Netherlands-based Royal Dutch Shell PLC edged Exxon Mobil Corp. as the top IW 1000 manufacturer after Exxon had maintained the No. 1 spot the previous five years.

Exxon has dominated the IndustryWeek 1000 ranking of the world’s largest public manufacturers based on revenue since 2001, two years after Exxon Corp. and Mobil Corp. merged. The lone exception was in 2005 when Shell and Exxon Mobil swapped rankings. Shell’s revenues grew 28.1% in 2011 to US$484.5 billion. Exxon Mobil was close behind with revenues reaching $471.1 billion last year, a 26.5% increase.

Despite global disruptions to oil production, including unrest in the Arab world, oil companies benefited from record-high oil prices and increased production. The petroleum and coal products sector led all IW 1000 industries with revenue growth averaging 24.5%. The industry is the largest IW 1000 sector with revenues totaling $5.8 trillion, or 29.2% of total IW 1000 revenues. Overall IW 1000 revenues reached $20.03 trillion last year, a 14.4% increase from 2010.

The petroleum and coal products sector remains strong as global demand for energy increases. In 2011 global energy consumption grew 2.5%, BP PLC (IW 1000/4) reported in its annual “Statistical Review of World Energy.” The oil and gas industry benefited from historically high average oil prices, which topped $100 per barrel for the first time, according to the BP report. Profit growth averaged 54% for the 105 IW 1000 petroleum and coal products companies reporting year-over-year net income growth in 2011.

The IW 1000 Top 20: Autos and Oil Dominate

Metals' Mixed Results

The primary metals industry followed petroleum and coal products with revenue growth averaging 23.1%. Included in this sector are major steel producers such as Arcelor Mittal SA (IW 1000/35) and Posco (IW 1000/68) and iron ore mining giants BHP Billiton Ltd. (IW 1000/50) and Vale SA (IW 1000/70). Global steel production rose 6.8% in 2011, down from a 15% increase in 2010, the World Steel Association reported. All major steel-producing countries showed production growth last year except for Japan and Spain.

Profits fell an average of 31% in the primary metals sector as many steel makers cited declining prices and global demand. Demand fell by 5% in the fourth quarter amid fears of an economic collapse in Europe and destocking efforts related to low iron ore prices, Arcelor Mittal CEO Lakshmi Mittal said in the company’s 2011 annual report.

China was the top steel-producing country in 2011 with annual steel production reaching 695.5 megatons, an increase of 8.9% over 2010, the World Steel Association reported. South Korea led all countries last year with production growth of 16.2%. Posco, based in South Korea, realized a revenue increase of 44% to US$59.8 billion in 2011. But the company’s profit fell 11.3% to US$3.2 billion.

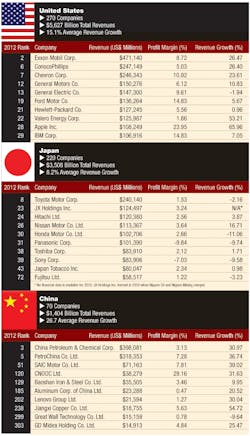

Largest Manufacturers in Major Markets (continued on page 3)

Fine-Tuned Machines

The global machinery market was one of the more promising stories of 2011 with steady revenue and profit growth. Average IW 1000 machinery revenues grew 17.8% and profits grew an average of 48.6%. Caterpillar Inc. (IW 1000/64), the top company in this category, reported record profits and revenues in 2011. The Peoria, Ill.-based maker of agricultural and industrial machinery posted revenues of $60.1 billion, up 41.2% from the previous year. Profits rose 82.5% to $4.9 billion.

The revenue gain was the largest annual percentage increase for the company since 1947. Caterpillar partly attributed the strong performance to sales related to increased mining activity on high commodity prices and machinery demand in the Asia/Pacific region. The company also acquired Bucyrus International Inc. in 2011 to expand its mining product line.

Japan’s Komatsu Ltd. (IW 1000/179), a manufacturer of industrial machinery and mining and construction equipment, was among IW 1000 profit-growth leaders with net income increasing 349% to US$1.9 billion in 2011. Despite disruptions related to the tsunami and earthquake that struck Japan in March 2011, the company benefited from rebounding industrial machinery demand in Japan, North America and Europe and increased vehicle production in emerging markets, such as China.

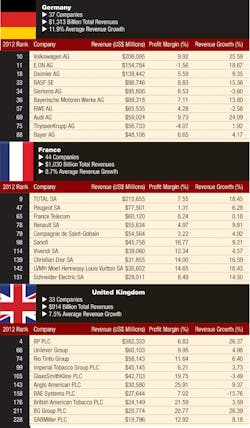

Largest Manufacturers in Major Markets (continued)

Motor Vehicles on the Move

Motor vehicles and motor vehicle parts were among the top 10 revenue-gaining industries in 2011 and even stronger profit performers. Motor-vehicle revenue growth averaged 14.8%, while automotive suppliers’ revenues grew an average of 16.3%. Profit growth rebounded to an average rate of 104.7% for motor vehicles and 210.7% for motor vehicle parts.

Japan’s Nissan Motor Co. (IW 1000/26) was one of the top profit gainers in 2011 with net income rising 653.1% to US$4.1 billion. Revenues increased 16.7% to $113.4 billion. Vehicle sales reached a record 4.85 million units. The company reported significant growth in global markets, including a 21.9% unit sales increase in China and an 11.8% sales increase in the United States.

Commercial and military truck manufacturer Navistar International Corp. (IW 1000/332), based in Lisle, Ill., realized a 672.7% profit increase in 2011 to $1.7 billion. The company cited an improved North American truck business and an engine business that returned to profitability in the second half as contributing factors.

Automotive manufacturers that showed significant revenue gains in 2011 include Italy’s Fiat SpA (IW 1000/48), up 66%, China’s SAIC Motor Co. (IW 1000/51) with revenues up 39% and U.S. truck producer Paccar Inc. (IW 1000/268) with a revenue increase of 59%.

Expansion of the Chinese auto industry is playing a more significant role in overall industry performance. SAIC Motor has begun making inroads into the U.S. market, including its announcement in June that it would locate its North American headquarters in Birmingham, Mich.

Best of the Rest

Other major global sectors that experienced average revenue growth of at least 15% in 2011 include fabricated metal products, rubber products, plastics and apparel. The pharmaceutical industry ranked first among IW 1000 manufacturers in average profit growth with a whopping 4,356% increase. That figure was skewed by Allergan Inc. (IW 1000/716), which saw its net income grow to $934.5 million from $600,000 in 2010. Excluding Allergan, pharmaceutical manufacturers profit growth averaged 32.1%.

Revenue growth averaged nearly 17% for the rubber products industry. China’s Sinochem International Co. Ltd. (IW 1000/474) led this category with revenue growth of 38.7%.

Manufacturers comprising the computers and other electronics products sector, the second-largest on the IW 1000 with 105 companies, combined for average revenue growth of 13.1%. But the industry ranked dead last in average profit growth as several major consumer-electronics manufacturers, including Panasonic Corp. (IW 1000/31), Sony Corp. (IW 1000/39), and Nokia Corp. (IW 1000/86) reported losses last year. In fact, five of the 10 companies whose profits declined the most in 2011 were in the computers and other electronics sector.

Textiles, paper, primary metals, food, and publishing and printing were the other industries showing negative average profit growth in 2011. Furniture and fixtures was the only sector showing negative average revenue growth.

Check out Alan Beaulieu's insights into the International IW 1000 by reading the companion story, "IW 1000 Growth is Bric Solid."About the Author

Jonathan Katz

Former Managing Editor

Former Managing Editor Jon Katz covered leadership and strategy, tackling subjects such as lean manufacturing leadership, strategy development and deployment, corporate culture, corporate social responsibility, and growth strategies. As well, he provided news and analysis of successful companies in the chemical and energy industries, including oil and gas, renewable and alternative.

Jon worked as an intern for IndustryWeek before serving as a reporter for The Morning Journal and then as an associate editor for Penton Media’s Supply Chain Technology News.

Jon received his bachelor’s degree in Journalism from Kent State University and is a die-hard Cleveland sports fan.