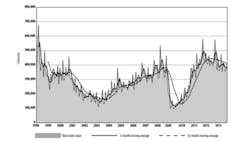

Domestic machine shops and other manufacturers ordered $397.57 million of machine tools and related technology during September, a 5.8% improvement over $375.72 million, the revised figure for August new orders. However, the new figure represents a 31.1% decline from September 2012’s result, $577.17 million, a historically high total that coincided with IMTS 2012.

For the year to date, U.S. manufacturers’ manufacturing technology purchases now amount to $3,507.71 million, 11.3% behind the comparable nine-month total for 2012.

The data is included in the monthly U.S. Manufacturing Technology Orders report, a study prepared by AMT – the Association for Manufacturing Technology based on actual data for metal cutting equipment and metal forming and fabricating equipment, as reported by participating companies. The data covers nationwide results as well as activity in six geographic regions.

“The monthly gain in USMTO indicates that manufacturers are making capital investments, and we expect these gains will grow in 2014. The year-over-year decline was anticipated due to the typical high volume during an IMTS year, which we saw in September 2012,” said Douglas K. Woods, president of AMT.

“A recent uptick in factory orders shows strong activity in a number of industries, particularly aerospace, which is forecast to grow more than 10% in the coming year,” Woods continued. “We also expect growth in automotive and energy, good news for manufacturing overall.”

Reviewing Regional Results

The regional results, as usual, show wide variations in market activity during September. The Northeast region had September orders totaling $60.76 million, 1.1% less than the August result, and 30.0% less than the September 2012 result. The region’s January-September total is $583.19 million, up 0.9% versus the nine-month total for 2012.

In the Southeast, manufacturers order $320.66 million worth of new metal cutting equipment, 6.7% less than the August result and 19.5% less than the September 2012 result. The region’s year-to-date total is $320.66 million, 19.5% less than the nine-month total for 2012.

(In the Southeast and West regions, AMT is reporting month/month and year/year data only for metal cutting equipment, but it noted that data for metal forming and fabricating equipment is “not an accurate reflection” of the activity, due to changes in survey participants.)

The North Central-East region ordered $105.83 million worth of new equipment during September, up 10.8% over August’s $95.55 million total, and down 27.8% from the September 2012 figure. The region’s nine-month result for 2013 is $906.05 million, down 10.3% versus the January-September 2012 figure.

The North Central-West region total rose 3.2% during September to $72.56 million, up from $70.33 million during August. That new result was 52.6% less than the September 2012 total, and brings the year-to-date result for 2013 to $646.78 million, 16.1% less than 2012’s nine-month total.

New machine tool orders in the South Central Region rose 13.0% from August to September, from $53.62 million to $60.59 million, but remained 22.5% behind the September 2012 total. The region’s year-to-date total is $541.76 million, down 21.7% versus the comparable nine-month total for 2012.

Finally, in the West region the new orders for metal cutting equipment rose 2.3% during September, up to $59.58 million from $58.26 million in August. The regional total for the month is $60.18 million, pushing the year-to-date total to $509.26 million, up just 0.6% over the region’s 2012 nine-month result.