Industrial CEOs Perform Balancing Acts ‘Pending Additional Clarity’ [Tales From The Transcript]

Few people can claim to have a more nuanced view of the U.S. manufacturing economy than Neil Schrimsher.

The president and CEO of Cleveland-based Applied Industrial Technologies Inc. leads a team that distributes $4.5 billion worth of bearings, power transmission products, factory automation gear and much more annually to customers in just about every other nook and cranny of the industrial world.

Speaking to analysts Aug. 15, he noted the finely balanced nature of demand across AIT’s top 30 and markets: Fourteen grew sales year over year in the three months ended June 30, down from 15 early this year. Many customers, he said, are “taking a more methodical approach to capital project spending.”

“We’re taking a prudent approach to our initial guidance [for AIT’s fiscal 2025], pending additional clarity on the direction of broader macro and industrial activity,” Schrimsher said. “Ultimately, we believe near-term slowness will be short in duration and we’re positioning the business accordingly.”

The past year’s other Tales From The Transcript

Q1 – Manufacturing Executives Confident But Careful Heading Into Summer

Q4 – Industrial Leaders Expect Growth Eventually But Are Still Playing Waiting Game

Q3 – Leaders See 'Stickier' Inflation, Look to Offset Wage Growth

That posture—careful now but prepared to turn up the wick soon—is one we found repeatedly during our latest analysis of quarterly earnings calls from leading names in 10 sectors of the IndustryWeek U.S. 500 list of the largest public manufacturing companies. Very often, the message from leadership teams was simple: “This is a tricky environment but we have a solid handle on what we need to do.”

Also notable in our quarterly scan for forward-looking sentiments about demand, the supply chain, inflation and the labor market was that those last two categories—painful thorns in all our sides 18 months ago—have essentially become non-issues. The collective outlook for supply chains, meanwhile, is the most positive in the two years we’ve been putting together these reports.

Here are our scores and synopses of comments made during earnings calls that took place from late May to mid-August. As in our past editions—you can check out the previous four in the sidebar—the categories are listed from least optimistic to most.

Demand: -0.04 (0.13 in Q1 and 0.09 in Q4)

After three quarters of hovering right around 50%, the share of positive comments about the demand picture from our 50 companies’ leaders slipped to 43%, hence the negative score here. It’s the first time since we launched Tales From the Transcript that the sales outlook has posted a negative number.

As has been the case in the past few quarters—and as evidenced by Schrimsher’s comments—the story differs greatly between subsectors. Manufacturers of construction supplies are downcast and hoping that lower interest rates kicks their order books back to life—Summit Materials Inc. CEO Anne Noonan said her team is dealing with “a notable lack of urgency to activate commercial jobs in some of our key markets”—while aerospace and defense firms continue to fly high and most chemicals companies are feeling better about what’s ahead for the rest of 2024.

Plenty of other leaders took a tone similar to AIT’s Schrimsher and talked about a bright outlook for some end markets while others look to be in for a few more mediocre-at-best quarters. That is making for a strategic and managerial balancing act at several companies.

Alamo Group Inc. is a case point: President and CEO Jeff Leonard and his team have started consolidating their production of forestry and tree care equipment into one plant and are planning similar moves for some agricultural equipment. High dealer inventories and interest rates means the intermediate outlook for that group isn’t great, Leonard said.

But Leonard also got to tell investors that Alamo’s sales to government and industrial customers rose 14% in Q2 from a year earlier to a record high. That division also finished June with “a very healthy order backlog.”

Labor: -0.03 (0.03 in Q1 and 0.00 in Q4)

A slight deterioration in our metric for how executives spoke of the labor market shouldn’t be the main takeaway this quarter. What struck us most is that workforce stresses have all but disappeared for the 50 companies in this cohort: Summit Materials CFO Scott Anderson stood out as saying that labor is still tight and “probably our most sticky bucket” but also following that up by saying he expects Summit’s situation to improve by 2024’s end.

Across the board, executives’ comments about their labor needs and desires were focused far more on operational efficiency in a broad sense (with the occasional gripe about higher wages thrown in) as well as plans—either already underway or on the drawing board—to trim workers to respond to the above-mentioned ebbs and flows of demand. Management teams still hunting for talent, including the one at UFP Industries Inc., spoke of far better availability than in the not-too-distant past.

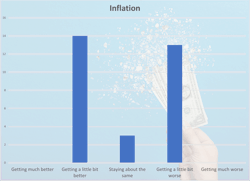

Inflation: 0.02 (0.01 in Q1 and 0.06 in Q4)

Sealed Air Corp. President and CFO Dustin Semach spoke for several of his peers at other companies when he told analysts that the volatility in various input costs from recent years is “really easing out now in 2024.” Other executives spoke thankfully of drops in metals and fuel prices.

But our near-even indicator speaks to the fact that it’s not all sunshine and roses. Jamie Beggs, CFO of polymer manufacturer Avient Corp., said input cost savings from the first half won’t be repeated: “We are seeing modest levels of inflation across the majority of our raw material baskets, including hydrocarbon-based materials such as polyethylene and polypropylene as well as pigments and certain performance additives.” And Owens Corning Inc. Chairman and CEO Brian Chambers said European economies have much more work to do when it comes to reining in inflation.

Another noteworthy observation that caught our ear on this front: Martin Marietta Materials Inc. CFO Jim Nickolas said cost pressures have eased and are settling in around “5% to 6% on baseline cost inflation.”

If that’s a new normal, it’s not one many leadership teams will welcome. And it speaks to their ongoing efforts to get more from their labor forces.

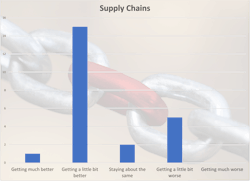

Supply chains: 0.26 (0.07 in Q1 and 0.11 in Q4)

Players in the automotive sector spoke of a good flow for parts and aren’t, in the words of Lear Corp. President and CEO Ray Scott, “seeing signs of distress or change” in their supply chains. And even leaders in the booming aerospace sector said that parts shortage and delivery issues have lessened since early this year. But executives at both Lockheed Martin Corp. and Textron Inc. noted a few persistent sources of heartburn in their supplier base.

Still, to finish on a very positive note reflective of the Q2 supply-chain consensus: Ball Corp. CEO Dan Fisher told analysts early last month that his team’s focus on efficiency has produced logistics gains that look likely to pay off for a while.

“Freight cost is better, our warehousing footprint smaller,” Fisher said. “So there’s a lot of supply chain efficiencies that we’re benefiting from. You’ll see more of it as volumes grow.”

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has been in business journalism since the mid-1990s and writes about public companies, markets and economic trends for Endeavor Business Media publications, focusing on IndustryWeek, FleetOwner, Oil & Gas Journal, T&D World and Healthcare Innovation. He also curates the twice-monthly Market Moves Strategy newsletter that showcases Endeavor stories on strategy, leadership and investment and contributes to other Market Moves newsletters.

With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati in 1997, initially covering retail and the courts before shifting to banking, insurance and investing. He later was managing editor and editor of the Nashville Business Journal before being named editor of the Nashville Post in early 2008. He led a team that helped grow the Post's online traffic more than fivefold before joining Endeavor in September 2021.