Ready, Steady, Go (Slow): The 2016 IndustryWeek Manufacturing Salary Survey

The results from the latest IndustryWeek Salary Survey have been collected, tallied and parsed, and the responses reflect the current state of manufacturing: reliably profitable, but not growing by leaps and bounds. Pay is holding steady and job satisfaction remains high, but economic challenges including a strong dollar, cheap imports and low oil prices are tempering optimism a bit from previous years.

“This has been a very difficult year for the metals industry,” said a C-Suite executive in her 40s, with more than 20 years of experience in the sector. “Several factors have affected us: Oil prices, nickel decrease and the strong dollar.” A purchasing/procurement manager in his 30s from the industrial machinery industry remarked that “manufacturing is changing rapidly with new technology, e.g. IoT. Companies that manage talent well and give their employees the freedom to explore and grow will do better.”

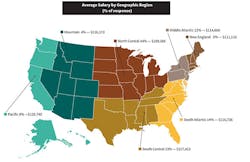

The more than 900 U.S. manufacturing managers who responded to the survey made, on average, $114,528 in 2015. This was down a hair from 2014, when the average was $114,615. C-Suite-level respondents took a decent hit in their paychecks, reporting an average salary of $164,209, compared to $193,644 last year. But some levels of management—for instance VPs of operations and lean/continuous improvement managers fared better, showing slight increases over last year.

Salary increases were down slightly from last year, with 9% reporting their pay up by more than 5% in the past year, compared to 12% in the 2015 survey. Twenty percent saw a 3 to 5% increase, compared to 22% last year.

Despite the overall downturn in the U.S. manufacturing economy in the last four months of 2015, job satisfaction remained high. Seventy-three percent of respondents said that they were “very satisfied” or “satisfied” with their current jobs, compared to 74% the year prior.

“I’m extremely satisfied with being in the process industrial world,” wrote an engineering manager in his 50s who works in the petroleum and coal sector. “There’s no place I’d rather be.”

“Manufacturing has been a great way to spend my career,” said a VP of operations in his 40s, working in the automotive/transportation sector. “Challenging work, cutting-edge technology and the satisfaction of making something tangible that benefits society and my employees is very rewarding.”

Downsides included long hours, upper management embracing change at sloth speed and scant year-over-year pay increases.

“More and more salary jobs are demanding 50 to 60+ hours/week and to be on call 24/7,” bemoaned an engineering manager working for a $1 billion+ company in the metals industry.” The expectation is for life to revolve around the job. In the long run, that is not good for individuals, families or companies.”

“In over 20 years of doing my job, I always have to ask for a raise,” lamented an administrator in her 50s in the paper/printing/publishing sector. “I get the same answer every time—we can’t afford a pay increase. Hard work, dedication, commitment and skills don’t seem to mean much. Why do I have to beg for compensation?”

Who Gets Paid What

For this year’s survey, we heard from a cross-section of manufacturing professionals in 19 categories. The highest percentages of respondents hailed from the industrial machinery (16%) and automotive/transportation (14%) sectors.

Same as in last year’s survey, respondents in the chemical sector earned the highest salaries: $135,411. Healthcare manufacturing picked up steam, with pharmaceutical and medical devices/lab equipment moving up to the No. 2 and 3 slots in average salaries.

Base salary ranked third in the question, “What matters most to you about your job?” Job stability punched in at No. 1 with 21% of respondents, followed by challenging work. Interestingly, the rankings of what matters most did not change one whit from last year’s survey, showing, perhaps, that manufacturing managers are rock-solid in their priorities.

Skills Shortage

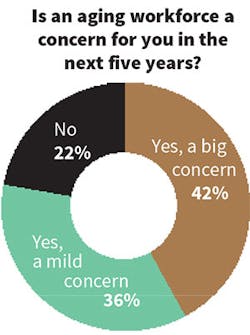

If anything keeps our survey group up at night, it’s workforce concerns. Seventy-eight percent consider the aging workforce a real worry in the next five years. And 67% say that they have struggled to fill a position in the past year because of a lack of skilled candidates.

Could the problem stem from manufacturers relying on the same pool of white male candidates that they always have, rather than making an effort to tap into the rest of the U.S. workforce? Salary Survey respondents overwhelmingly skewed white, male and over 40. Only 12% of survey respondents were women, and a mere 9% came from non-white backgrounds—a poor representation of the overall U.S. workforce, which is 49% female and 31% non-white. Lower salaries aren’t helping: the female survey respondents were paid considerably less than men, reporting an average salary of $90,482 vs. $117,662.

A couple of respondents made note of gender disparity in their comments. “Women are not as valued as men in manufacturing,” wrote a purchasing/procurement manager in the plastics industry who is over 60 and female. “They tend to get the ‘busy work’ that makes things happen, but their opinions are discarded. Also, they are not paid as much.”

When survey-takers were asked, “What is the biggest challenge facing manufacturing today?” the skilled workforce shortage came up repeatedly. “Succession planning,” answered a VP of operations in his 50s in the wood products/furniture industry. “Having a strong bench of professionals to take over leadership of manufacturing companies as the older workforce retires.”

“The talent shortage in the skilled trades,” said a director of manufacturing/production in his 60s, working in the paper/printing/publishing sector. “There are too few students that become apprentices, and too few program opportunities for the students that are interested in manufacturing.”

Yet young professionals who do choose manufacturing are well-paid compared to their counterparts in other professions. The few 21-29 year olds responding to the survey made an average salary of $74,409. By comparison, the average starting salary for a college graduate in 2014 was $48,707. Survey respondents 30-39 made an average salary of $91,918.

Counter to the image of manufacturing as the fallback track for the non-college-bound, our respondents had plenty of higher education. Thirty-five percent had a bachelor’s degree, and 44% had education beyond that.

The hardest positions to fill for our survey pool were engineers with four-year degrees, followed by industrial maintenance technicians, quality specialists and sales people. CNC operators, welders and toolmakers round out the list.

The State of Manufacturing

Respondents also had a lot to say about manufacturing’s image and the state of manufacturing. “Manufacturing needs to pitch itself differently and in viable venues,” said a lean/continuous improvement manager in his 60s in the metals industry. “I’d pitch manufacturing on Super Bowl Sunday for starters.”

“Manufacturing is the backbone of the U.S. economy, yet we are not adequately defending our position,” worried an R&D/product manager in his 50s in the industrial machinery sector. “We are headed down the same path as former manufacturing powerhouses such as the UK.”

Another reader was more optimistic about the younger generation’s hands-on abilities: “We are happy to see a lot of young people acquire an interest in making and designing things,” said a C-Suite level executive working for a $51-$100 million company. “Some of these people are making their way into manufacturing.”

About the Author

Laura Putre

Senior Editor, IndustryWeek

As senior editor, Laura Putre works with IndustryWeek's editorial contributors and reports on leadership and the automotive industry as they relate to manufacturing. She joined IndustryWeek in 2015 as a staff writer covering workforce issues.

Prior to IndustryWeek, Laura reported on the healthcare industry and covered local news. She was the editor of the Chicago Journal and a staff writer for Cleveland Scene. Her national bylines include The Guardian, Slate, Pacific-Standard and The Root.

Laura was a National Press Foundation fellow in 2022.

Got a story idea? Reach out to Laura at [email protected]