3 Economic Factors Reshaping Manufacturing in 2026

Key Highlights

- Persistent inflation above 2% is significantly impacting margins over time.

- Tariff impacts are evolving and AI's potential is vast but underutilized; the article discusses strategies around this.

- Rapid market shifts demand faster pricing adjustments and targeted strategies, rather than traditional quarterly or annual reviews.

As we start 2026, U.S. manufacturers are operating in an environment where inflation remains stubbornly above target, uncertain trade policy makes planning a chore and the promise of AI is both tantalizing and difficult to grasp.

For a sustainable edge in this environment, manufacturers must plan for three key areas: how stubborn inflation will continue to shape margins, how to respond to tariff pressure and how AI will move from pilots to practical.

Inflation Persists Under the Radar

Many manufacturers have been besieged by margin compression from higher-than-expected cost increases. Inflation has persistently stuck close to 3%, above the Federal Reserve’s target of 2%. The delta between the two rates may seem small, so addressing it has not been top-of-mind for many businesses. But over time, that difference adds up.

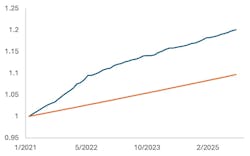

In the chart below, Joe Tracy, a distinguished fellow at Purdue University’s Daniels School of Business, plotted two lines from February 2021 through October 2025 to illustrate what would have happened to prices if the Fed achieved its 2% (orange) and what actually happened (blue).

The difference is stark: In the Fed’s 2% target scenario, cumulative price changes are about 10%. In the actual scenario, cumulative price changes were about 20%. That small delta between 2% and 3% inflation made a big difference in prices over time.

Gradual changes can sneak up on businesses, going unnoticed until their effects compound. The Federal Reserve projects continued elevated inflation in the new year, so forgetting pricing discipline could be a costly mistake.

Conducting a price-volume-cost-mix analysis can be an early-warning system for slow-moving margin erosion. The framework breaks down revenue and margin changes into clear drivers: specific customers, products, regions, plants and even time. This granularity helps pinpoint where cost pressure has accumulated the most, and where to defend margins with corrective price adjustments.

Tariffs Take Their Time

The most talked-about business story of 2025 will have an encore in 2026. Oceans of ink have been spilled about how tariffs would affect the economy. Enough time has passed now, and early results are in.

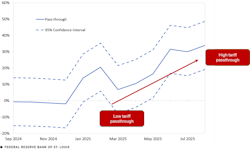

The Federal Reserve Bank of St. Louis published a blog post in mid-October 2025 that showed how companies are, or are not, reacting to tariffs.

Initially, companies passed through relatively little tariff costs, as many had either a) seen tariffs coming and built up an inventory they could work through or b) adopted a wait-and-see approach to see if tariffs would stick and how competitors would react. Over time, inventories were depleted, and the harsh reality of tariffs set in. As 2025 progressed, companies passed on an increasing amount of tariff costs to prices.

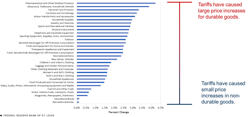

Response measures varied by industry. Durable goods manufacturers had greater success passing tariff costs through to prices, while producers of non-durable goods had a more difficult time recovering tariff costs.

Manufacturers can expect more tariff volatility in 2026, especially as political parties stake out talking points in advance of midterm elections. What is here today may be gone tomorrow, and vice versa, so manufacturers will be well-served to react appropriately, no matter the direction that tariff policy takes. Two pricing tips to keep in mind are:

Shorten cycle time – Annual or quarterly price change cycles used to be sufficient to stay on top of the market. Because these were infrequent events, a process that took six to eight weeks (or longer) was acceptable. Today, market conditions move faster than ever. Pricing that takes too long can cause manufacturers to fall behind the cost or price curve, leading to smaller margins or money left on the table. Remove unnecessary steps and increase the frequency of price reviews to ensure market relevance.

Segment smartly – Customers, products and channels react very differently in volatile environments. Blanket price changes are rarely effective. Separating price-sensitive customers from value-driven customers is key to ensuring targeted, margin-accretive decisions. Segmenting customer attributes—such as industry, region, channel of purchase and relative annual spend—is a worthwhile exercise to group customers that look the same and buy the same so they can be priced appropriately.

AI Will Make the Leap from Novelty to Necessary

AI is at a crossroads. A widely cited study from MIT claimed that “95% of organizations are getting zero return” on GenAI projects despite “$30–40 billion in enterprise investment.” These projects are not cheap, but the promise of AI is too alluring to ignore. Manufacturers intent on deploying AI must ensure they are in the winning 5%.

Winners remember that AI is a means to an end, not the end itself. To launch an AI pilot, focus first on the problem to be solved. Then, break it into discrete steps and determine which steps are repetitive. Pairing your transaction data with relevant, industry-specific context is a recipe for success in AI pilots.

Positive results can come with astonishing speed. One global manufacturing customer in the automotive industry recently undertook an AI pricing pilot. The team discovered, validated and chased a $65,000 margin opportunity early in their pilot review.

An executive at the manufacturer said, “What I'm finding is that AI is very good at cutting through the noise. We have hundreds of thousands of part numbers across 33 markets, and AI is very good at pinpointing exactly where we should be looking.”

AI allows smarter decisions faster. What would have taken an analyst months to manually uncover was accomplished in hours and minutes. This efficiency and quick reaction time will be an important differentiator for manufacturers navigating uncertainty.

Persistent inflation, uneven tariff pressures and the normalization of effective AI are creating an economic environment where the old playbook of waiting on the sidelines will not be enough. A waiting-for-things-to-settle approach is too costly. In an industrial market that is defined less by stability and more by the need for constant adjustment, the biggest profits will belong to those who learn fastest, not those who wait longest.

About the Author

Dan Cakora

Pricing Economist, Vendavo

Dan Cakora is a pricing economist and business consultant with vendavo, a SaaS market leader in B2B pricing, selling and rebate solutions. Dan has worked in various aspects of pricing for over 15 years. He started his career as a field economist, responsible for helping to measure inflation for the federal government. Before joining the Vendavo team, Dan was a customer at a large, international B2B distributor. He has led pricing teams, developed pricing and sales enablement products, and has a passion for data visualization. Dan has an MBA from DePaul University and a BS in economics from Purdue University.