Luminar Technologies Inc., the self-driving sensor startup backed by billionaire Peter Thiel, is rolling out a cheaper-to-make version of its laser technology and ramping up production to supply the key component for autonomous vehicles.

The startup released a new sensor platform on April 12 that reduces the cost of its most expensive part from tens of thousands of dollars to $3. This will make Luminar’s light detection and ranging devices, or lidar, viable for vehicles sold to consumers, once produced in high volumes, according to CEO Austin Russell.

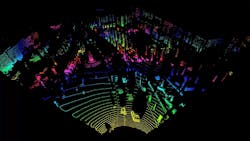

Competition is intensifying to supply lidar, which to this point has been one of the most expensive components of self-driving vehicles. The technology uses short-wavelength pulses of light to better detect objects surrounding cars in greater detail than radar.

Luminar is contending with the likes of Velodyne Lidar Inc., which supplies automakers including Ford Motor Co., and could end up having to take on Alphabet Inc.’s Waymo, which makes its own sensors and may supply hardware to other companies.

‘Defining Year’

“This year is the defining year for who’s getting into what programs at the end of the day, and there to stay,” Russell said, referring to suppliers bidding now to win contracts for automakers’ test fleets, which could turn into agreements for production cars. “We’ve had 150 different AV programs reaching out, wanting to get sensors on their cars.”

Luminar also announced that it’s acquired Black Forest Engineering, a small Colorado Springs-based chip designer, as part of its cost-reduction efforts. It’ll increase production capacity to 5,000 lidar units a quarter by year-end at its manufacturing plant in Orlando, Fla., up from 100 in all of 2017, Russell said.

Lidar was at the center of Uber Technologies Inc.’s agreement to give Alphabet a stake worth about $245 million to settle claims the ride-hailing company had stolen its technology. It’s also come under increased scrutiny after an Uber vehicle using the sensors struck and killed a woman in Arizona last month.

Expensive Part

Lidar prices, which reached $70,000 for early prototypes, have fallen to around $6,000, and should drop to $250 per unit once companies reach mass production starting next year, according to IHS Markit.

“It’s a wide-open market,” said Egil Juliussen, director of automotive technology research at IHS. “There’s not going to be one winner; there’s going to be three to four major suppliers.”

Luminar’s Russell, 23, declined to disclose what Luminar charges for its laser sensors, but said its internal cost to produce them will be “a lot” less than $1,000 a unit once it reaches mass production volume.

“It easily meets the requirements to get into consumer vehicles as a whole,” he said. The company already counts the research arm of Toyota Motor Corp. as one of four global automakers that use its sensors for their autonomous vehicle test fleets.

Luminar said a year ago that it had raised $36 million from three investors, including 1517 Fund, a venture capital firm partly backed by Thiel. Luminar has hired 200 people over the past year, in part to beef up its production facility in Orlando. It’s also brought on senior executives from auto supplier Harman International Industries Inc. and Motorola Solutions Inc.

Russell dropped out of Stanford University at 17 after winning a Thiel Fellowship, which the tech titan created to encourage young entrepreneurs to ditch college in favor of pursuing their startup ideas.

By Gabrielle Coppola

About the Author

Bloomberg

Licensed content from Bloomberg, copyright 2016.