The IW US 500: An American-Made Revenue Rebound

Even as economic woes continue to afflict European business, manufacturing in the U.S. is marching ahead.

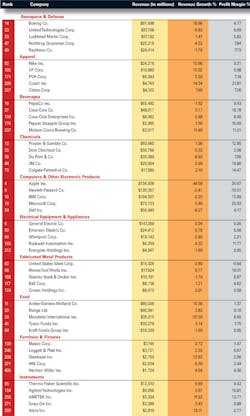

IW U.S. 500 manufacturers saw revenues inch upward 1% to $6.07 trillion in 2012, led by the unsurpassed success of companies like Colfax Corp. (IW 500/238), a manufacturer of gas- and fluid-handling products that saw a 464% growth in revenue from the previous year.

The companies comprising this year's IW U.S. 500 -- IndustryWeek's annual list of the largest publicly held U.S. manufacturers based on revenue -- boasted the highest total revenues recorded on the IW 500 to date.

See Also: The IndustryWeek U.S. 500 Rankings

However, while overall revenues crept upward, total profits slipped downward 9.16% to $506 billion. Ten percent of the IW 500 companies didn't turn a profit in 2012, with Boston Scientific Corp. (IW 500/147) suffering a 56.12%, or $4 billion, net loss.

Pictured above: Texas and California knock it out of the park: Each state houses more than 50 of the IW U.S. 500 manufacturing companies.

Such a disparity reveals the toll the eurozone crisis continues to take on U.S. manufacturers, even as domestic profits are rebounding. In 2012, domestic manufacturing profits spiked 52%, according to GDP accounts.

Manufacturing on the Rise Domestically

Manufacturing growth domestically, albeit limited, is being driven by a rebound in the housing industry and higher demand for transportation equipment. A number of key industries were able to make gains, according to Dan Meckstroth, chief economist for the Manufacturers Alliance for Productivity and Innovation. Even medical supply manufacturers saw orders increase as hospitals prepare for looming Obamacare mandates.

In particular, the machinery, wood products and transportation-related industries logged some of the greatest gains in 2012 and continue to show the most promise. That's, in large part, because of pent-up demand.

See Also: Up-to-Date Financial Reports on the IW U.S. 500

Purchases of big ticket items, like heavy and light motor vehicles, were postponed during the recession and now are in the ordering cards.

"Consumers basically repaired their automobiles as long as they could," Meckstroth says. "Now, they're at the point that they just need to replace them; they're too expensive to repair."

The average revenue growth for the eight companies in the motor vehicles sector was 5.61%, led by Wabash National Corp. (IW 500/440), a manufacturer of commercial trucking equipment that increased its revenue 23.13% and upped its profits a roaring 602.24% in 2012.

Aerospace Market Soaring

Plus, the aerospace market is exploding. Boeing (IW 500/14) has five years of orders in backlog and predicts the global market will demand in the next 19 years 35,280 new airplanes worth $4.84 trillion.

Average IW 500 revenue growth in the aerospace and defense sector was 9.97% in 2012, with five of the 11 companies represented on the IW 500 posting double-digit revenue gains. Transdigm Group Inc. (IW 500/409), a producer of highly-engineered aircraft components, recorded a 40.98% increase in revenue, up to $1.7 billion, and BE Aerospace Inc. (IW 500/272), a manufacturer of aircraft cabin interior products, upped its revenue figures 23.42% to $3.1 billion.

Among the six companies in the railcars, ships and other transportation equipment sector, including names like General Dynamics Corp. (IW 500/43) and Huntington Ingalls Industries Inc. (IW 500/157), average revenue growth was 18.36%.

But the biggest winners on the IW 500 list were those in the petroleum and coal products sector, which nabbed the top three spots on this year's list. In fact, the 59 companies in the sector represented 12% of the total number of companies on the annual list, but generated 27% of the list's total revenue.

A View From the Top

Exxon Mobil Corp. (IW 500/1) secured the No. 1 spot, a position it has held for the past decade. The energy giant took in $467 billion in revenue, outperforming its closest competitor, Chevron Corp. (IW 500/2), by 99%. Yet, despite its strong lead on the annual list, Exxon's revenue fell 0.82% from the previous year. Its profits, however, still managed to increase 9.3% to $45 billion.

On the other end of the spectrum, the publishing and printing industry continued its downward spiral, as the sector posted an average 3.1% loss in revenue in 2012.

Of the 12 companies included in the sector, McGraw-Hill Cos. Inc. (IW 500/215) suffered the greatest loss, as its revenue fell 28.75%. The publishing company also dropped 51 spots on the IW 500 list.

Overall, manufacturing in the U.S. is gaining momentum, if only slowly. The cycle will continue to be muted, Meckstroth says, as risk-averse consumers continue to operate within their means, a far cry from the debt-based spending that characterized the U.S. two decades ago.

"We're not going back to this new economy people were talking about in the late '90s. It's just not in the cards," Meckstroth says.

| Find the IndustryWeek U.S. 500 stock index at www.industryweek.com; the 2013 IW U.S. 500 ranking at www.iw.com/IW-US-500; and extensive, continually updated financial reports at www.iw.com/IW-US-500-Financial. |

Instead, the U.S. is going to have to accept incremental GDP growth, he predicted. But when compared to the financial situation in Europe, the U.S. economic picture is one of the strongest in the world, Meckstroth says.

Creating the IW U.S. 500

IndustryWeek partnered with Mergent Inc. to create the 2013 IW U.S. 500 ranking of the largest publicly held manufacturing companies headquartered in the United States.

Mergent acquired the Financial Services Division of Moody's Investors Service in 1998. The organization has been collecting and delivering financial information for more than 100 years.

See Also: An interactive map highlighting the location of each IW U.S. 500 company

IndustryWeek's relationship with Mergent/Moody's dates back to 1996. Led by Mergent's Director of Equity Research Ricardo Angel, the firm's global databases were used to identify all publicly held manufacturing companies meeting IW's selection criteria.

The revenue cutoff for inclusion on this year's IW U.S. 500 list was $1,121.8 million.

In addition to the team at Mergent, Erik Fine, a Charlotte, N.C.-based information consultant involved in the IW 500 since its inception, oversaw the analysis and data-collection effort. Mergent collected the financial data elements directly from reports distributed by the corporations

About the Author

Ginger Christ

Ginger Christ, Associate Editor

Ginger Christ is a former associate editor for EHS Today, a Penton publication.

She has covered business news for the past seven years, working at daily and weekly newspapers and magazines in Ohio, including the Dayton Business Journal and Crain's Cleveland Business.

Most recently, she covered transportation and leadership for IndustryWeek, a sister publication to EHS Today.

She holds a bachelor of arts in English and in Film Studies from the University of Pittsburgh.