment. However, information on industrial market niches is very difficult to acquire, is generally qualitative, and requires considerable industrial experience to gather. For example, if you are a manufacturer of a machine that stacks 50-lb. sacks of cheese whey, you will have to identify the market niche to succeed. The food industry has 23,000 plants in the U.S., but the buyers who would be interested in your machine are a niche of a niche, of a niche, of a niche like this:

Food industry - 23,000 plants

Cheese natural and processed – 712 plants

Processed cheese – 332 plants

Dry condensed cheese – 191 plants

Dry condensed cheese and whey - 85 plants

When you analyze the niche further to define the line speeds, size of bags, number of shifts, number of employees, you will find that there are 20 to 30 prospective buyers that could buy your equipment. How you find and sell to these buyers is completely different then finding and selling cell phones to young adults using television advertising.

Finding and defining the buyers in industrial market niches is perhaps the most difficult part of industrial marketing. For example, palletizing machines are sold in 20 different industries and hundreds of market niches. The buyers could be the owners of a small food processing plant or multiple buyers in a multinational corporation.

- Industrial Market Research. Consumer market research methods generally do not work for industrial products, because the industrial samples are small and the buyers are not a homogeneous group that can be considered a valid sample. Because of these two problems, statistical techniques for projecting the sample cannot be used as representative of a larger market. Answers to questions on market share and market size must be found using qualitative techniques that requires field research and personal interviewing. Suffice it to say, this can only be done by an interviewer who has a strong background in technical and industrial products and knows how to do an unstructured interview.

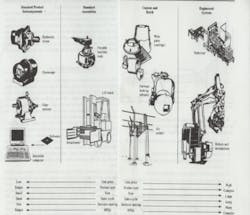

- Product range. Perhaps the most important factor that separates consumer from industrial marketing is what I call the product range. The chart below shows that industrial products range from simple components that are standard and off-the-shelf to engineered systems with custom engineered machines.

As you move from left to right in the product range, marketing strategies change drastically with the type of product, length of the sales cycle, product size, and the number of decision makers.

For example, the selling, promotion, and pricing strategies that are used to sell low price products, say standard hydraulic motors, to known accounts, are fairly straightforward, and consumer marketing techniques might work.

As the industrial products become more complex with higher prices and longer sales cycles, the selling, sales channel, advertising, pricing, and product development strategies become more complex and more specific to the situation. Capital equipment used on production lines is usually very large, designed to the customer’s specs, very complex, has high unit prices must be justified in terms of ROI and approved by the board of directors.

For example, selling a complete production line to a multinational company begins when a sales engineering department answers a request for quote that includes hundreds of pages of specifications. The technical sales is usually handled by the factory's major account sales department and may require selling many decision makers on the buying team, such as plant manager, plant engineer, purchasing manager, and division manager in different geographic locations. If the company gets the sales contract, they must have a service department that can install the products, write customized operation manuals, and take care of the production line with 24/7 service.

The point is that the organization and strategies used for marketing and sales of a standard off-the-shelf product will not work for the marketing and sales of a large, complex industrial system.

The Knowledge Gap

“Most students who graduate from university marketing courses are not ready to go to work in industrial companies,” says Jack McNally, dealer sales manager of a midsize casting company. “The methods for marketing industrial products are substantially different from consumer marketing. Our industry has to invest considerable time in on-the-job training to teach these people industrial sales and marketing. It would be helpful if college professors went out into the manufacturing sectors to see for themselves how industrial products are bought and sold.”

Mr. McNally’s experience is much like my own experience training salespeople to sell industrial equipment. For years we had to take technical people who were very familiar with the equipment (like engineers and technicians) and try to make them salespeople. This only worked part of the time, and the on-the-job training was very extensive because these people had never had any education or training in industrial sales or marketing.

I finally took the time in 1993 to write a basic primer, The Manufacturers Guide to Business Marketing, on industrial marketing that could be used as a training program for engineers and sales people. This helped people learn the basic strategies as they were also learning the field sales techniques and helped them understand the basics of the company’s marketing plan.

American small and midsize manufacturers are floating on an ocean of uncertainty caused by the invasion of Chinese products and the continuous outsourcing of product lines by multinational companies. Most of them need to diversify and find new customers and markets to grow. To accomplish this, they must first understand and define the market niches in terms of specific users and then to choose the strategies that will achieve their sales and profit forecast.

The product development, pricing sales, sales channel, and promotion strategies to find new customers and markets are very different from consumer marketing.

Mike Collins is the author of The Manufacturers Guide To Business Marketing. His website is mpcmgt.com.