Innovation Centers Filling Manufacturers' Need for Speed

It’s hard to look ahead when you’re constantly looking over your shoulder, but that’s the predicament many manufacturers face these days. Disruptive change is occurring constantly and even the biggest businesses (Nokia, Blackberry, Kodak) can find themselves quickly overtaken by upstarts with new technologies or business models.

Accelerating change puts a premium on innovation but many companies are finding that “traditional innovation approaches are broken,” says Jerome Buvat, global head of research, Capgemini Consulting. Companies are spending more and getting less on their investment. In consumer goods, for example, research from Nielsen shows that more than 85% of new products fail.

Innovation centers are providing one important method for organizations to develop new business models and products, Buvat and his co-authors find in a new report, “The Innovation Game: Why and How Businesses are Investing in Innovation Centers.”

Despite their best intentions, large, traditional corporations may not offer fertile ground for innovation. “They can be constrained by legacy organizational models, risk-averse cultures and a rigid approach,” note the authors. In fact, they cite a Forbes article reporting a recent study that only 5% of research & development staff feel highly motivated to innovate.

Rather than traditional R&D centers that were focused inwards, the report finds, innovation centers are open and collaborative, designed to “leverage the ecosystem of startups, venture capitalists, accelerators, vendors and academic institutions” found in global tech hubs such as Silicon Valley, Tel Aviv and London.

Innovation centers also are being located close to key markets in order to help companies understand fast-changing consumer behaviors. For example, Spanish banking group BBVA opened an innovation center in Bogota, Columbia, Buvat noted, so that it could better understand customer behaviors in South America. BBVA says it is using innovation centers to attract talent and foster “a culture of collaboration with entrepreneurs, startups and developers.”

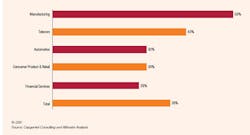

Manufacturers, criticized in some quarters for being slow to change, are jumping on the innovation center model. While only 38% of the 200 largest global companies have created innovation centers, 58% of the manufacturers in that group have done so, with the average manufacturer establishing six to seven centers. Top manufacturers are most likely to have set up their innovation centers in five locations – Silicon Valley, Shanghai, Seoul, Munich and London.

The study found manufacturers are focusing their innovation efforts on three major areas mobility, big data/analytics and the Internet of Things.

Buvat said the researchers were surprised by the interest of manufacturers in establishing the centers but believes that with globalized production leveling production costs, manufacturers see innovation as a key way to differentiate themselves. “This is compelling manufacturing companies to harness more value from innovation,” he said.

The study found that innovation centers generally fall into one of four models:

In-house innovation labs – These centers “perform all innovation activities from inception to prototyping using an in-house approach,” the report stated. Walmart Labs reflects this structure, working with the company’s global e-commerce team so that e-commerce innovations can be quickly inserted into Walmart’s websites.

University residence - Companies following this model set up a center at a university campus, such as Volkswagen has done at Stanford University. Volkswagen has provided $5.75 million in funding to build the Volkswagen Automotive Innovation Lab and fund five years of automotive research. Caterpillar has research partnerships with nine universities, including the University of Illinois and Shanghai Jiao Tong University.

Community anchor - Companies such as Nestle use this model where centers “actively identify mentors and provide opportunities to startups to work actively with the company to test the startup’s products.”

Innovation outpost – These outposts feature small teams, typically in Silicon Valley, where they can ensure their company is “involved in the tech community, without committing significant investment.” Over time, companies may expand these operations. A case in point: Renault-Nissan, which started with a small research office in Silicon Valley in 2011 and two years later expanded the office to focus on autonomous driving and connected vehicles.

Innovation centers can speed up development efforts. Walmart Labs, for example, created a new search engine for its e-commerce site in just nine months that helped to increase the conversion of buyers to sellers by 20%. The centers also offer a range of other benefits, the study found, from attracting talent to driving employee engagement.

Still, innovation centers don’t operate without risk. Buvat said companies must strive to find the “right balance” between being connected to outside experts and institutions and wasting time with startups that won’t prove useful to the company.

As one vice president at a major retailer told the researchers, “You need to be honest with yourself and with what is working, regardless of the amount of time, money or personal capital you have spent. Some of our projects that were initially promising were just not flying and we had to kill them.”

Setting the appropriate metrics for innovation centers is critical, the report finds. Those metrics can include the number of new products developed or the reduction in costs. And measures should go beyond just quantities, the researchers point out: “[M]easuring the quality of inputs and the efficacy of processes is of equal importance.”

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.